Cigna 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K 43

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

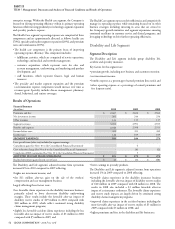

Balance Sheet Caption/Nature of Critical

Accounting Estimate Assumptions/Approach Used E ect if Di erent Assumptions Used

Health Care medical claims payable

Medical claims payable for the Health

Care segment include both reported

claims and estimates for losses incurred

but not yet reported.

Liabilities for medical claims payable as of

December 31 were as follows (in millions):

•2010— gross $1,246; net $1,010

•2009 — gross $921; net $715

ese liabilities are presented above both

gross and net of reinsurance and other

recoverables.

ese liabilities generally exclude amounts

for administrative services only business.

See Note 5 to the Consolidated Financial

Statements for additional information.

e Company develops estimates for Health Care medical

claims payable using actuarial principles and assumptions

consistently applied each reporting period, and recognizes

the actuarial best estimate of the ultimate liability within

a level of confi dence, as required by actuarial standards of

practice, which require that the liabilities be adequate under

moderately adverse conditions.

e liability is primarily calculated using “completion

factors” (a measure of the time to process claims), which

are developed by comparing the date claims were incurred,

generally the date services were provided, to the date claims

were paid. e Company uses historical completion factors

combined with an analysis of current trends and operational

factors to develop current estimates of completion factors.

e Company estimates the liability for claims incurred in

each month by applying the current estimates of completion

factors to the current paid claims data. is approach

implicitly assumes that historical completion rates will be a

useful indicator for the current period. It is possible that the

actual completion rates for the current period will develop

diff erently from historical patterns, which could have a

material impact on the Company’s medical claims payable

and shareholders’ net income.

Completion factors are impacted by several key items

including changes in: 1) electronic (auto-adjudication) versus

manual claim processing, 2) provider claims submission

rates, 3) membership and 4) the mix of products.

In addition, for the more recent months, the Company also

relies on medical cost trend analysis, which refl ects expected

claim payment patterns and other relevant operational

considerations. Medical cost trend is primarily impacted by

medical service utilization and unit costs, which are aff ected

by changes in the level and mix of medical benefi ts off ered,

including inpatient, outpatient and pharmacy, the impact

of copays and deductibles, changes in provider practices

and changes in consumer demographics and consumption

behavior.

Despite refl ecting both historical and emerging trends in

setting reserves, it is possible that the actual medical trend for

the current period will develop diff erently from the expected,

which could have a material impact on the Company’s

medical claims payable and shareholders’ net income.

For each reporting period, the Company evaluates key

assumptions by comparing the assumptions used in

establishing the medical claims payable to actual experience.

When actual experience diff ers from the assumptions used in

establishing the liability, medical claims payable are increased

or decreased through current period shareholders’ net

income. Additionally, the Company evaluates expected future

developments and emerging trends which may impact key

assumptions. e estimation process involves considerable

judgment, refl ecting the variability inherent in forecasting

future claim payments. ese estimates are highly sensitive

to changes in the Company’s key assumptions, specifi cally

completion factors, and medical cost trends.

For the year ended December 31, 2010,

actual experience diff ered from the Company’s

key assumptions as of December 31, 2009,

resulting in $93 million of favorable incurred

claims related to prior years’ medical claims

payable or 1.3% of the current year incurred

claims as reported for the year ended

December 31, 2009. For the year ended

December 31, 2009, actual experience diff ered

from the Company’s key assumptions as of

December 31, 2008, resulting in $43 million

of favorable incurred claims related to prior

years’ medical claims, or 0.6% of the current

year incurred claims reported for the year

ended December 31, 2008. Specifi cally, the

favorable impact is due to faster than expected

completion factors and lower than expected

medical cost trends, both of which included an

assumption for moderately adverse experience.

e impact of this favorable prior year

development was an increase to shareholders’

net income of $26 million after-tax

($39 million pre-tax) for the year ended

December 31, 2010. e change in the

amount of the incurred claims related to prior

years in the medical claims payable liability

does not directly correspond to an increase

or decrease in shareholders’ net income as

explained in Note 5 to the Consolidated

Financial Statements.