Columbia Sportswear 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

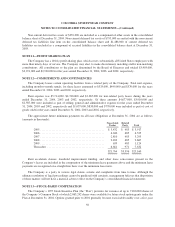

In connection with a distribution center expansion project, the Company entered into a note purchase

agreement. Pursuant to the note purchase agreement, the Company issued senior promissory notes in the

aggregate principal amount of $25 million, bearing an interest rate of 6.68% and maturing August 11, 2008.

Proceeds from the notes were used to finance the expansion of the Company’s distribution center in Portland,

Oregon. The senior promissory notes require the Company to comply with certain ratios related to indebtedness

to earnings before interest, taxes, depreciation and amortization (“EBITDA”) and tangible net worth. At

December 31, 2004, the Company was in compliance with these covenants.

In June 2001, the Company’s Japanese subsidiary borrowed 550,000,000 Japanese yen (for which

US$2,148,000 was outstanding at December 31, 2004) for general working capital requirements, bearing an

interest rate of 1.71% and 1.72% at December 31, 2004 and 2003, respectively. Principal and interest payments

are made semi-annually through June 2006.

Other amounts primarily include installment payments on purchase obligations made in the ordinary course

of business for non-product purchases.

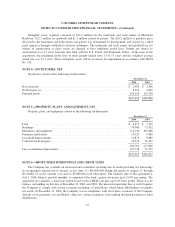

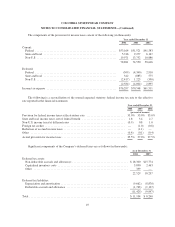

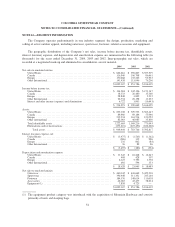

Principal payments due on these notes at December 31, 2004 were as follows (in thousands):

Year ended

December 31,

2005 ........................................................... $ 5,216

2006 ........................................................... 5,224

2007 ........................................................... 3,708

2008 ........................................................... 3,698

2009 ........................................................... 6

$17,852

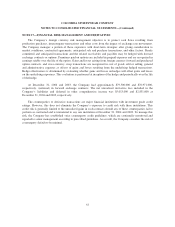

NOTE 9—SHAREHOLDERS’ EQUITY

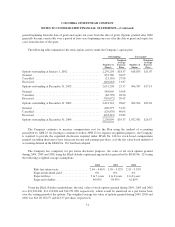

On May 16, 2002, the Company’s shareholders approved an increase in the number of authorized shares of

common stock from 50,000,000 shares to 125,000,000 shares. At December 31, 2004 and 2003, 40,126,381 and

40,253,235 shares of common stock were issued and outstanding, respectively.

On June 9, 1999, the Company’s shareholders approved the 1999 Employee Stock Purchase Plan (“ESPP”).

There are 750,000 shares of common stock authorized for issuance under the ESPP, which allows qualified

employees of the Company to purchase shares on a quarterly basis up to fifteen percent of their respective

compensation. The purchase price of the shares is equal to eighty five percent of the lesser of the closing price of

the Company’s common stock on the first or last trading day of the respective quarter. At December 31, 2004 and

2003, 250,552 and 204,493 shares of common stock, respectively, had been issued under the ESPP.

In April 2004, the Company’s Board of Directors authorized the repurchase of up to $100 million of the

Company’s common stock. In January 2005, the Company’s Board of Directors authorized the repurchase of up

to an additional $100 million of the Company’s common stock. Shares of the Company’s common stock may be

purchased in the open market or through privately negotiated transactions, subject to market conditions. The

repurchase program does not obligate the Company to acquire any specific number of shares or to acquire shares

over any specified period of time. At December 31, 2004, the Company had repurchased 798,356 shares under

this program at an aggregate purchase price of $43.1 million.

47