Cincinnati Bell 2011 Annual Report Download - page 196

Download and view the complete annual report

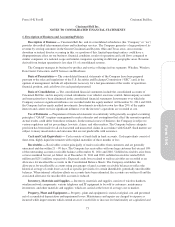

Please find page 196 of the 2011 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.bargained postretirement plans (approximately 10-14 years) and average life expectancy of retirees for the

management postretirement plan (approximately 16 years).

Termination Benefits — The Company has written severance plans covering both its management and

union employees and, as such, accrues probable and estimable employee separation liabilities in accordance with

ASC 712, “Compensation — Nonretirement Postemployment Benefits.” These liabilities are based on the

Company’s historical experience of severance, historical severance costs, and management’s expectation of

future separations.

Special termination benefits are recognized upon acceptance by an employee of a voluntary termination

offer. For terminations involving a large group of employees, we consider whether a pension and postretirement

curtailment event has occurred. We define a curtailment as an event that reduces the expected years of future

service of present employees by 10% or more.

Business Combinations — In accounting for business combinations, we apply the accounting requirements

of ASC 805, “Business Combinations,” which requires the recording of net assets of acquired businesses at fair

value. In developing estimates of fair value of acquired assets and assumed liabilities, management analyzes a

variety of factors including market data, estimated future cash flows of the acquired operations, industry growth

rates, current replacement cost for fixed assets, and market rate assumptions for contractual obligations. Such a

valuation requires management to make significant estimates and assumptions, particularly with respect to the

intangible assets. In addition, contingent consideration is presented at fair value at the date of acquisition.

Transaction costs are expensed as incurred.

Fair Value Measurements — Fair value of financial and non-financial assets and liabilities is defined as

the price representing the amount that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants. Fair value is utilized to measure certain investments on a

recurring basis. Fair value measurements are also utilized to determine the initial value of assets and liabilities

acquired in a business combination, to perform impairment tests, and for disclosure purposes. Management uses

quoted market prices and observable inputs to the maximum extent possible when measuring fair value. In the

absence of quoted market prices or observable inputs, fair value is determined using valuation models that

incorporate assumptions that a market participant would use in pricing the asset or liability.

Fair value measurements are classified within one of three levels, which prioritizes the inputs used in the

methodologies of measuring fair value for asset and liabilities, as follows:

Level 1 — Quoted market prices for identical instruments in an active market;

Level 2 — Quoted prices for similar assets and liabilities in active markets, quoted prices for identical or

similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable

for the asset or liability (i.e., interest rates, yield curves, etc.), and inputs that are derived principally from or

corroborated by observable market data by correlation or other means (market corroborated inputs); and

Level 3 — Unobservable inputs that reflect management’s determination of assumptions that market

participants would use in pricing the asset or liability. These inputs are developed based on the best

information available, including our own data.

Foreign Currency Translation and Transactions — The financial position of foreign subsidiaries is

translated at the exchange rates in effect at the end of the period, while revenues and expenses are translated at

average rates of exchange during the period. Gains or losses from translation of foreign operations where the

local currency is the functional currency are included as components of accumulated other comprehensive (loss)/

income. Gains and losses arising from foreign currency transactions are recorded in other income (expense) in

the period incurred. Certain intercompany balances may be designated as long-term. Exchange gains/(losses) on

long-term intercompany balances are recorded as a component of accumulated other comprehensive income/

(loss).

78

Form 10-K Part II Cincinnati Bell Inc.