Cincinnati Bell 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Data Center Performance Plan

On December 7, 2010, the Compensation Committee approved a new long-term incentive program to be

implemented under the 2007 Long Term Incentive Plan (the “Data Center Performance Plan”). The program is

primarily intended to (i) encourage rapid and profitable growth of revenue and Adjusted EBITDA in the Data

Center Colocation segment of the Company’s business, (ii) create significant enterprise value through the growth

of the Data Center Colocation segment, (iii) bring about a significant change in the strategic direction of the

Company’s business in a short time frame and (iv) provide management and the Board with strategic flexibility.

The Compensation Committee granted each performance unit award (denominated in $1.00 per unit)

providing for a specified cash payment to each participating NEO in the event that (i) the executive is

continuously employed for a three year period after the date of grant, (ii) specified Adjusted EBITDA targets are

met over such three year period, (iii) a “qualifying transaction” is consummated within ten years of the date of

grant and (iv) at least $1,000,000,000 of equity value is created in the Data Center Colocation segment prior to

the “qualifying transaction.” The program also gives the Compensation Committee discretion to make fractional

payments in an amount up to, but not more than, the base amount in the event there is either: (a) a qualifying

transaction before the fifth anniversary of the initial award grant date; or (b) there is a qualifying transaction after

the fifth anniversary of the initial award grant date and the equity value created is at least $500,000,000. If a

qualifying transaction does not occur within 10 years of the grant date, the performance unit awards terminate

with no payment to the participating NEOs. Moreover, if a participating NEOs’ employment is terminated for

any reason (other than a termination for the executive’s retirement, death or disability), prior to the

consummation of a qualifying transaction, then the executive will not receive any payment under the award

(other than with respect to previously vested performance units, if any). A “qualifying transaction” includes

certain sales of the Data Center Colocation business (including an initial public offering), certain transactions that

would result in the Company ceasing to own its other businesses, and a change in control of the Company. Other

than for Mr. Wojtaszek, who is the President of CyrusOne Inc. and primarily responsible for the Data Center

Colocation segment, it is the Compensation Committee’s intention that the grants described below are and will

be the only grants made to the participating NEOs under the Data Center Performance Plan. After an assessment

of competitive market conditions and the segment’s 2011 performance, the Compensation Committee granted to

Mr. Wojtaszek an additional unit award of $4.0 million.

Pursuant to the terms of the Data Center Performance Plan, no executive may receive performance units in

any calendar year under such program with a value in excess of $5,000,000.

The Company’s Chief Executive Officer does not currently participate in the Data Center Performance Plan.

Moreover, for each performance cycle, Adjusted EBITDA achieved must be at least 90% of the targeted goal in

order to generate a potential threshold level of payment equal to 75% of the target award for each executive and

100% or higher in order to generate a potential payment of 100% of the target award.

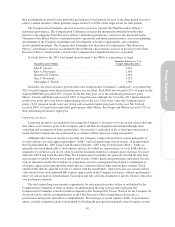

For the 2011-2013 and 2012-2014 performance periods, the Compensation Committee approved a

maximum grant of units (assumes incremental value created is at or in excess of $1,000,000,000) under the new

Data Center Performance Plan to the following NEOs as follows:

2011 2012

Mr. Freyberger ............................................. $0.9 M —

Mr. Torbeck ............................................... $5.0 M —

Mr. Wojtaszek ............................................. $4.0 M $4.0 M

Mr. Wilson ................................................ $3.5 M —

As noted above, in order for the performance unit grants to the NEOs and other Section 16 officers to vest,

certain Adjusted EBITDA performance measures must be met for the years 2011, 2012 and 2013. For 2011, the

Adjusted EBITDA performance measure was met, and 50% of the granted performance units were vested.

Benefits

NEOs, hired prior to January 1, 2009, participate in the same pension plan as all other eligible salaried and

certain non-union hourly employees. The pension plan is a qualified defined benefit plan with a nonqualified

provision that applies to the extent that eligible earnings or benefits exceed the applicable Code limits for

qualified plans. The Company makes all required contributions to this plan. In addition, the Chief Executive

51

Proxy Statement