Cigna 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K

34

PART II

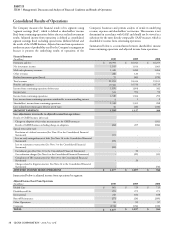

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

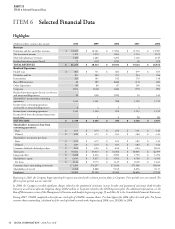

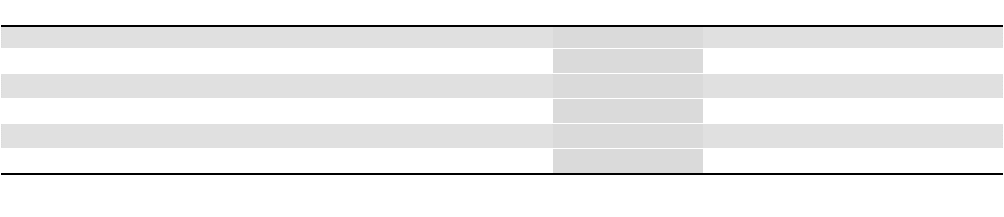

Key Consolidated Financial Data

(Dollars in millions)

2010 2009 2008

Revenues $ 21,253 $ 18,414 $ 19,101

Medical membership (in thousands) (1) 12,473 11,669 12,338

Adjusted income from operations (2) $ 1,277 $ 1,097 $ 946

Shareholders’ income from continuing operations $ 1,345 $ 1,301 $ 398

Cash fl ows from operating activities $ 1,743 $ 745 $ 1,656

Shareholders’ equity $ 6,645 $ 5,417 $ 3,592

(1) Includes medical members of the Company’s Health Care segment as well as the International health care business, including expatriate benefits.

(2) For a definition of adjusted income from operations, see the “Consolidated Results of Operations” section of this MD&A beginning on page 38.

Results of Operations

•Revenues rose signifi cantly in 2010, refl ecting strong premium

growth in the Company’s ongoing operating segments due to solid

growth in each of the Company’s targeted markets. Net investment

income and realized investment results also improved signifi cantly

primarily refl ecting improving economic conditions.

•Medical membership increased, refl ecting the acquisition of

Vanbreda International as well as the strength of the Company’s

value proposition centered around health advocacy and its focus on

growth in targeted markets, primarily the middle market and select

segments.

•Adjusted income from operations increased signifi cantly in 2010,

refl ecting focused execution of the Company’s business strategy,

which includes a growing global customer base.

•Shareholders’ income from continuing operations also increased,

but at a lower rate than adjusted income from operations. is is

primarily due to signifi cantly lower results in the Company’s run-

off GMIB business. Results from this business are volatile, as key

market inputs to the valuation of these assets and liabilities, such as

interest rates, are adjusted each quarter.

•Cash fl ows from operating activities remain strong, refl ecting solid

underlying earnings as well as business growth. Strong operating

cash fl ows enabled the Company to contribute $212 million to its

pension plan as well as to repurchase 6.2 million shares of stock for

$201 million.

Liquidity and Financial Condition

During 2010, the Company entered into several transactions to

position itself to execute on its strategy as well as to strengthen its

liquidity and fi nancial condition.

• e recent acquisition of Vanbreda International in the third

quarter of 2010 positions the Company to be a global leader in the

delivery of expatriate benefi ts.

• e Company sold its workers’ compensation and case management

business to GENEX Holdings.

• e Company reduced its balance sheet exposure in the run-

off reinsurance operations by reinsuring its run-off workers’

compensation and personal accident business.

• e Company retired portions of its long-term debt through a

tender off er process, and issued replacement debt at a signifi cantly

lower interest rate.

Shareholders’ equity increased substantially during 2010, refl ecting

strong shareholders’ net income as well as increased invested asset

values (primarily fi xed maturities) refl ecting lower market yields.

ose favorable impacts were partially off set by the unfavorable eff ects

of the pension plan liability on shareholders’ equity due to changes

in the discount rate and mortality assumptions. e Company’s

commercial mortgage loan portfolio continued to perform well, with

minimal write-downs and stabilizing real estate valuations.

Business Strategy

As a global health service organization, CIGNA’s mission is to help

the people it serves improve their health, well-being and sense of

security. As part of this mission, the Company remains committed

to health advocacy as a means of creating sustainable solutions for

employers, improving the health of the individuals that the Company

serves, and lowering the costs of health care for all constituencies.

CIGNA’s long-term growth strategy is based on: (1) growth in targeted

geographies, product lines, buying segments and distribution channels;

(2) improving its strategic and fi nancial fl exibility; and (3) pursuing

additional opportunities in high-growth markets with particular focus

on individuals. Our strategy can be summarized as follows:

•“Go deep” with growth in targeted customer segments, geographies,

buying segments and distribution channels;

•“Go individual” by delivering high quality products and services

which improve health, wellness and insurance needs that are helpful

and easy to use; and

•“Go global” by pursuing additional opportunities in high-growth

markets across the globe and serving individuals regardless of where

they live and work.

To achieve these goals, CIGNA expects to focus on the following

which have the most potential for profi table growth:

•Domestic Health Care segment. In this market, CIGNA is focused

on expanding and deepening client and customer relationships

across each segment. Specifi cally: (1) within key geographic

segments, growing the “Select” market, which generally includes

employers with more than 50 but fewer than 250 employees and

the “Middle Market” segment which generally includes employers

with more than 250 but less than 5,000 employees, by leveraging

the Company’s customer knowledge, diff erentiated service model,

product portfolio and distribution model; (2) engaging those

national account employers who share and will benefi t from

the Company’s value proposition of using health advocacy and

employee engagement to increase productivity, performance and