Cigna 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CIGNA CORPORATION 2010 Form 10K 35

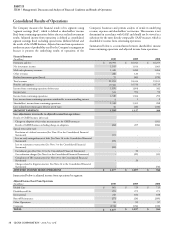

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

the health outcomes of their employees; and (3) targeting sub-

markets including industry, government and municipal entities and

individuals that align closest to the Company’s stated strategy.

•In the Disability and Life segment, CIGNA’s strategy is to grow

its Disability business by fully leveraging the key components of

its industry-leading disability management model to reduce costs

for its clients and return their employees to work sooner through:

(1) eff ective customer engagement and early outreach; (2) a

full suite of clinical and return-to-work resources to support the

employer’s ability to manage disability and work related events; and

(3) specialized case management services that address an individual’s

unique needs.

•In the International segment, CIGNA continues to expand the

product and geographic footprint by executing local strategies

that grow supplemental, primary medical and expatriate benefi ts

through: (1) product and channel expansion in its supplemental

health, life and accident business in key Asian geographies; (2) the

introduction of new expatriate benefi ts products, that provide greater

benefi t and geographic fl exibility to individual and employers (such

as through the Vanbreda International acquisition); and (3) further

expansion of distribution capabilities to capitalize on emerging and

growing markets globally.

e Company plans to improve its strategic and fi nancial fl exibility

by driving further reductions in its Health Care operating expenses,

improving its medical cost competitiveness in targeted markets and

eff ectively managing balance sheet exposures.

See the “Run-off operations” section below for further discussion of

the Company’s actions to manage its balance sheet exposures. e

Company’s operational strategies are discussed further in the Health

Care segment section of the MD&A beginning on page 48.

e Company’s ability to increase revenue, shareholders’ net income

and operating cash fl ows from ongoing operations is directly related

to progress on the execution of its strategy as described above as well

as other key factors, including the Company’s ability to:

•profi tably price products and services at competitive levels that

refl ect emerging experience;

•cross sell its various health and related benefi t products;

•invest available cash at attractive rates of return for appropriate

durations; and

•eff ectively deploy capital.

In addition to the Company-specifi c factors cited above, overall results

are infl uenced by a range of economic and other factors, especially:

•cost trends and infl ation for medical and related services;

•utilization patterns of medical and other services;

•employment levels;

•the tort liability system;

•developments in the political environment both domestically and

internationally, including U.S. health care reform;

•interest rates, equity market returns, foreign currency fl uctuations

and credit market volatility, including the availability and cost of

credit in the future; and

•federal, state and international regulation.

e Company regularly monitors the trends impacting operating

results from the above mentioned key factors to appropriately

respond to economic and other factors aff ecting its operations, both

in its ongoing and run-off operations.

Run-off Operations

e Company’s run-off reinsurance operations have signifi cant

exposures, primarily for its guaranteed minimum death benefi ts

(“GMDB”, also known as “VADBe”) and guaranteed minimum

income benefi ts (“GMIB”) products. As part of its strategy to

eff ectively manage these exposures, the Company operates an equity

hedge program to substantially reduce the impact of equity market

movements on the liability for the GMDB business. e Company

actively monitors the performance of the hedge program, and

evaluates the cost/benefi t of hedging other risks, including interest

rate risk.

ese products are also infl uenced by a range of economic and behavioral

factors that were not hedged as of December 31, 2010, including:

•equity markets for GMIB contracts;

•interest rates;

•future partial surrender elections for GMDB contracts;

•annuity election rates for guaranteed minimum income benefi ts

(“GMIB”) contracts;

•annuitant lapse rates; and

•the collection of amounts recoverable from retrocessionaires.

In order to manage these factors, the Company:

•actively studies policyholder behavior experience and adjusts future

expectations based on the results of the studies, as warranted;

•implemented a partial hedge in February 2011 for a portion of the

equity market risk for GMIB contracts and a portion of the interest

rate risk for GMDB and GMIB contracts, and will continue to

evaluate further adjustments to the hedging program;

•performs regular audits of ceding companies to ensure compliance

with agreements as well as to help maximize the collection of

receivables from retrocessionaires; and

•monitors the fi nancial strength and credit standing of its

retrocessionaires and establishes or collects collateral when

warranted.

Health Care Reform

In the fi rst quarter of 2010, the Patient Protection and Aff ordable Care

Act, including the Reconciliation Act of 2010, (“Health Care Reform”)

was signed into law. Health Care Reform mandates broad changes in

the delivery of health care benefi ts that may impact the Company’s

current business model, including its relationship with current and

future customers, producers and health care providers, products, services,

processes and technology. Health Care Reform includes, among others,

provisions for mandatory coverage of benefi ts, a minimum medical loss

ratio for insured business, eliminates lifetime and annual benefi t limits

and creates health insurance exchanges. e provisions of the law take

eff ect over the next several years from 2010 to 2018. Many provisions

of Health Care Reform have become eff ective during 2010, and interim

fi nal regulations have been issued, however there are still many provisions

which have yet to become eff ective, and it is possible that the ultimate