Cigna 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CIGNA CORPORATION 2010 Form 10K

36

PART II

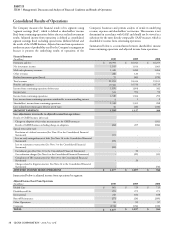

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

impact of Health Care Reform could have a material impact on the

Company’s results of operations. e Company is evaluating potential

business opportunities resulting from Health Care Reform that will

enable it to leverage the strengths and capabilities of its broad health and

wellness portfolio.

Health Care Reform will require the assessment of fees and excise

taxes on health services companies such as CIGNA and others in the

health care industry to help fund the additional insurance benefi ts and

coverages provided by this legislation. e amount which the Company

will be required to pay starting in 2013 and 2014 for these fees and

excise taxes will result in charges to the Company’s fi nancial statements

in future periods. In addition, since these fees and excise taxes will not be

tax deductible, the Company’s eff ective tax rate is expected to increase in

future periods. However, the Company is unable to estimate the amount

of these fees and excise taxes or the increase in the eff ective tax rate

because guidance for the calculation has not been fi nalized.

Health Care Reform also changes certain tax laws which aff ected the

Company’s 2010 fi nancial statements. Although these provisions

do not become eff ective until 2013, they are expected to limit the

tax deductibility of certain future retiree benefi t and compensation-

related payments earned after 2009. e Company recorded after-tax

charges of approximately $10 million for the twelve months ended

December 31, 2010 related to these changes. e Company will

continue to evaluate the impact of these tax laws as further guidance is

made available.

During 2010, the Company incurred total after-tax costs of approximately

$25 million related to Health Care Reform comprised of:

•$10 million of additional income tax related to the impact of the tax

law changes as described previously, and

•$15 million of costs related to building the infrastructure necessary

to comply with the provisions of Health Care Reform which were

eff ective in 2010 and 2011 of which $7 million were incremental costs.

e remaining $8 million refl ected the estimated cost of internal staff

redeployed to work on Health Care Reform initiatives.

Many provisions of Health Care Reform are not eff ective until future

years and the Company will continue to implement these provisions.

On January 1, 2011, the minimum loss ratio became eff ective and

will require payment of premium rebates beginning in 2012 to

employers and customers covered under the Company’s comprehensive

medical insurance if certain minimum medical loss ratios are not met.

Management estimates charges for rebates to approximate $25 million

after-tax for the year ending December 31, 2011. is estimate followed

the most current regulatory guidance for the calculation of rebates and

was developed using assumptions about the amount and distribution for

claim experience, enrollment and premiums earned by state and market

segment. Actual rebates could diff er substantially from management’s

estimates if actual experience diff ers from the assumptions.

Management is currently unable to estimate the full impact of Health

Care Reform on the Company’s future results of operations, and

its fi nancial condition and liquidity due to uncertainties related to

interpretation, implementation and timing of its many provisions. It is

possible; however, that this impact could be material to future results of

operations. Management, through its internal task force, continues to

closely monitor implementation of the law, report on the Company’s

compliance with Health Care Reform, actively engage with regulators to

assist with the ongoing conversion of legislation to regulation and assess

potential opportunities arising from Health Care Reform.

Acquisitions and Dispositions

In line with its growth strategy, the Company has strengthened its

market position and reduced balance sheet exposures through the

following acquisition and disposition transactions.

Reinsurance of Run-off Workers’ Compensation and

Personal Accident Business

On December 31, 2010, the Company essentially exited from its

workers’ compensation and personal accident reinsurance business

by purchasing retrocessional coverage from a Bermuda subsidiary

of Enstar Group Limited and transferring administration of this

business to the reinsurer. See Note 3 to the Consolidated Financial

Statements for additional information.

Sale of Workers’ Compensation and Case Management

Business

On December 1, 2010 the Company completed the sale of its

workers’ compensation and case management business to GENEX

Holdings, Inc. e Company recognized an after-tax gain on sale

of $11 million ($18 million before tax) which was reported in other

revenues in the Disability and Life segment. See Note 3 to the

Consolidated Financial Statements for additional information.

Acquisition of Vanbreda International

On August 31, 2010, the Company acquired 100% of the voting

stock of Vanbreda International NV (“Vanbreda International”),

based in Antwerp, Belgium for a cash purchase price of $412 million.

See Note 3 to the Consolidated Financial Statements for additional

information about the acquisition of Vanbreda International.

Acquisition of Great-West Healthcare

On April 1, 2008, the Company acquired the Health care division

of Great-West Life and Annuity, Inc. (“Great-West Healthcare”).

See Note 3 to the Consolidated Financial Statements for additional

information.

Initiatives to Lower Operating Expenses

As part of its strategy, the Company has undertaken several initiatives

to realign its organization and consolidate support functions in an

eff ort to increase effi ciency and responsiveness to customers and to

reduce costs.

During 2008 and 2009, the Company conducted a comprehensive

review to reduce certain operating expenses of its ongoing businesses

(“cost reduction program”). As a result, the Company recognized

severance-related and real estate charges in other operating expenses.

Severance charges in 2008 and 2009 resulted from reductions of

approximately 2,350 positions in the Company’s workforce. Cost

reduction activities associated with these charges are substantially

complete as of December 31, 2010 with severance expected to

be paid by the end of the second quarter of 2011. In 2010, the

Company recorded an incremental pre-tax charge of $6 million

($4 million after-tax) to refl ect actual severance experience diff ering

from prior assumptions.