Cigna 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K

52

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

enterprise strategy. Within the Health care segment, the Company is

focused on driving operating effi ciency within its primary operating

functions while investing prudently in technology, segment expansion

and specialty products expense.

e Health Care segment’s operating expenses are comprised of three

components and are approximately allocated as follows: health care

(70%), specialty and market segment expansion (20%), and premium

taxes and commissions (10%).

• e health care component is the primary focus of improving

operating expense effi ciency. is component includes:

–fulfi llment activities, which are comprised of service operations,

technology, and medical and network management;

–customer acquisition, which represent costs for sales and

account management, underwriting, and marketing and product

development; and

–staff functions, which represent fi nance, legal and human

resources.

• e specialty and market segment expansion and the premium

tax/commission expense components would increase over time as

revenues grow. Specialty includes disease management, pharmacy,

dental, behavioral, and seniors coverages.

e Health Care segment expects to drive effi ciencies and competitively

manage its operating expenses while remaining focused on its other

business strategies including investing in areas that are critical to

the Company’s growth initiatives and segment expansions, ensuring

continued excellence in customer service and clinical programs, and

leveraging technology to drive further operating effi ciencies.

Disability and Life Segment

Segment Description

e Disability and Life segment includes group disability, life,

accident and specialty insurance.

Key factors for this segment are:

•premium growth, including new business and customer retention;

•net investment income;

•benefi ts expense as a percentage of earned premium (loss ratio); and

•other operating expense as a percentage of earned premiums and

fees (expense ratio).

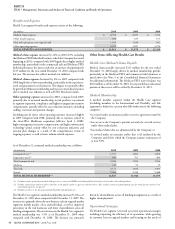

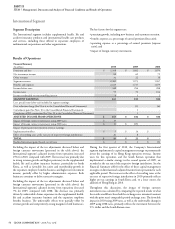

Results of Operations

Financial Summary

(In millions)

2010 2009 2008

Premiums and fees $ 2,667 $ 2,634 $ 2,562

Net investment income 261 244 256

Other revenues 123 113 117

Segment revenues 3,051 2,991 2,935

Benefi ts and expenses 2,640 2,598 2,553

Income before taxes 411 393 382

Income taxes 120 109 109

SEGMENT EARNINGS 291 284 273

Less: special items (after-tax) included in segment earnings:

Curtailment gain (See Note 10 to the Consolidated Financial Statements) - 4 -

Cost reduction charge (See Note 6 to the Consolidated Financial Statements) - (4) (2)

Completion of IRS examination (See Note 20 to the Consolidated Financial Statements) - 5 -

ADJUSTED INCOME FROM OPERATIONS $ 291 $ 279 $ 275

Realized investment gains (losses), net of taxes $ 12 $ (1) $ (48)

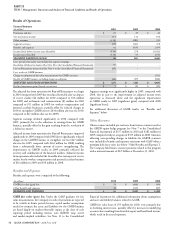

e Disability and Life segment’s adjusted income from operations

increased 4% in 2010 compared to 2009 refl ecting:

•higher net investment income; and

•the $11 million after-tax gain on the sale of the workers’

compensation and case management business.

Largely off setting these factors were:

•less favorable claims experience in the disability insurance business,

primarily related to lower short-term disability underwriting

margins. ese results include the favorable after-tax impact of

disability reserve studies of $29 million in 2010 compared with

$20 million in 2009, which refl ect continued strong disability

claims management programs;

•slightly less favorable accident claims experience including the less

favorable after-tax impact of reserve studies of $3 million in 2010

compared with $5 million in 2009; and

•lower earnings in specialty products.

e Disability and Life segment’s adjusted income from operations

increased 1% in 2009 compared to 2008 refl ecting:

•favorable claims experience in the disability insurance business

including the favorable after-tax impact of disability reserve studies

of $20 million in 2009 compared with $8 million in 2008. e

results in 2008 also included a $3 million favorable after-tax

impact of a reinsurance settlement. e favorable claims experience

and reserve study impacts are largely driven by continued strong

disability claims management programs;

•improved claims experience in the accident business including the

more favorable after-tax impact of reserve studies of $5 million in

2009 compared with $3 million in 2008; and

•higher premiums and fees in the disability and life businesses.