Cincinnati Bell 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

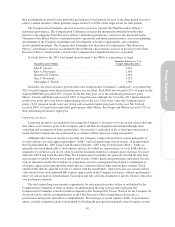

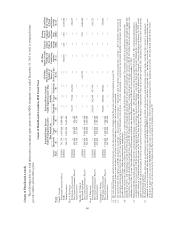

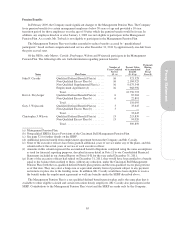

(e) The amounts shown in this column for Messrs. Cassidy, Freyberger, Wojtaszek, and Wilson represent the one-year increase in the value

of their qualified defined benefit plan and nonqualified excess plan for 2011, 2010 and 2009, respectively, projected forward to age 65

for each executive with interest credited at 3.5%, which is the rate a terminated participant would then be given (such interest rate was

increased to 4.0% effective as of March 1, 2012) and then discounted back to the respective year at the discount rate (3.90% for 2011,

4.90% for 2010, and 5.50% for 2009) required under Accounting Standards Codification Topic 960. The present value of the accrued

pension benefits for Mr. Cassidy increased by $300,000 in 2011, due to increases in his service eligible pay and after service-related

credits. Additionally, a decrease in the applicable discount rate and an updated mortality table yielded an increase of approximately

$1.6 million in present value. The increase in the amounts in 2011, compared to 2010, for Messrs. Wojtaszek and Wilson is substantially

due to the change in the discount rate as mentioned above. The Company froze its qualified pension plan for management employees in

2009; therefore, Mr. Torbeck is not entitled to any benefits under this plan. None of the executives receive any preferential treatment or

above-market interest under the Company’s retirement plans.

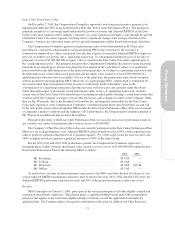

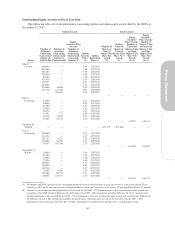

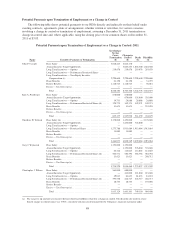

(f) The table below shows the components of the “All Other Compensation” column.

Name Year

401(k) Match

($) (1)

Flexible Perquisite

Program Reimbursements

($) (2)

Other

Expenses

($) (3)

Total “All Other

Compensation”

($)

John F. Cassidy ............ 2011 8,800 — — 8,800

2010 8,800 35,000 — 43,800

2009 9,200 37,004 — 46,204

Kurt A. Freyberger ......... 2011 9,800 — — 9,800

Theodore H. Torbeck ....... 2011 863 — — 863

2010 1,615 4,126 — 5,741

Gary J. Wojtaszek .......... 2011 9,800 — — 9,800

2010 9,800 21,368 — 31,168

2009 7,402 17,743 14,542 39,687

Christopher J. Wilson ....... 2011 8,298 — — 8,298

2010 9,324 15,695 — 25,019

2009 9,200 13,000 — 22,200

(1) Under the terms of the Cincinnati Bell Inc. Retirement Savings Plan, the Company’s matching contribution is equal to 100% on the

first 3% and 50% on the next 2% of contributions made to the plan by the participant. Eligible compensation includes base wages

plus any incentive paid to eligible participants. The maximum company matching contribution is $9,800.

(2) The Flexible Perquisite Reimbursement Program was terminated effective January 27, 2011; each executive received an increase in

base salary to offset the termination of the program.

(3) The amounts in 2009 for Mr. Wojtaszek includes residual amounts paid for 2008 relocation expenses.

(g) During 2009, the Company implemented a mandatory one-week furlough for certain executives. As a result, the actual annual salary

received and identified in this table is less than the amount approved by the Board.

(h) On September 7, 2010, Mr. Torbeck joined the Company as President and General Manager for the Cincinnati Bell Communications

Group.

(i) Mr. Wojtaszek served as the Chief Financial Officer of the Company until August 5, 2011 when Mr. Freyberger was appointed Chief

Financial Officer and Mr. Wojtaszek was appointed President of CyrusOne Inc.

(j) Includes $2,100,000 retention bonus paid in 2010. If Mr. Cassidy retires, resigns or is terminated for “cause” (as defined in his

employment agreement) (each, a “Repayment Event”) prior to December 31, 2012, he will be required to repay a portion of his retention

bonus. The amount that Mr. Cassidy will be required to repay is equal to $50,000 multiplied by the number of months remaining between

the occurrence of the Repayment Event and December 31, 2012, and would be payable back to the Company over a 120-month period.

59

Proxy Statement