Cigna 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K 109

PART II

ITEM 8 Financial Statements and Supplementary Data

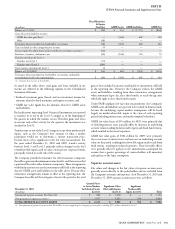

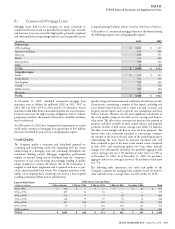

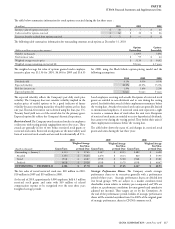

Instrument/Volume

ofActivity Primary Risk Purpose Cash Flows Accounting Policy

Derivatives Not Designated As Accounting Hedges

Futures—

$892million (2010)

and $1,058million

(2009) of U.S. dollar

equivalent market

price of outstanding

contracts

Equity and foreign currency To reduce domestic and

international equity market

exposures for certain reinsurance

contracts that guarantee

minimum death benefi ts

(GMDB) resulting from changes

in variable annuity account

values based on underlying

mutual funds. Currency futures

are primarily euros, Japanese yen

and British pounds.

e Company receives (pays)

cash daily in the amount

of the change in fair value

of the futures contracts.

Cash fl ows are included

in operating activities.

Fair value changes are reported

in other revenues. Amounts

not yet settled from the

previous day’s fair value change

(daily variation margin)

are reported in premiums,

accounts and notes receivable,

net or accounts payable,

accrued expenses and other

liabilities.

Fair Value E ect on the Financial Statements (in millions)

Other Revenues

For the years ended

December31,

2010 2009

Futures $ (157) $ (283)

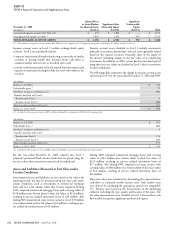

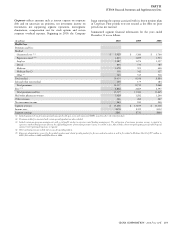

Interest rate swaps—

$45million (2010)

and $76million

(2009) of par value

ofrelated investments

Interest rate To hedge the interest cash fl ows

of fi xed maturities to match

associated liabilities.

e Company periodically

exchanges cash fl ows

between variable and fi xed

interest rates and these

cash fl ows are included in

investing activities.

Fair values are reported in

other long-term investments or

other liabilities, with changes

in fair value reported in other

realized investment gains and

losses.

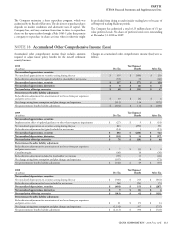

Fair Value E ect on the Financial Statements (in millions)

Other Long-Term Investments Other Realized Investment

Gains (Losses)

As of December31, For the years ended

December31,

2010 2009 2010 2009

Interest rate swaps $ 3 $ 4 $ (2) $ (1)

