Cincinnati Bell 2011 Annual Report Download - page 208

Download and view the complete annual report

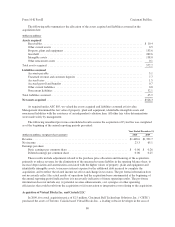

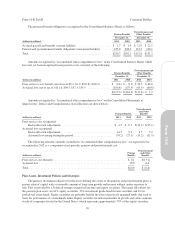

Please find page 208 of the 2011 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Consolidated Statements of Operations, totaled $7.0 million in 2011, $6.6 million in 2010, and $6.0 million in

2009.

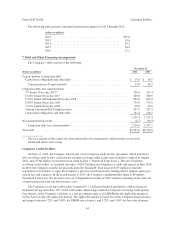

Debt Covenants

Credit Facility

The Corporate credit facility has financial covenants that require the Company to maintain certain leverage

and interest coverage ratios. Also, for the period from October 1, 2011 to June 11, 2014, capital expenditures are

permitted as long as they do not exceed $1.0 billion in the aggregate. The Corporate credit facility also contains

certain covenants which, among other things, restrict the Company’s ability to incur additional debt or liens, pay

dividends, repurchase Company common stock, sell, transfer, lease, or dispose of assets and make investments or

merge with another company. If the Company were to violate any of its covenants and were unable to obtain a

waiver, it would be considered a default. If the Company were in default under the Corporate credit facility, no

additional borrowings under this facility would be available until the default was waived or cured. The Corporate

credit facility provides for customary events of default, including for failure to make any payment when due and

for a default on any other existing debt instrument having an aggregate principal amount that exceeds $35

million.

Public Indentures

Various issuances of the Company’s public debt, which include the 7% Senior Notes due 2015, 8

1

⁄

4

%

Senior Notes due 2017, 8

3

⁄

4

% Senior Subordinated Notes due 2018, and 8

3

⁄

8

% Senior Notes due 2020, are

governed by indentures which contain covenants that, among other things, limit the Company’s ability to incur

additional debt or liens, pay dividends or make other restricted payments, sell, transfer, lease, or dispose of assets

and make investments or merge with another company.

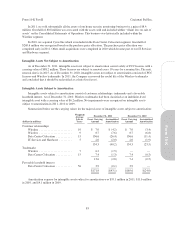

One of the financial covenants permits the issuance of additional Indebtedness up to a 4:00 to 1:00

Consolidated Adjusted Senior Debt to EBITDA ratio (as defined by the individual indentures). Once this ratio

exceeds 4:00 to 1:00, the Company is not in default; however, additional Indebtedness may only be incurred in

specified permitted baskets, including a Credit Agreement basket providing full access to the Corporate credit

facility. Also, the Company’s ability to make Restricted Payments (as defined by the individual indentures)

would be limited, including common stock dividend payments or repurchasing outstanding Company shares. As

of December 31, 2011, the Company was below the 4:00 to 1:00 Consolidated Adjusted Senior Debt to EBITDA

ratio. In addition, the Company had in excess of $1.2 billion available in its restricted payment basket as of

December 31, 2011. If the Company is under the 4:00 to 1:00 ratio on a proforma basis, the Company may use

this basket to make restricted payments, including share repurchases or dividends, and/or the Company may

designate one or more of its subsidiaries as Unrestricted (as defined in the various indentures) such that any

Unrestricted Subsidiary would generally not be subject to the restrictions of these various indentures. However,

certain provisions which govern the Company’s relationship with Unrestricted Subsidiaries would begin to apply.

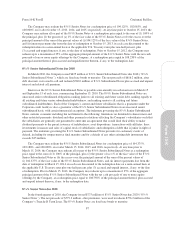

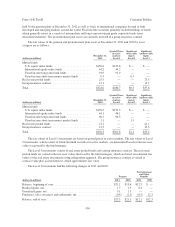

Extinguished Notes

In 2010, the Company redeemed its 8

3

⁄

8

% Senior Subordinated Notes due 2014 (“8

3

⁄

8

% Subordinated

Notes”) with a principal balance of $560 million and its Tranche B Term Loan with a principal balance of $760

million. The Company also terminated an interest rate swap related to the 8

3

⁄

8

% Subordinated Notes. In 2009, the

Company redeemed its 7

1

⁄

4

% Senior Notes due 2013 with a principal balance of $439.9 million. For the years

ended December 31, 2010 and 2009, the Company recognized debt extinguishment losses of $46.5 million and

$10.3 million, respectively.

90

Form 10-K Part II Cincinnati Bell Inc.