Cigna 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K

56

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Results of Operations

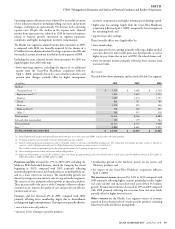

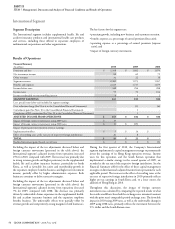

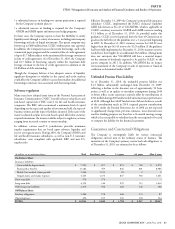

Financial Summary

(In millions)

2010 2009 2008

Premiums and fees $ 25 $ 29 $ 43

Net investment income 114 113 104

Other revenues (158) (283) 331

Segment revenues (19) (141) 478

Benefi ts and expenses 91 (419) 1,499

Income (loss) before income taxes (benefi ts) (110) 278 (1,021)

Income taxes (benefi ts) (136) 93 (375)

SEGMENT EARNINGS LOSS 26 185 646

Less: special items (after-tax) included in segment earnings:

Resolution of federal tax matters (See Note 20 to the Consolidated Financial Statements) 97 - -

Loss on Reinsurance transaction (See Note 3 to the Consolidated Financial Statements) (20) - -

Less: results of GMIB business:

Charge on adoption of fair value measurements for GMIB contracts - - (131)

Results of GMIB business excluding charge on adoption (24) 209 (306)

ADJUSTED LOSS FROM OPERATIONS $ 27 $ 24 $ 209

Realized investment gains (losses), net of taxes $ 5 $ (2) $ (19)

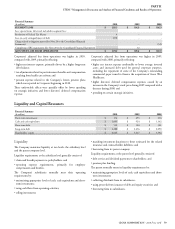

e adjusted loss from operations for Run-off Reinsurance was larger

in 2010 compared with 2009 due to reduced favorable after-tax impact

of reserve studies ($6 million for 2010 compared to $16 million

for 2009) and settlements and commutations ($3 million for 2010

compared to $11 million in 2009) for workers compensation and

personal accident businesses, partially off set by reduced charges in

2010 to strengthen GMDB reserves ($34 million after-tax for 2010,

compared to $47 million after-tax for 2009).

Segment earnings declined signifi cantly in 2010 compared with

2009, primarily due to the reduction in earnings from the GMIB

business, partially off set by the gain resulting from the resolution of

a federal tax matter.

Adjusted income from operations for Run-off Reinsurance improved

signifi cantly in 2009 compared with 2008 due to signifi cantly reduced

charges in the GMDB business to strengthen reserves ($47 million

after-tax for 2009, compared with $263 million for 2008) resulting

from a substantially lower amount of reserve strengthening. e

improvement in GMDB results in 2009 primarily refl ected the

recovery and stabilization of the fi nancial markets. Adjusted income

from operations also included the favorable after-tax impact of reserve

studies for the workers compensation and personal accident business

of $16 million in 2009 and $30 million in 2008.

Segment earnings were signifi cantly higher in 2009, compared with

2008, due in part to the improvement in adjusted income from

operations as discussed above and the signifi cant improvement

in GMIB results in 2009 (signifi cant gains) compared with 2008

(signifi cant losses).

For additional discussion of GMIB results, see “Benefi ts and

Expenses” below.

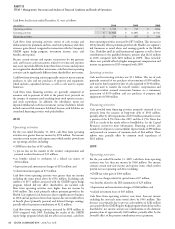

Other Revenues

Other revenues included pre-tax losses from futures contracts used in

the GMDB equity hedge program (see Note 7 to the Consolidated

Financial Statements) of $157 million in 2010 and $282 million in

2009 compared with pre-tax gains of $333 million in 2008. Amounts

refl ecting corresponding changes in liabilities for GMDB contracts

were included in benefi ts and expenses consistent with GAAP when a

premium defi ciency exists (see below “Other Benefi ts and Expenses”).

e Company held futures contract positions related to this program

with a notional amount of $0.9 billion at December 31, 2010.

