Cincinnati Bell 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.reward and if there is a better way to align management’s performance goals to maximize shareholders

return. In connection with its analysis, the Company engaged ISS to provide a better understanding of the

protocols that ISS uses to evaluate executive compensation. The Company learned that ISS considers the

following long-term incentives to be non-performance based compensation:

•Any long-term incentives that are settled in cash even though the award only vests on the achievement

of objective performance measures, and

•Stock option grants that vest solely on the passage of time.

In 2009, in conjunction with shareholders approval increasing the number of common shares available for

issuance under the 2007 Long Term Incentive Plan, the Compensation Committee adopted a policy

limiting the number of common shares to be awarded under the 2007 Long Term Incentive Plan each year

to 2,000,000 shares. Working within this limitation, to make certain that ISS considered the 2012 long-

term incentive awards for the CEO as performance based compensation, the Compensation Committee

did the following:

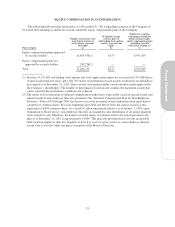

•The CEO’s 2012-2014 long-term performance unit award will vest on the achievement of the

Unlevered Cash Return on Average Assets performance objectives (the “UCR Objectives”) and will

be payable entirely in common shares. Unlevered Cash Return on Average Assets is defined as

operating cash flow excluding interest payments as a percentage of average total assets.

•The remaining portion of the CEO’s long-term incentives will be in non-qualified stock options that

will vest on the achievement of the UCR Objectives.

To the extent that paying the other NEOs long-term incentives in shares causes the 2,000,000 share

limitation to be exceeded, the Compensation Committee has determined that such long-term incentives

will be settled in cash or will be granted as SARs rather than non-qualified stock options.

In addition, the Compensation Committee did not grant any discretionary bonuses to the NEOs for 2011.

The negative say-on-pay vote also resulted in the Company, its directors and certain executive officers being

named defendants in two purported shareholder derivative actions—one in federal court and one in state court. In

the state court action, the plaintiff and the defendants entered into a proposed settlement that the state court has

approved preliminarily, subject to final approval of the shareholders at a hearing scheduled for April 2012. The

settlement’s terms focus on corporate governance measures emphasizing clearer and improved communications

with its shareholders and enhanced internal processes in addressing such shareholders’ concerns about the

Company’s executive compensation. In addition, on March 1, 2012, in the federal court action, the parties agreed

to stay the federal court action pending entry of a judgment in the state court action. Counsel for the plaintiffs in

federal court action will file an application for attorneys’ fees and expenses in the state court action. The parties

in the federal court action also agreed that, upon entry of a state court action judgment, they will dismiss the

federal court action with prejudice. Set forth below are representative items to which the Company has agreed in

the state court settlement. (The entire proposed settlement is set forth in the Company’s Form 8-K, Current

Report, dated December 20, 2011):

•If a majority of shareholders vote against the advisory “say-on-pay” vote proposal set forth in the proxy

statement: (i) the Compensation Committee will retain the services of an executive compensation

consultant that has not previously been engaged by the Company or any of its affiliates for the purpose of

reviewing and evaluating the existing compensation policies and recommendations, and, upon the

engagement of such new executive compensation consultant, the Company will promptly convene a

meeting with the new consultant and the Compensation Committee’s existing consultant to discuss the

negative vote and whether and to what extent the proposed executive compensation program should be

changed; and (ii) the Company, either through the Compensation Committee or the Board, shall publish to

the shareholders a formal written response within 90 days.

•The Company shall maintain a Compensation Committee composed entirely of fully independent

directors, and the Board shall rotate the members of the Compensation Committee. Beginning in fiscal

year 2012 and each year thereafter, one member of the Compensation Committee will step down and a

42