Cincinnati Bell 2011 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2011 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

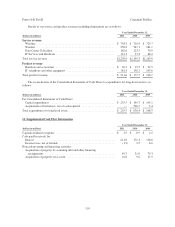

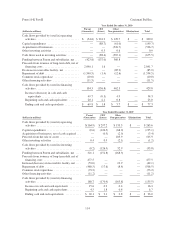

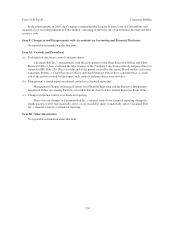

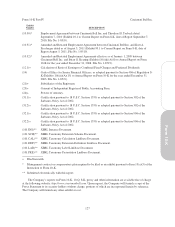

Form 10-K Part II Cincinnati Bell Inc.

Year Ended December 31, 2009

(dollars in millions)

Parent

(Issuer) Guarantors Non-guarantors Eliminations Total

Cash flows provided by (used in) operating

activities ................................ $(164.9) $ 184.4 $ 246.1 $ — $ 265.6

Capital expenditures ........................ (0.6) (68.0) (126.5) — (195.1)

Acquisitions of businesses ................... — (2.9) (0.5) — (3.4)

Proceeds from sale of assets .................. — 105.9 — — 105.9

Other investing activities ..................... 0.4 (2.1) 0.5 — (1.2)

Cash flows provided by (used in) investing

activities ................................ (0.2) 32.9 (126.5) — (93.8)

Funding between Parent and subsidiaries, net .... 321.1 (208.5) (112.6) — —

Proceeds from issuance of long-term debt, net of

financing costs ........................... 477.5 — — — 477.5

Increase/(decrease) in receivables facility, net .... (53.0) — 10.9 — (42.1)

Repayment of debt .......................... (480.5) (8.4) (17.6) — (506.5)

Common stock repurchase ................... (73.2) — — — (73.2)

Other financing activities .................... (11.2) — — — (11.2)

Cash flows provided by (used in) financing

activities ................................ 180.7 (216.9) (119.3) — (155.5)

Increase in cash and cash equivalents ......... 15.6 0.4 0.3 — 16.3

Beginning cash and cash equivalents ......... 4.5 0.4 1.8 — 6.7

Ending cash and cash equivalents ............ $ 20.1 $ 0.8 $ 2.1 $ — $ 23.0

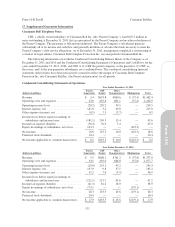

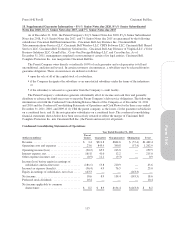

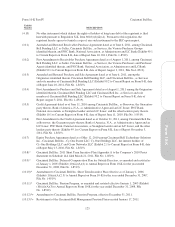

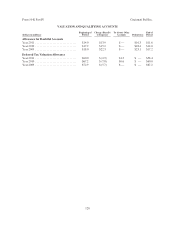

19. Quarterly Financial Information (Unaudited)

2011

(dollars in millions, except per common share amounts)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

Revenue ............................... $360.8 $367.5 $368.8 $365.3 $1,462.4

Operating income ........................ 86.4 77.6 86.3 9.2 259.5

Net income (loss) ........................ 17.9 13.5 17.6 (30.4) 18.6

Basic earnings (loss) per common share ...... $ 0.08 $ 0.06 $ 0.08 $ (0.17) $ 0.04

Diluted earnings (loss) per common share ..... $ 0.08 $ 0.05 $ 0.07 $ (0.17) $ 0.04

2010

(dollars in millions, except per common share amounts)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

Revenue ............................... $323.7 $338.6 $351.9 $362.8 $1,377.0

Operating income ........................ 82.4 69.8 82.6 64.5 299.3

Net income (loss) ........................ 22.8 9.6 14.5 (18.6) 28.3

Basic earnings (loss) per common share ...... $ 0.10 $ 0.03 $ 0.06 $ (0.11) $ 0.09

Diluted earnings (loss) per common share ..... $ 0.10 $ 0.03 $ 0.06 $ (0.11) $ 0.09

The effects of assumed common share conversions are determined independently for each respective quarter

and year and may not be dilutive during every period due to variations in operating results. Therefore, the sum of

quarterly per share results will not necessarily equal the per share results for the full year.

During the three months ended December 31, 2011, the Company recognized a goodwill impairment loss of

$50.3 million in the Wireless business segment. The impairment loss arose from declines in revenues and

wireless subscribers.

119

Form 10-K