Cigna 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K 107

PART II

ITEM 8 Financial Statements and Supplementary Data

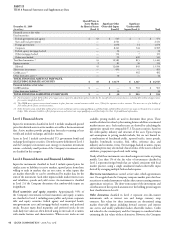

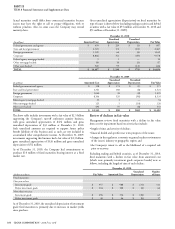

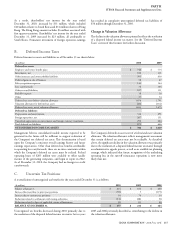

D. Other Long-term Investments

As of December 31, other long-term investments consisted of the

following:

(In millions)

2010 2009

Real estate entities $ 394 $ 289

Securities partnerships 288 272

Interest rate and foreign currency swaps 19 16

Mezzanine loans 13 13

Other 45 5

TOTAL $ 759 $ 595

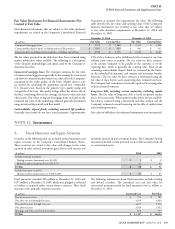

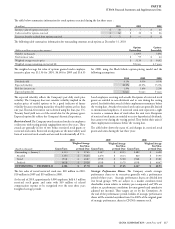

Investments in real estate entities and securities partnerships

with a carrying value of $169 million at December 31, 2010 and

$121 million at December 31, 2009 were non-income producing

during the preceding twelve months.

As of December 31, 2010, the Company had commitments to

contribute:

•$224 million to limited liability entities that hold either real estate or

loans to real estate entities that are diversifi ed by property type and

geographic region; and

•$297 million to entities that hold securities diversifi ed by issuer and

maturity date.

e Company expects to disburse approximately 55% of the

committed amounts in 2011.

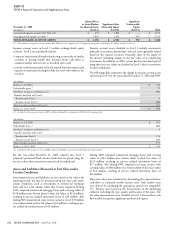

E. Short-Term Investments and Cash

Equivalents

Short-term investments and cash equivalents included corporate

securities of $1.1 billion, federal government securities of $137 million

and money market funds of $40 million as of December 31, 2010.

e Company’s short-term investments and cash equivalents as of

December 31, 2009 included corporate securities of $624 million,

federal government securities of $402 million and money market

funds of $104 million.

F. Concentration of Risk

As of December 31, 2010 and 2009, the Company did not have a

concentration of investments in a single issuer or borrower exceeding

10% of shareholders’ equity.

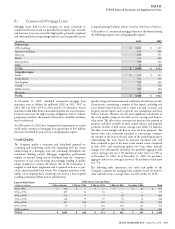

NOTE 13 Derivative Financial Instruments

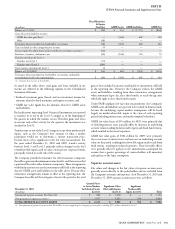

e Company uses derivative fi nancial instruments primarily as

part of a strategy to reduce the equity market exposures relating to

guaranteed minimum death benefi t contracts. Derivative fi nancial

instruments are also used by the Company as a part of its investment

strategy to manage the characteristics of investment assets (such

as duration, yield, currency and liquidity) to meet the varying

demands of the related insurance and contractholder liabilities (such

as paying claims, investment returns and withdrawals). Derivatives

are typically used under this strategy to minimize interest rate and

foreign currency risks. e Company routinely monitors exposure

to credit risk associated with derivatives and diversifi es the portfolio

among approved dealers of high credit quality to minimize this risk.

In addition, the Company has written or sold contracts to guarantee

minimum income benefi ts.

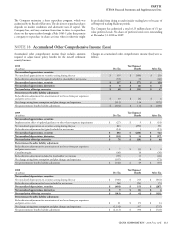

e Company uses hedge accounting when derivatives are designated,

qualify and are highly eff ective as hedges. Eff ectiveness is formally

assessed and documented at inception and each period throughout

the life of a hedge using various quantitative methods appropriate

for each hedge, including regression analysis and dollar off set. Under

hedge accounting, the changes in fair value of the derivative and the

hedged risk are generally recognized together and off set each other

when reported in shareholders’ net income.

e Company accounts for derivative instruments as follows:

•Derivatives are reported on the balance sheet at fair value with

changes in fair values reported in shareholders’ net income or

accumulated other comprehensive income.

•Changes in the fair value of derivatives that hedge market risk related

to future cash fl ows — and that qualify for hedge accounting — are

reported in a separate caption in accumulated other comprehensive

income. ese hedges are referred to as cash fl ow hedges.

•A change in the fair value of a derivative instrument may not always

equal the change in the fair value of the hedged item; this diff erence

is referred to as hedge ineff ectiveness. Where hedge accounting is

used, the Company refl ects hedge ineff ectiveness in shareholders’

net income (generally as part of realized investment gains and

losses).

Certain of the Company’s over-the-counter derivative instruments

contain provisions requiring either the Company or the counterparty

to post collateral depending on the amount of the net liability

position and predefi ned fi nancial strength or credit rating thresholds.

e collateral posting requirements vary by counterparty. e

aggregate fair value of derivative instruments with such credit-risk-

related contingent features where the Company was in a net liability

position was $25 million at December 31, 2010 and $29 million

at December 31, 2009 for which the Company was not required

to post collateral with its counterparties. If the various contingent

features underlying the agreements were triggered as of the balance

sheet date, the Company would be required to post collateral equal

to the total net liability. e Company is a party to certain other

derivative instruments that contain termination provisions for which

the counterparties could demand immediate payment of the total net

liability position if the fi nancial strength rating of the Company were

to decline below specifi ed levels. As of December 31, 2010 and 2009,