Classmates.com 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

withholding will adversely impact our cash flows from financing activities. The amounts remitted in the years ended December 31, 2010 and

2009 were $9.6 million and $6.8 million, respectively, for which we withheld 1.6 million shares and 1.1 million shares of common stock,

respectively, that were underlying the restricted stock units which vested and stock awards that were issued. The amount we pay in future years

will vary based on our stock price and the number of applicable restricted stock units vesting and stock awards being issued during the year.

Based on our current projections, we expect to continue to generate positive cash flows from operations, at least in the next twelve months.

We may use our existing cash balances and future cash generated from operations to fund, among other things, both contractual payments and

optional prepayments on the outstanding balances under the FTD Credit Agreement; dividend payments, if declared by United Online, Inc.'s

Board of Directors; the development and/or acquisition of other services, businesses or technologies; the repurchase of our common stock

underlying restricted stock units and stock awards to pay the required employee withholding taxes due on vested restricted stock units and stock

awards issued; the repurchase of our common stock under the Program; future capital expenditures and future acquisitions of intangible assets,

including rights, content and intellectual property.

Under the terms of the FTD Credit Agreement, there are significant limitations on our ability to use cash flows generated by the FTD

segment for the benefit of United Online, Inc. or the Communications and Content & Media segments. The FTD Credit Agreement also includes

provisions which may require us to make debt prepayments in the event that we generate excess cash flow, as defined in the FTD Credit

Agreement, on an annual basis. The assessments of future excess cash flow for FTD, on a standalone basis, require us to forecast its respective

cash flows from operations less certain cash outflows, including, but not limited to, those related to capital expenditures and income taxes. The

determination of excess cash flow obligations requires us to make significant estimates regarding our cash flows from operations, capital

expenditures, income taxes, and other items. Actual results could differ from our current projections and we could be required to pay materially

different amounts under the excess cash flow provisions of the FTD Credit Agreement. The degree to which our assets are leveraged and the

terms of our debt could materially and adversely affect our ability to obtain additional capital as well as the terms at which such capital might be

offered to us. With respect to the UOL Credit Agreement, in April 2010, we paid $14.7 million to retire such credit facility. We currently expect

to have sufficient liquidity to fulfill our debt service obligations, at least in the next twelve months.

If we need to raise additional capital through public or private debt or equity financings, strategic relationships or other arrangements, this

capital might not be available to us in a timely manner, on acceptable terms, or at all. Our failure to raise sufficient capital when needed could

severely constrain or prevent us from, among other factors, developing new or enhancing existing services or products, repurchasing our

common stock, acquiring other services, businesses or technologies or funding significant capital expenditures and/or purchases of intangible

assets, including rights, content and intellectual property, and have a material adverse effect on our business, financial position, results of

operations, and cash flows as well as impair our ability to pay future dividends and our ability to service our debt obligations. If additional funds

were raised through the issuance of equity or convertible debt securities, the percentage of stock owned by the then-current stockholders could

be reduced. Furthermore, such equity or any debt securities that we issue might have rights, preferences or privileges senior to holders of our

common stock. In addition, trends in the securities and credit markets may restrict our ability to raise any such additional funds, at least in the

near term.

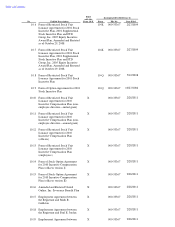

Year Ended December 31, 2009 compared to Year Ended December 31, 2008

Net cash provided by operating activities decreased by $0.5 million, or 0.3%, for the year ended December 31, 2009 compared to the year

ended December 31, 2008. Net cash provided by operating

77