Cigna 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K 65

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Investment Assets

e Company’s investment assets do not include separate account

assets. Additional information regarding the Company’s investment

assets and related accounting policies is included in Notes 2, 11, 12,

13, 14, 15 and 18 to the Consolidated Financial Statements.

Fixed Maturities

Investments in fi xed maturities include publicly-traded and privately

placed debt securities, mortgage and other asset-backed securities,

preferred stocks redeemable by the investor, hybrid and trading

securities. Fair values are based on quoted market prices when

available. When market prices are not available, fair value is generally

estimated using discounted cash fl ow analyses, incorporating current

market inputs for similar fi nancial instruments with comparable

terms and credit quality. In instances where there is little or no market

activity for the same or similar instruments, the Company estimates

fair value using methods, models and assumptions that the Company

believes a hypothetical market participant would use to determine a

current transaction price.

e Company performs ongoing analyses of prices used to value

the Company’s invested assets to determine that they represent

appropriate estimates of fair value. is process involves quantitative

and qualitative analysis including reviews of pricing methodologies,

judgments of valuation inputs, the signifi cance of any unobservable

inputs, pricing statistics and trends. e Company also performs

sample testing of sales values to confi rm the accuracy of prior fair

value estimates.

e Company’s fi xed maturity portfolio continues to be diversifi ed

by issuer and industry type, with no single industry constituting

more than 10% of total invested assets as of December 31, 2010.

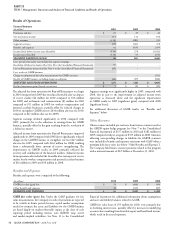

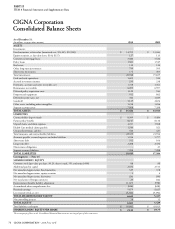

(In millions)

2010 2009

Federal government and agency $ 687 $ 571

State and local government 2,467 2,521

Foreign government 1,169 1,070

Corporate 9,632 8,585

Federal agency mortgage-backed 10 34

Other mortgage-backed 88 121

Other asset-backed 656 541

TOTAL $ 14,709 $ 13,443

As of December 31, 2010, $13.5 billion, or 92%, of the fi xed

maturities in the Company’s investment portfolio were investment

grade (Baa and above, or equivalent), and the remaining $1.2 billion

were below investment grade. e majority of the bonds that are

below investment grade are rated at the higher end of the non-

investment grade spectrum. ese quality characteristics have not

materially changed during the year.

e net appreciation of the Company’s fi xed maturity portfolio

increased nearly $400 million during 2010, driven by a decline in

market yields. Although asset values are well in excess of amortized

cost, there are specifi c securities with amortized cost in excess of fair

value by approximately $80 million as of December 31, 2010.

Corporate fi xed maturities includes private placement investments of

$4.7 billion, which are generally less marketable than publicly-traded

bonds, but yields on these investments tend to be higher than yields

on publicly-traded bonds with comparable credit risk. e Company

performs a credit analysis of each issuer, diversifi es investments by

industry and issuer and requires fi nancial and other covenants that

allow the Company to monitor issuers for deteriorating fi nancial

strength and pursue remedial actions, if warranted.

e Company’s investment in state and local government securities

is diversifi ed by issuer and geography with no single exposure greater

than $30 million. e Company focuses on the underlying issuer’s

credit quality with 94% rated A3 or better excluding guarantees

by monoline bond insurers, consistent with the prior year. As of

December 31, 2010, 63%, or $1,542 million, of the Company’s total

investments in state and local government securities were guaranteed

by monoline bond insurers, providing additional credit quality

support. e quality ratings of these investments with and without

this guaranteed support as of December 31, 2010 were as follows:

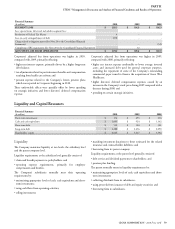

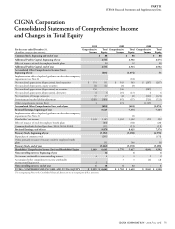

(In millions)

Quality Rating

As of December31,2010

Fair Value

With Guarantee Without Guarantee

State and local governments Aaa $ 79 $ 78

Aa1-Aa3 1,172 1,092

A1-A3 232 278

Baa1-Baa3 59 42

Not available - 52

TOTAL STATE AND LOCAL GOVERNMENTS $ 1,542 $ 1,542

e Company invests in high quality foreign government obligations, with an average quality rating of AA as of December 31, 2010. e

diversifi cation of these investments was consistent with the geographic distribution of the international business operations.