Cincinnati Bell 2011 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2011 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

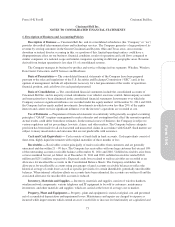

Deferred income taxes are provided for temporary differences between financial statement and income tax

assets and liabilities. Deferred income taxes are recalculated annually at rates then in effect. Valuation

allowances are recorded to reduce deferred tax assets to amounts that are more likely than not to be realized. The

ultimate realization of the deferred income tax assets depends upon the ability to generate future taxable income

during the periods in which basis differences and other deductions become deductible and prior to the expiration

of the net operating loss carryforwards.

Previous tax filings are subject to normal reviews by regulatory agencies until the related statute of

limitations expires.

Operating taxes — Certain operating taxes such as property, sales, use, and gross receipts taxes are reported

as expenses in operating income primarily within cost of services. These taxes are not included in income tax

expense because the amounts to be paid are not dependent on our level of income. Liabilities for audit exposures

are established based on management’s assessment of the probability of payment. The provision for such

liabilities is recognized as an operating expense. Upon resolution of an audit, any remaining liability not paid is

released and increases operating income.

Regulatory taxes — The Company incurs federal regulatory taxes on certain revenue producing transactions.

We are permitted to recover certain of these taxes by billing the customer; however, collections cannot exceed

the amount due to the federal regulatory agency. These federal regulatory taxes are presented in sales and cost of

services on a gross basis because, while the Company is required to pay the tax, it is not required to collect the

tax from customers and, in fact, does not collect the tax from customers in certain instances. The amounts

recorded as revenue for 2011, 2010, and 2009 were $20.6 million, $19.9 million, and $16.7 million, respectively.

The amounts expensed for 2011, 2010, and 2009 were $22.7 million, $22.0 million, and $17.2 million,

respectively. We record all other federal taxes collected from customers on a net basis.

Stock-Based Compensation — Compensation cost is recognized for all share-based awards to employees.

We value all share-based awards to employees at fair value on the date of grant and expense this amount over the

required service period, generally defined as the applicable vesting period. The fair value of stock options and

stock appreciation rights is determined using the Black-Scholes option-pricing model using assumptions such as

volatility, risk-free interest rate, holding period and dividends. The fair value of stock awards is based on the

Company’s closing share price on the date of grant. For all share-based payments, an assumption is also made for

the estimated forfeiture rate based on the historical behavior of employees. The forfeiture rate reduces the total

fair value of the awards to be recognized as compensation expense. Our accounting policy for graded vesting

awards is to recognize compensation expense on a straight-line basis over the vesting period. We have also

granted employee awards to be ultimately paid in cash which are indexed to the change in the Company’s

common stock price. These awards are adjusted to the fair value of the Company’s common stock, and the

adjusted fair value is expensed on a pro-rata basis over the vesting period. When an award is granted to an

employee who is retirement eligible, the compensation cost is recognized over the service period up to the date

that the employee first becomes eligible to retire.

Pension and Postretirement Benefit Plans — The Company maintains qualified and non-qualified defined

benefit pension plans, and also provides postretirement healthcare and life insurance benefits for eligible

employees. We recognize the overfunded or underfunded status of the defined benefit pension and other

postretirement benefit plans as either an asset or liability. Changes in the funded status of these plans are

recognized as a component of comprehensive (loss)/income in the year they occur. Pension and postretirement

healthcare and life insurance benefits earned during the year and interest on the projected benefit obligations are

accrued and recognized currently in net periodic benefit cost. Prior service costs and credits are amortized over

the average life expectancy of participants or remaining service period, based upon whether plan participants are

mostly retirees or active employees. Net gains or losses resulting from differences between actuarial experience

and assumptions, or from changes in actuarial assumptions are recognized as a component of annual net periodic

benefit cost. Unrecognized actuarial gains or losses that exceed 10% of the projected benefit obligation are

amortized on a straight-line basis over the average remaining service life of active employees for the pension and

77

Form 10-K