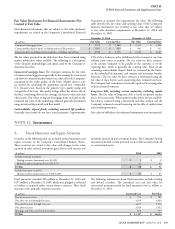

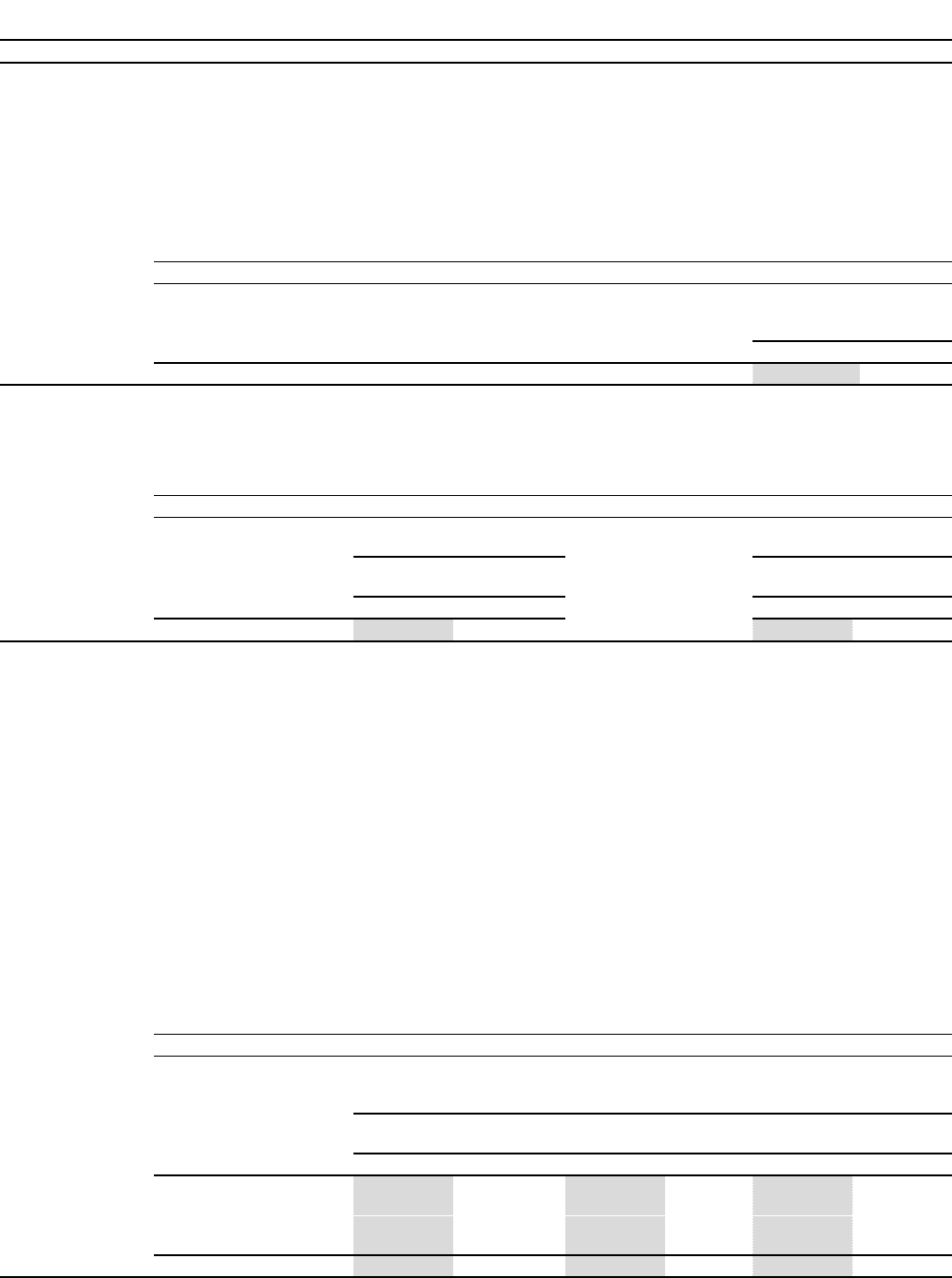

Written options

(GMIB liability)—

$1,134million

(2010) and

$1,183million (2009)

of maximum potential

undiscounted future

payments as de ned

in Note24

Purchased options

(GMIB asset)—

$624million (2010)

and $651million

(2009) of

maximum potential

undiscounted future

receipts as de ned in

Note24

Equity and interest rate e Company has written

reinsurance contracts with

issuers of variable annuity

contracts that provide annuitants

with certain guarantees of

minimum income benefi ts,

resulting from the level of

variable annuity account values

compared with a contractually

guaranteed amount. Payment

by the Company depends on

the actual account value in the

underlying mutual funds and the

level of interest rates when the

contractholders elect to receive

minimum income payments.

e Company purchased

reinsurance contracts to reduce

a portion of the market risk

assumed. ese contracts are

accounted for as written and

purchased options.

e Company periodically

receives (pays) fees based

on either contractholders’

account values or deposits

increased at a contractual

rate. e Company will also

pay (receive) cash depending

on changes in account values

and interest rates when

contractholders fi rst elect to

receive minimum income

payments. ese cash fl ows

are reported in operating

activities.

Fair values are reported

in other liabilities (GMIB

liability) and other assets

(GMIB asset). Changes in fair

value are reported in GMIB

fair value (gain)/loss.

Fair Value E ect on the Financial Statements (in millions)

Instrument

Other Assets, including other

intangibles

Accounts Payable, Accrued

Expenses and Other

Liabilities GMIB Fair Value (Gain)/Loss

As of December31, As of December31, For the years ended

December31,

2010 2009 2010 2009 2010 2009

Written options (GMIB

liability) $ — $ — $ 903 $ 903 $ 112 $ (669)

Purchased options (GMIB

asset) 480 482 — — (57) 365

TOTAL $ 480 $ 482 $ 903 $ 903 $ 55 $ 304