Cigna 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CIGNA CORPORATION 2010 Form 10K

62

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

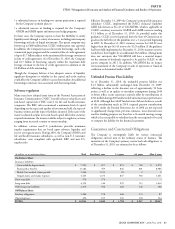

On March 14, 2008, the Company entered into a commercial paper

program (“the Program”). Under the Program, the Company is

authorized to sell short-term unsecured commercial paper notes from

time to time up to a maximum of $500 million. e proceeds are used

for general corporate purposes, including working capital, capital

expenditures, acquisitions and share repurchases. e Company uses

the credit facility described below as back-up liquidity to support

the outstanding commercial paper. If at any time funds are not

available on favorable terms under the Program, the Company may

use the Credit Agreement (see below) for funding. In October 2008,

the Company added an additional dealer to its Program. As of

December 31, 2010, the Company had $100 million in commercial

paper outstanding, at a weighted average interest rate of 0.38% and

remaining maturities ranging from 11 to 35 days.

In June 2007, the Company amended and restated its fi ve-year

committed revolving credit and letter of credit agreement for

$1.75 billion, which permits up to $1.25 billion to be used for letters

of credit. is agreement is diversifi ed among 22 banks, with three

banks each having 11% of the commitment and the other 19 banks

having the remaining 67% of the commitment. e credit agreement

includes options, which are subject to consent by the administrative

agent and the committing banks, to increase the commitment amount

up to $2.0 billion and to extend the term of the agreement. e

Company entered into the agreement for general corporate purposes,

including support for the issuance of commercial paper and to

obtain statutory reserve credit for certain reinsurance arrangements.

ere were letters of credit in the amount of $82 million issued as of

December 31, 2010.

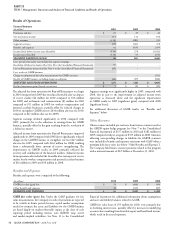

Uses of Capital

Pension funding

e Company contributed $212 million to the domestic qualifi ed

pension plans, of which $69 million was required and $143 million

was voluntary.

Acquisition of Vanbreda International

In 2010, the Company acquired Vanbreda International for

$412 million. e acquisition was funded from available cash. See

Note 3 for further information.

Repayments of long-term debt

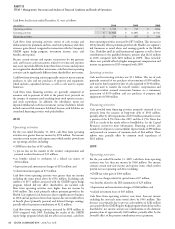

On December 1, 2010 the Company off ered to settle its 8.5%

Notes due 2019, including accrued interest from November 1 through

the settlement date. e tender price equaled the present value of

the remaining principal and interest payments on the Notes being

redeemed, discounted at a rate equal to the 10 year treasury rate plus

a fi xed spread of 100 basis points. e tender off er priced at a yield of

4.128% and principal of $99 million was tendered, with $251 million

remaining outstanding. e Company paid $130 million, including

accrued interest and expenses, to settle the Notes, resulting in an after-

tax loss on early debt extinguishment of $21 million.

On December 9, 2010 the Company off ered to settle its 6.35%

Notes due 2018, including accrued interest from September 16

through the settlement date. e tender price equaled the present value

of the remaining principal and interest payments on the Notes being

redeemed, discounted at a rate equal to the 10 year treasury rate plus

a fi xed spread of 45 basis points. e tender off er priced at a yield of

3.923% and principal of $169 million was tendered, with $131 million

remaining outstanding. e Company paid $198 million, including

accrued interest and expenses, to settle the Notes, resulting in an after-

tax loss on early debt extinguishment of $18 million.

Share Repurchase

e Company maintains a share repurchase program, which was

authorized by its Board of Directors. e decision to repurchase

shares depends on market conditions and alternate uses of capital. e

Company has, and may continue from time to time, to repurchase

shares on the open market through a Rule 10b5-1 plan which permits

a company to repurchase its shares at times when it otherwise might

be precluded from doing so under insider trading laws or because

of self-imposed trading blackout periods. e Company suspends

activity under this program from time to time and also removes such

suspensions, generally without public announcement.

e Company repurchased 6.2 million shares for $201 million during

2010, and an additional 1.8 million shares for $73 million through

February 25, 2011. On February 23, 2011, the Board of Directors

increased share repurchase authority by $500 million. e total

remaining share repurchase authorization as of February 25, 2011 was

$674 million.

e Company did not repurchase any shares during 2009 and

repurchased 10.0 million shares for $378 million in 2008.

Liquidity and Capital Resources Outlook

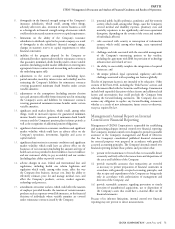

At December 31, 2010, there was approximately $810 million in cash

available at the parent company level. In 2011, the parent company’s

cash obligations are expected to consist of the following:

•scheduled interest payments of $167 million on outstanding short-

term and long-term debt of $2.8 billion at December 31, 2010;

•scheduled maturities of long-term debt of $448 million;

•contributions to the domestic qualifi ed pension plan of $250 million,

of which approximately 50% are expected to be required; and

•approximately $100 million of commercial paper that will mature

over the next three months. e Company expects to either repay the

commercial paper or refi nance it either by issuing long-term debt or

re-issuing commercial paper.

e Company expects, based on cash on hand, current projections

for dividends from the Company’s subsidiaries, as well as its ability to

issue debt or equity securities in the capital markets to have suffi cient

liquidity to meet its obligations.

However, the Company’s cash projections may not be realized and the

demand for funds could exceed available cash if:

•ongoing businesses experience unexpected shortfalls in earnings;

•regulatory restrictions or rating agency capital guidelines reduce the

amount of dividends available to be distributed to the parent company

from the insurance and HMO subsidiaries (including the impact of

equity market deterioration and volatility on subsidiary capital);

•signifi cant disruption or volatility in the capital and credit markets

reduces the Company’s ability to raise capital or creates unexpected

losses related to the GMDB and GMIB businesses;