Columbia Sportswear 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.licensing agreements for products that include socks, bags, packs, leather outerwear, eyewear, watches and other

accessories.

Net licensing income increased $0.6 million, or 50.0%, to $1.8 million in 2003 from $1.2 million in 2002.

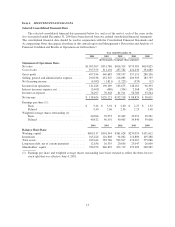

Interest (Income) Expense, Net: Interest income was $2.1 million in 2003 compared to $2.8 million for

the comparable period in 2002. The decrease in interest income was due to the lower interest rate environment

and the relative mix of taxable and tax-exempt investment securities compared to the same period in 2002.

Interest expense was $1.6 million in 2003 compared to $2.4 million for the comparable period in 2002. The

decrease in interest expense was attributable to the repayment of short-term notes payable and long-term debt.

Income Tax Expense: The provision for income taxes increased to $70.5 million in 2003 from $61.5

million in 2002. The reduction in the effective tax rate from 37.5% to 37.0% is primarily due to a reduction in

accrued income taxes related to favorable outcomes of various federal, state and international income tax audits

during the year.

Liquidity and Capital Resources

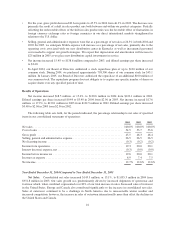

Our primary ongoing funding requirements are to finance working capital and the continued growth of the

business. We financed our operations for the year ended December 31, 2004 primarily through cash provided by

operating activities. At December 31, 2004, we had total cash and cash equivalents of $130.0 million compared

to $104.1 million at December 31, 2003. Cash provided by operating activities was $93.7 million in 2004

compared to $121.1 million in 2003. The decrease in cash provided by operating activities was due to an increase

in accounts receivable as a result of increased sales in the latter part of 2004, an increase in inventories primarily

attributable to the higher speculative inventory position that we took for fall 2004, an unplanned increase in net

cancellations of U.S. orders primarily due to unfavorable winter weather conditions, an increase in raw materials

and work-in-process inventory in China for 2005 and our current outlook for spring 2005 growth. The

appreciation in foreign currency exchange rates of the Euro and Canadian dollar against the U.S. dollar also

contributed to the increase in accounts receivable and inventories. The increase in net income partially offset the

increases in accounts receivable and inventory.

Our primary capital requirements are for working capital, investing activities associated with the expansion

of our global operations and general corporate needs. Net cash used in investing activities was $43.6 million in

2004 compared to $78.8 million in 2003. In 2004, our investing activities primarily consisted of $44.5 million

used for capital expenditures, including approximately $30.3 related to the construction of our distribution center

in Kentucky. In 2003, our investing activities included $31.9 million related to net purchases of short-term

investments, $29.9 million for the acquisition of Mountain Hardwear, net of cash acquired, and $17.1 million for

capital expenditures including approximately $10.4 million related to the initial phase of construction of our

Kentucky distribution center.

Cash used in financing activities was $29.3 million in 2004 and $5.3 million in 2003. In 2004, net cash used

in financing activities was for the repurchase of common stock of $43.1 million and the repayment of long-term

debt of $4.6 million, partially offset by proceeds from the sale of stock under employee stock plans of $18.4

million. In 2003, net cash used in financing activities was primarily for the net repayment of notes payable of

$9.9 million, the repayment of Mountain Hardwear’s debt of $6.4 million, and the repayment of long-term debt

of $4.5 million, partially offset by proceeds from the sale of stock under employee stock plans of $16.1 million.

To fund our domestic working capital requirements, we have available unsecured revolving lines of credit

with aggregate seasonal limits ranging from $30 million to $75 million, of which $5 million to $50 million is

committed. At December 31, 2004, no domestic balance was outstanding under these lines of credit.

Internationally, our subsidiaries have local currency operating lines in place guaranteed by us with a combined

22