Columbia Sportswear 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.To implement our business strategy, we must manage growth effectively. We need to continue to change

various aspects of our business, to maintain and enhance our information systems and operations to respond to

increased demand and to attract, retain and manage qualified personnel. Growth could place an increasing strain

on management, financial, product design, marketing, distribution and other resources, and we could experience

operating difficulties. For example, in recent years, we have undertaken a number of new initiatives that require

significant management attention and corporate resources, including the development or expansion of

distribution facilities on two continents, the acquisition, rejuvenation and expansion of the Sorel brand, and the

acquisition, integration and expansion of Mountain Hardwear, Inc. This growth involves many risks and

uncertainties that, if not managed effectively, could have a material adverse effect on our results of operations

and financial condition.

We May be Adversely Affected by Currency Exchange Rate Fluctuations

We generally purchase products in U.S. dollars. However, the cost of these products sourced overseas may

be affected by changes in the value of the relevant currencies. Price increases caused by currency exchange rate

fluctuations could make our products less competitive or have an adverse effect on our margins. Our

international revenues and expenses generally are derived from sales and operations in foreign currencies, and

these revenues and expenses could be materially affected by currency fluctuations, including amounts recorded

in foreign currencies and translated into U.S. dollars for consolidated financial reporting. Currency exchange rate

fluctuations could also disrupt the business of the independent manufacturers that produce our products by

making their purchases of raw materials more expensive and more difficult to finance. Foreign currency

fluctuations could have a material adverse effect on our results of operations and financial condition.

We May be Adversely Affected by Labor Disruptions

Our business depends on our ability to source and distribute products in a timely manner. Labor disputes at

factories, shipping ports, transportation carriers, or distribution centers create significant risks for our business,

particularly if these disputes result in work slowdowns, lockouts, strikes, or other disruptions during our peak

manufacturing and importing seasons, and could have a material adverse effect on our business, potentially

resulting in cancelled orders by customers, unanticipated inventory accumulation, and reduced revenues and

earnings.

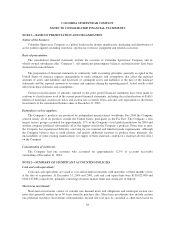

We Depend on Independent Manufacturers

Our products are produced by independent manufacturers worldwide. We do not operate or own any

production facilities. Although we enter into a number of purchase order commitments each season, we do not

have long-term contracts with some manufacturers. We therefore face risks that manufacturing operations will

fail to perform as expected or that our competitors will gain production or quota capacities that we need for our

business. If a manufacturer fails to ship orders in a timely manner or to meet our standards, we could miss

delivery deadlines, which could result in cancellation of orders, refusal to accept deliveries or a reduction in

purchase prices, any of which could have a material adverse effect on our business.

Reliance on independent manufacturers also creates quality control risks. A failure in our quality control

program could result in diminished product quality, which may have a material adverse affect on our results of

operations and financial condition.

In an effort to ensure that our independent manufacturers operate with safe, ethical and humane working

conditions, we regularly monitor factories and we enforce our requirements that each manufacturer agree to

comply with our Standards of Manufacturing Practices and applicable laws and regulations, but we do not

control these vendors or their labor practices. If a manufacturer violates labor or other laws, or engages in

practices that are not generally accepted as ethical in our key markets, it could have a material adverse effect on

our results of operations and financial condition.

30