Columbia Sportswear 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

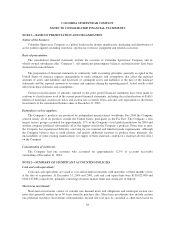

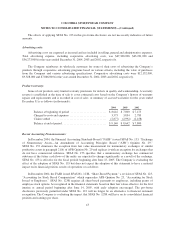

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

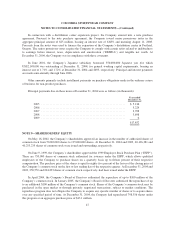

The Company has arrangements in place to facilitate the import and purchase of inventory through the

issuance of sight letters of credit. The arrangements consist of an unsecured and uncommitted revolving line of

credit of $25,000,000 and a $125,000,000 import line of credit at December 31, 2004, to issue documentary

letters of credit on a sight basis and are renewed on an annual basis. The combined limit under this agreement

was $150,000,000 at December 31, 2004. The revolving line accrues interest at the bank’s prime rate minus 2%

per annum. The revolving line also has a fixed rate option based on the bank’s cost of funds plus 65 basis points.

There was no balance outstanding on this line at December 31, 2004 and 2003. At December 31, 2004, the

Company had outstanding letters of credit of $71,513,000 for firm purchase orders placed under the import line

of credit facility.

The Company also has available an unsecured and uncommitted $150,000,000 import letter of credit line

subject to annual renewal. At December 31, 2004, the Company had outstanding letters of credit of $18,554,000

for firm purchase orders placed under this facility.

The Company’s Canadian subsidiary has available an unsecured and uncommitted line of credit providing

for borrowing to a maximum of C$30,000,000 (US$25,010,000 at December 31, 2004). There was no balance

outstanding on this line at December 31, 2004 and 2003.

The Company’s European subsidiary has available an unsecured and uncommitted line of credit providing

for borrowing to a maximum of 20,000,000 EURO (US$27,134,000 at December 31, 2004). There was no

balance outstanding at December 31, 2004 and 2003.

The Company’s Japanese subsidiary also has an unsecured and uncommitted line of credit providing for

borrowing to a maximum of 1,000,000,000 JPY (US$9,765,000 at December 31, 2004). There was no balance

outstanding on this line at December 31, 2004 and 2003.

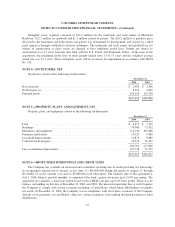

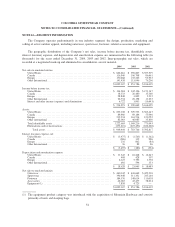

NOTE 7—ACCRUED LIABILITIES

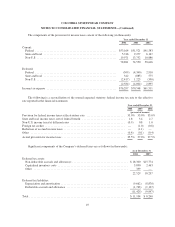

Accrued liabilities consist of the following (in thousands):

December 31,

2004 2003

Accrued salaries, bonus, vacation and other benefits ................................ $22,449 $21,591

Accrued product warranty ..................................................... 9,140 8,642

Accrued cooperative advertising ................................................ 6,640 4,198

Other ..................................................................... 11,560 7,872

$49,789 $42,303

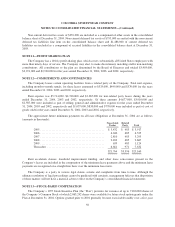

NOTE 8—LONG-TERM DEBT AND OTHER LIABILITIES

Long-term debt and other liabilities consist of the following (in thousands):

December 31,

2004 2003

Senior promissory notes payable ............................................... $14,286 $17,858

Termloan ................................................................. 2,148 3,073

Other ..................................................................... 1,418 —

17,852 20,931

Less current portion .......................................................... 5,216 4,596

$12,636 $16,335

46