Cigna 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K 49

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

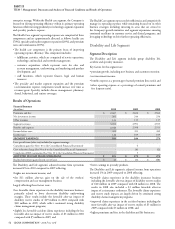

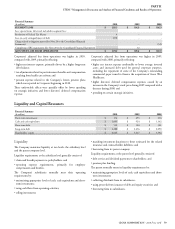

Operating expense effi ciencies were achieved by successful execution

of cost reduction initiatives including staffi ng, real estate and pension

changes, resulting in an approximately 3% decrease in the operating

expense ratio. Despite this decline in the expense ratio, adjusted

income from operations was reduced in 2010 by increased expenses

related to business growth, investment in segment expansion,

compliance and higher management incentive compensation.

e Health Care segment’s adjusted income from operations in 2009,

as compared with 2008, was favorably impacted by the absence of a

$7 million after-tax adjustment related to a large experience-rated life and

non-medical account in run-out recorded in the fi rst quarter of 2008.

Excluding this item, adjusted income from operations for 2009 was

slightly higher than 2008 refl ecting:

•lower operating expenses, excluding the impact of an additional

quarter from the Great-West Healthcare acquisition (eff ective

April 1, 2008), primarily driven by cost reduction initiatives and

pension plan changes, partially off set by higher management

incentive compensation and higher information technology spend;

•higher stop loss earnings largely from the Great-West Healthcare

acquisition (eff ective April 1, 2008), tempered by lower margins on

the remaining book; and

•improved specialty earnings.

ese favorable eff ects were largely off set by:

•lower membership;

•lower guaranteed cost earnings primarily refl ecting a higher medical

care ratio driven by unfavorable prior year development, as well as

higher in-year claims due, in part to H1N1 fl u-related claims; and

•lower investment income primarily refl ecting lower income from

real estate funds.

Revenues

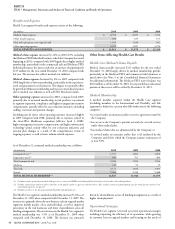

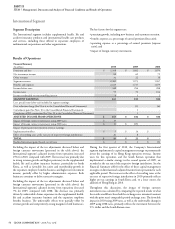

e table below shows premiums and fees for the Health Care segment:

(In millions)

2010 2009 2008

Medical:

Guaranteed cost (1) (2) $ 3,929 $ 3,380 $ 3,704

Experience-rated (2) (3) 1,823 1,699 1,953

Stop loss 1,287 1,274 1,197

Dental 804 731 785

Medicare 1,470 595 400

Medicare Part D 558 342 327

Other (4) 543 515 518

Total medical 10,414 8,536 8,884

Life and other non-medical 103 179 184

Total premiums 10,517 8,715 9,068

Fees (2) (5) 2,802 2,669 2,597

TOTAL PREMIUMS AND FEES $ 13,319 $ 11,384 $ 11,665

(1) Includes guaranteed cost premiums primarily associated with open access and commercial HMO, as well as other risk-related products.

(2) Premiums and/or fees associated with certain specialty products are also included.

(3) Includes minimum premium arrangements with a risk profile similar to experience-rated funding arrangements. The risk portion of minimum premium revenue is reported in

experience-rated medical premium whereas the self funding portion of minimum premium revenue is recorded in fees.

Also, includes certain non-participating cases for which special customer level reporting of experience is required.

(4) Other medical premiums include risk revenue and specialty products.

(5) Represents administrative service fees for medical members and related specialty product fees for non-medical members as well as fees related to Medicare Part D of $57 million in

2010, $41 million in 2009, and $69 million in 2008.

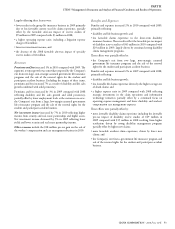

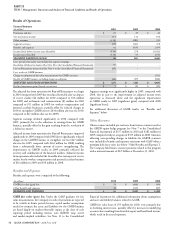

Premiums and fees increased by 17% in 2010 (10% excluding the

Medicare PFFS Individual business, which the Company has exited

beginning in 2011), compared with 2009, primarily refl ecting

membership growth in most risk-based products, including Medicare,

and to a lesser extent rate increases. e membership growth was

driven by strong retention and new sales in targeted market segments.

e increase in fees primarily refl ects growth in specialty products.

ese increases refl ect the success of the Company’s eff orts to enhance

customer access, improve the quality of care and provide cost eff ective

products and services.

Premiums and fees decreased 2% in 2009, compared with 2008,

primarily refl ecting lower membership largely due to disenrollment

resulting from higher unemployment. is impact was partially off set by:

•rate actions across all products;

•increases in fees relating to specialty products;

•membership growth in the Medicare private fee for service and

Voluntary products; and

•the impact of the Great-West Healthcare acquisition (eff ective

April 1, 2008).

Net investment income increased by 34% in 2010 compared with

2009 primarily refl ecting higher security partnership results, higher

real estate income and increased invested assets driven by business

growth. Net investment income decreased by 10% in 2009 compared

with 2008 primarily refl ecting lower income from real estate funds

partially off set by higher invested assets.

Other revenues for the Health Care segment consist of revenues

earned on direct channel sales of certain specialty products, including

behavioral health and disease management.