Cincinnati Bell 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Without such reapproval by the Company’s shareholders at their 2012 annual meeting, awards that are

granted under the 2007 Long Term Incentive Plan to covered employees on or after such meeting may be subject

to the deduction limits of Code 162(m) of the Code, thereby possibly increasing the taxes that will have to be

paid by the Company in connection with compensation paid to the covered employees.

Even if the Company’s shareholders fail to reapprove the material terms of the performance goals set forth

under the plan, the Company retains the right to grant awards, including performance-based compensation

awards both under the 2007 Long Term Incentive Plan and outside such plan. The Company has no current

definitive policy as to awards it may grant to covered employees either under or outside the 2007 Long Term

Incentive Plan should the Company’s shareholders fail to reapprove the material terms of the performance goals

set forth under the plan. The failure of the shareholders to reapprove such terms and the resulting inability of

such awards to avoid the deduction limits of Section 162(m) of the Code would be a factor in determining future

awards to covered employees made by the Company.

The only certain result if the Company’s shareholders fail to reapprove the material terms of the

performance goals set forth under the 2007 Long Term Incentive Plan would be that no compensation payable by

reason of future awards granted under the plan to covered employees will be able to avoid being subject to the

deduction limits of Section 162(m) of the Code even if such avoidance would be beneficial to the Company and

its shareholders.

Vote Required

Reapproval of the material terms of the performance goals under which compensation can be paid

under the Cincinnati Bell Inc. 2007 Long Term Incentive Plan requires the affirmative vote of the holders

of the majority of the common shares and 6

3

⁄

4

% Cumulative Convertible Preferred Shares, voting as one

class, present in person or represented by proxy at the annual meeting and entitled to vote on this

proposal. Abstentions will count as votes against the proposal. Broker non-votes are not considered shares

entitled to vote on this proposal and will have no impact on the outcome of the proposal.

Our Recommendation

The Board recommends a vote “FOR” the adoption of the proposal reapproving the material terms of

the performance goals under the 2007 Long Term Incentive Plan.

Effect of Management Vote

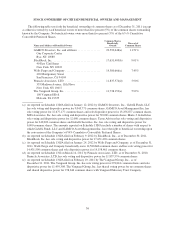

Since the directors and officers of the Company own beneficially 11,554,804 voting shares, or

approximately 6% of the outstanding voting shares, their votes on the proposal are not likely to have a material

impact on whether this proposal is adopted.

PROPOSAL TO APPROVE AN AMENDMENT TO THE

CINCINNATI BELL INC. 2007 STOCK OPTION PLAN FOR NON-EMPLOYEE DIRECTORS

(Item 4 on Proxy Card)

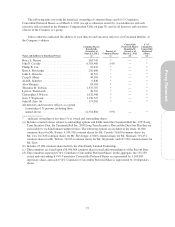

The Cincinnati Bell Inc. 2007 Stock Option Plan for Non-Employee Directors (the “2007 Directors Plan”),

which was adopted by the Board and became effective on May 3, 2007 after approval of the Company’s

shareholders at the 2007 Annual Meeting, permits stock options and restricted stock awards to be granted to

those directors of the Company who are not employees of the Company or any of its subsidiaries (the “non-

employee directors”).

Under the current terms of the 2007 Directors Plan, up to 1,000,000 common shares may in the aggregate be

the subject of awards granted during the life of the plan, all of which could be subject to stock option awards but

only up to 300,000 of which could be granted as restricted stock. The Board has already granted approximately

300,000 common shares as restricted stock awards and is not able, without an amendment to the Plan, to grant

any additional restricted stock awards under the plan (although previously awarded restricted shares might in the

future be returned to the 2007 Directors Plan as a result of cancellations or expiration of the prior restricted share

awards).

27

Proxy Statement