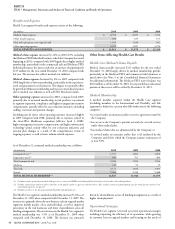

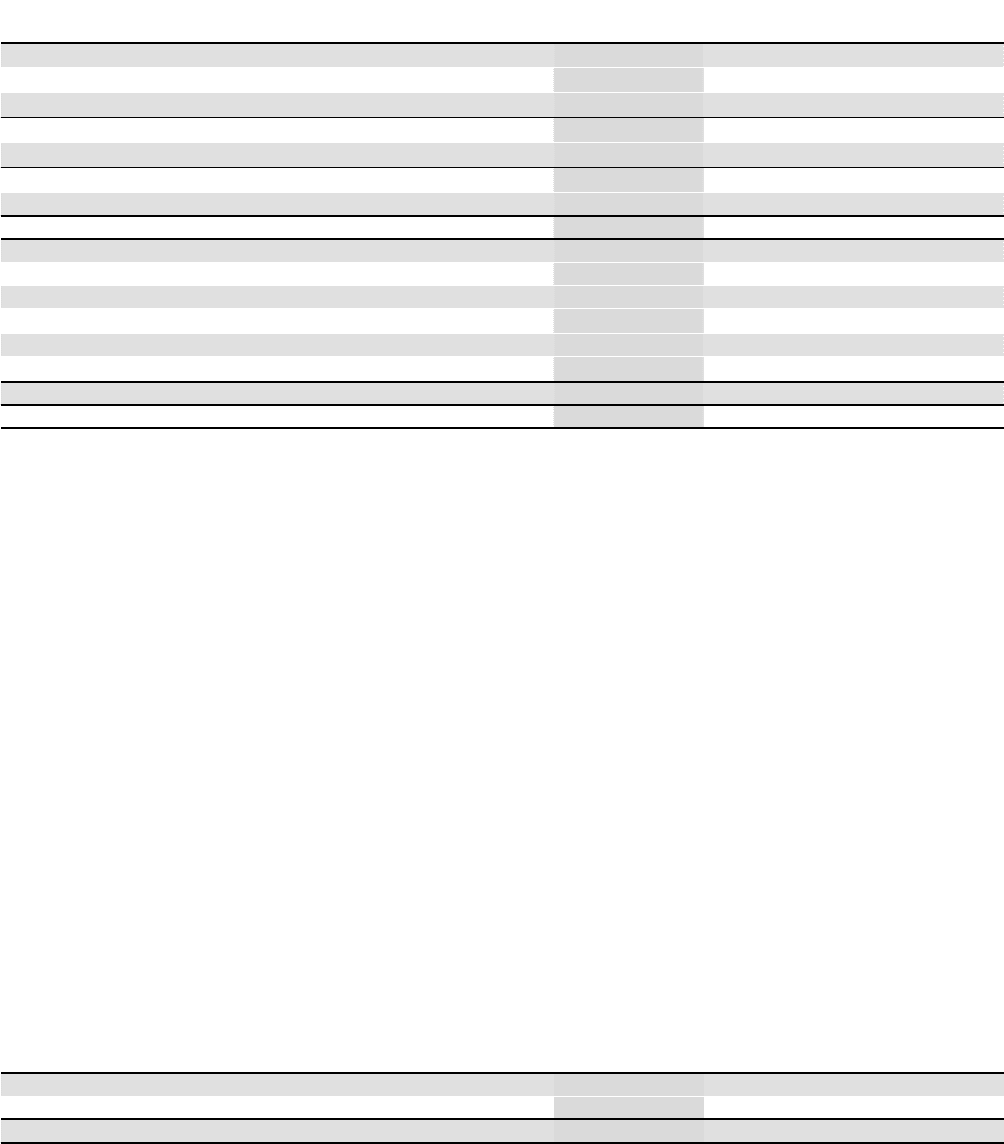

Benefi ts and Expenses

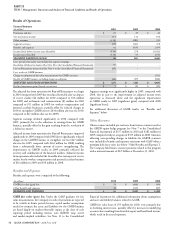

Benefi ts and expenses were comprised of the following:

(In millions)

2010 2009 2008

GMIB fair value (gain) loss $ 55 $ (304) $ 690

Other benefi ts and expenses 36 (115) 809

BENEFITS AND EXPENSES $91 $ 419 $ 1,499

GMIB fair value (gain) loss. Under the GAAP guidance for fair

value measurements, the Company’s results of operations are expected

to be volatile in future periods because capital market assumptions

needed to estimate the assets and liabilities for the GMIB business

are based largely on market-observable inputs at the close of each

reporting period including interest rates (LIBOR swap curve)

and market-implied volatilities. See Note 11 to the Consolidated

Financial Statements for additional information about assumptions

and asset and liability balances related to GMIB.

GMIB fair value losses of $55 million for 2010, were primarily due

to declining interest rates, partially off set by increases in underlying

account values resulting from favorable equity and bond fund returns,

which result in decreased exposures.