Columbia Sportswear 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Fair value of financial instruments:

Based on borrowing rates currently available to the Company for bank loans with similar terms and

maturities, the fair value of the Company’s long-term debt approximates the carrying value. Furthermore, the

carrying value of all other financial instruments potentially subject to valuation risk (principally consisting of

cash and cash equivalents, short-term investments, accounts receivable and accounts payable) also approximate

fair value because of their short-term maturities.

Derivatives:

The Company accounts for derivatives in accordance with SFAS No. 133, “Accounting for Derivative

Instruments and Hedging Activities,” as amended.

Substantially all foreign currency derivatives entered into by the Company qualify for and are designated as

foreign-currency cash flow hedges, including those hedging foreign currency denominated firm commitments.

Changes in fair values of outstanding cash flow hedge derivatives that are highly effective are recorded in

other comprehensive income, until earnings are affected by the variability of cash flows of the hedged

transaction. In most cases amounts recorded in other comprehensive income will be released to earnings some

time after maturity of the related derivative. The consolidated statement of operations classification of effective

hedge results is the same as that of the underlying exposure. Results of hedges of product costs are recorded in

cost of sales when the underlying hedged transaction affects earnings. Unrealized derivative gains and losses

recorded in current assets and liabilities and amounts recorded in other comprehensive income are non-cash

items and therefore are taken into account in the preparation of the consolidated statement of cash flows based on

their respective balance sheet classifications.

Stock-based compensation:

The Company has elected to follow the accounting provisions of Accounting Principles Board Opinion

No. 25 (“APB 25”), “Accounting for Stock Issued to Employees”, for stock-based compensation and to furnish

the pro forma disclosures required under SFAS No. 148, “Accounting for Stock-Based Compensation—

Transition and Disclosure.” No stock-based employee compensation cost is reflected in net income because all

options granted under those plans had an exercise price equal to the market value of the underlying common

stock on the date of the grant.

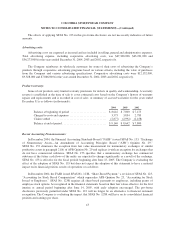

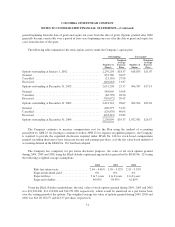

The following table illustrates the effect on net income and earnings per share if the Company had applied

the fair value recognition provisions of SFAS No. 123 to stock-based compensation (in thousands, except per

share amounts):

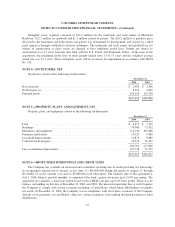

2004 2003 2002

Net income, as reported ........................................... $138,624 $120,121 $102,518

Add: Stock-based employee compensation expense included in reported

netincome,netoftax ....................................... — — —

Deduct: Total stock-based employee compensation expense determined

under fair value based method for all awards, net of tax ............ 9,277 8,585 6,611

Proformanetincome ............................................. $129,347 $111,536 $ 95,907

Earnings per share—basic

As reported ................................................. $ 3.44 $ 3.01 $ 2.60

Proforma .................................................. 3.21 2.79 2.43

Earnings per share—diluted

As reported ................................................. $ 3.40 $ 2.96 $ 2.56

Proforma .................................................. 3.17 2.75 2.39

42