Columbia Sportswear 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

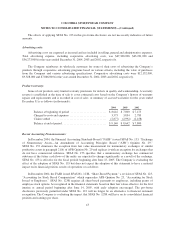

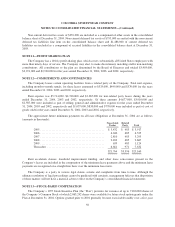

In December 2004, the FASB issued FASB Staff Position (“FSP”) No. 109-1, “Application of FASB

Statement No. 109, Accounting for Income Taxes, to the Tax Deduction on Qualified Production Activities

Provided by the American Jobs Creation Act of 2004,” and FSP No. 109-2, “Accounting and Disclosure

Guidance for the Foreign Earnings Repatriation Provision within the American Jobs Creation Act of 2004.”

These staff positions provide accounting guidance on how companies should account for the effects of the

American Jobs Creation Act of 2004 (the “Act”) that was signed into law on October 22, 2004. FSP No. 109-1

states that tax relief (special tax deduction for domestic manufacturing) from this legislation should be accounted

for as a special deduction instead of a tax rate reduction. FSP 109-2 gives a company additional time to evaluate

the effects of the legislation on any plan for reinvestment or repatriation of foreign earnings for purposes of

applying SFAS No. 109. The Company is evaluating all U.S. Treasury guidance as well as awaiting anticipated

further guidance. The Company expects to complete this evaluation within a reasonable amount of time after

additional guidance is published. The Company estimates that the range of possible amounts considered for

repatriation under this provision is between $0 and $150 million. The potential range of income tax is subject to

various factors and will become determinable once further guidance has been issued.

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs—An Amendment of Accounting

Research Bulletin (“ARB”) No. 43, Chapter 4.” SFAS No. 151 requires abnormal amounts of inventory costs

related to idle facility, freight, handling costs and wasted material (spoilage) expenses to be recognized as current

period charges. In addition, SFAS No. 151 requires that the allocation of fixed production overheads to the costs

of conversion be based on the normal capacity of the production facilities. SFAS No. 151 is effective for the

fiscal years beginning after June 15, 2005. The Company believes that the adoption of this statement will not

have a material impact on its financial position, results of operations or cash flows.

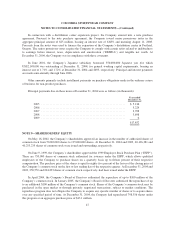

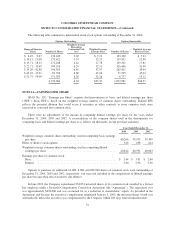

NOTE 3—ACQUISITION

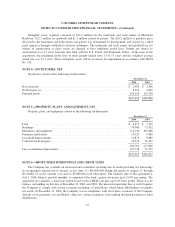

On March 31, 2003, the Company acquired Mountain Hardwear, Inc. (“Mountain Hardwear”) for aggregate

consideration of approximately $36 million, including approximately $30 million in cash and $6 million of debt

assumption. Mountain Hardwear, which is based in Richmond, California, designs, develops and markets

technically advanced equipment and apparel for outdoor enthusiasts and professionals. The acquisition was

accounted for under the purchase method of accounting and the results of operations of Mountain Hardwear have

been recorded in the Company’s consolidated financial statements beginning on April 1, 2003. The cost of the

acquisition was allocated on the basis of the estimated fair value of the assets acquired and the liabilities

assumed. The fair values of assets and liabilities acquired are presented below (in thousands):

Cash .............................................................................. $ 370

Accounts receivable .................................................................. 6,236

Inventory .......................................................................... 8,600

Prepaids and other assets .............................................................. 19

Property, plant and equipment .......................................................... 440

Intangible assets ..................................................................... 28,357

Total assets acquired ............................................................. 44,022

Accounts payable and accrued liabilities .................................................. 1,181

Deferred tax liabilities ................................................................ 6,193

Debt .............................................................................. 6,413

Total liabilities assumed ........................................................... 13,787

Net assets acquired ............................................................... $30,235

44