Cigna 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K 97

PART II

ITEM 8 Financial Statements and Supplementary Data

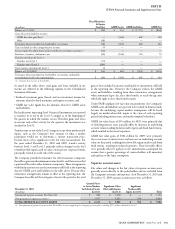

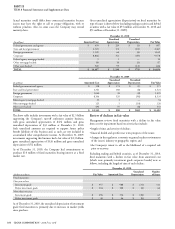

NOTE 11 Fair Value Measurements

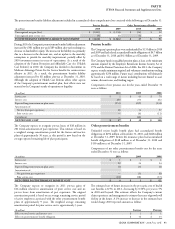

e Company carries certain fi nancial instruments at fair value in the

fi nancial statements including fi xed maturities, equity securities, short-

term investments and derivatives. Other fi nancial instruments are

measured at fair value under certain conditions, such as when impaired.

Fair value is defi ned as the price at which an asset could be exchanged

in an orderly transaction between market participants at the balance

sheet date. A liability’s fair value is defi ned as the amount that would

be paid to transfer the liability to a market participant, not the

amount that would be paid to settle the liability with the creditor.

Fair values are based on quoted market prices when available. When

market prices are not available, fair value is generally estimated using

discounted cash fl ow analyses, incorporating current market inputs

for similar fi nancial instruments with comparable terms and credit

quality. In instances where there is little or no market activity for

the same or similar instruments, the Company estimates fair value

using methods, models and assumptions that the Company believes

a hypothetical market participant would use to determine a current

transaction price. ese valuation techniques involve some level of

estimation and judgment by the Company which becomes signifi cant

with increasingly complex instruments or pricing models.

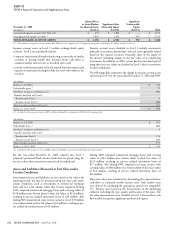

e Company’s fi nancial assets and liabilities carried at fair value

have been classifi ed based upon a hierarchy defi ned by GAAP. e

hierarchy gives the highest ranking to fair values determined using

unadjusted quoted prices in active markets for identical assets and

liabilities (Level 1) and the lowest ranking to fair values determined

using methodologies and models with unobservable inputs (Level 3).

An asset’s or a liability’s classifi cation is based on the lowest level of

input that is signifi cant to its measurement. For example, a fi nancial

asset or liability carried at fair value would be classifi ed in Level 3 if

unobservable inputs were signifi cant to the instrument’s fair value,

even though the measurement may be derived using inputs that are

both observable (Levels 1 and 2) and unobservable (Level 3).

e Company performs ongoing analyses of prices used to value

the Company’s invested assets to determine that they represent

appropriate estimates of fair value. is process involves quantitative

and qualitative analysis including reviews of pricing methodologies,

judgments of valuation inputs, the signifi cance of any unobservable

inputs, pricing statistics and trends. e Company also performs sample

testing of sales values to confi rm the accuracy of prior fair value estimates.

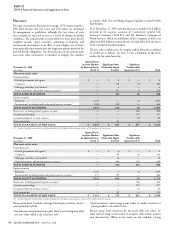

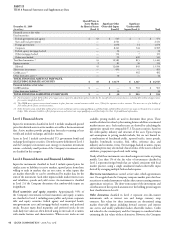

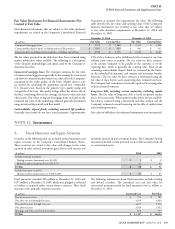

Financial Assets and Financial Liabilities Carried

at Fair Value

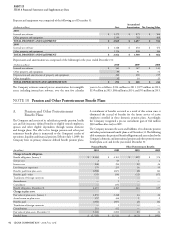

e following tables provide information as of December 31, 2010 and

December 31, 2009 about the Company’s fi nancial assets and liabilities

carried at fair value. Similar disclosures for separate account assets, which

are also recorded at fair value on the Company’s Consolidated Balance

Sheets, are provided separately as gains and losses related to these assets

generally accrue directly to policyholders. In addition, Note 10 contains

similar disclosures for the Company’s pension plan assets.

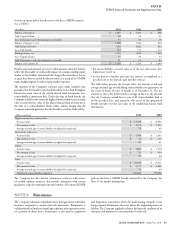

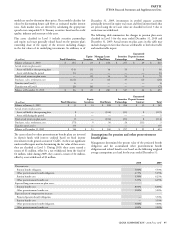

December31,2010

(In millions)

Quoted Prices

inActive Markets

for Identical Assets

(Level1)

Signi cant Other

Observable Inputs

(Level2)

Signi cant

Unobservable

Inputs

(Level3) Total

Financial assets at fair value:

Fixed maturities:

Federal government and agency $ 133 $ 550 $ 4 $ 687

State and local government — 2,467 — 2,467

Foreign government — 1,152 17 1,169

Corporate — 9,252 380 9,632

Federal agency mortgage-backed — 10 — 10

Other mortgage-backed — 85 3 88

Other asset-backed — 161 495 656

Total fi xed maturities (1) 133 13,677 899 14,709

Equity securities 6 87 34 127

Subtotal 139 13,764 933 14,836

Short-term investments — 174 — 174

GMIB assets (2) — — 480 480

Other derivative assets (3) —19—19

TOTAL FINANCIAL ASSETS AT FAIR VALUE,

EXCLUDINGSEPARATE ACCOUNTS $ 139 $ 13,957 $ 1,413 $ 15,509

Financial liabilities at fair value:

GMIB liabilities $ — $ — $ 903 $ 903

Other derivative liabilities (3) —32—32

TOTAL FINANCIAL LIABILITIES AT FAIR VALUE $ $ 32 $ 903 $ 935

(1) Fixed maturities include $443 million of net appreciation required to adjust future policy benefits for the run-off settlement annuity business including $74 million of appreciation for

securities classified in Level 3.

(2) The GMIB assets represent retrocessional contracts in place from two external reinsurers which cover 55% of the exposures on these contracts. The assets are net of a liability of $15 million

for the future cost of reinsurance.

(3) Other derivative assets include $16 million of interest rate and foreign currency swaps qualifying as cash flow hedges and $3 million of interest rate swaps not designated as accounting

hedges. Other derivative liabilities reflect foreign currency and interest rate swaps qualifying as cash flow hedges. See Note 13 for additional information.