Cigna 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K

48

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

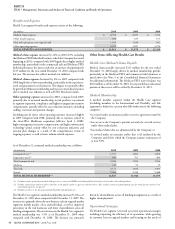

Segment Reporting

Operating segments generally refl ect groups of related products,

but the International segment is generally based on geography. e

Company measures the fi nancial results of its segments using “segment

earnings (loss)”, which is defi ned as shareholders’ income (loss) from

continuing operations excluding after-tax realized investment gains

and losses. “Adjusted income from operations” for each segment is

defi ned as segment earnings excluding special items and the results of

the Company’s GMIB business. Adjusted income from operations is

another measure of profi tability used by the Company’s management

because it presents the underlying results of operations of the segment

and permits analysis of trends. is measure is not determined in

accordance with GAAP and should not be viewed as a substitute

for the most directly comparable GAAP measure, which is segment

earnings. Each segment provides a reconciliation between segment

earnings and adjusted income from operations.

Beginning in 2010, the Company began reporting the expense

associated with its frozen pension plans in Corporate. Prior periods

were not restated; the eff ect on prior periods is not material.

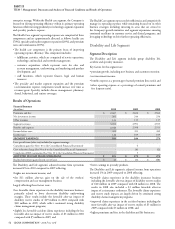

Health Care Segment

Segment Description

e Health Care segment off ers insured and self-insured medical,

dental, behavioral health, vision, and prescription drug benefi t plans,

health advocacy programs and other products and services that may

be integrated to provide comprehensive health care benefi t programs.

CIGNA HealthCare companies off er these products and services in

all 50 states, the District of Columbia and the U.S. Virgin Islands.

ese products and services are off ered through a variety of funding

arrangements such as guaranteed cost, retrospectively experience-

rated and administrative services only arrangements.

e Company measures the operating eff ectiveness of the Health

Care segment using the following key factors:

•segment earnings and adjusted income from operations;

•membership growth;

•sales of specialty products to core medical customers;

•changes in operating expenses per member; and

•medical expense as a percentage of premiums (medical care ratio) in

the guaranteed cost business.

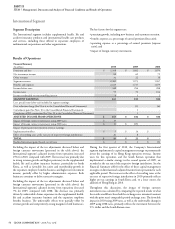

Results of Operations

Financial Summary

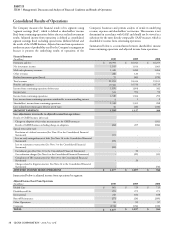

(In millions)

2010 2009 2008

Premiums and fees $ 13,319 $ 11,384 $ 11,665

Net investment income 243 181 200

Mail order pharmacy revenues 1,420 1,282 1,204

Other revenues 266 262 267

Segment revenues 15,248 13,109 13,336

Mail order pharmacy cost of goods sold 1,169 1,036 961

Benefi ts and other expenses 12,742 10,943 11,359

Benefi ts and expenses 13,911 11,979 12,320

Income before taxes 1,337 1,130 1,016

Income taxes 476 399 352

SEGMENT EARNINGS 861 731 664

Less: special items (after-tax) included in segment earnings:

Curtailment gain (See Note 10 to the Consolidated Financial Statements) - 25 -

Cost reduction charge (See Note 6 to the Consolidated Financial Statements) - (24) (27)

Completion of IRS examination (See Note 20 to the Consolidated Financial

Statements) -1 -

Charge related to litigation matters (See Note 24 to the Consolidated Financial

Statements) - - (24)

ADJUSTED INCOME FROM OPERATIONS $ 861 $ 729 $ 715

Realized investment gains (losses), net of taxes $ 26 $ (19) $ (13)

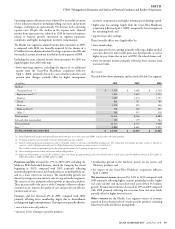

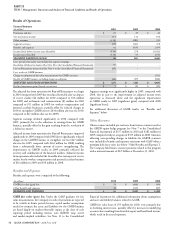

e Health Care segment’s adjusted income from operations

increased 18% in 2010, as compared with 2009 refl ecting:

•revenue growth in the commercial risk businesses, particularly in

the targeted market segments, as evidenced by a 15% increase in

commercial risk membership. In addition, adjusted income from

operations was favorably impacted by increased penetration of our

specialty products;

•a lower guaranteed cost medical care ratio driven by lower medical

cost trend, refl ecting lower utilization levels, as well as favorable prior

year development; and

•higher investment income due to higher security partnership

results, higher real estate income and increased assets driven by

membership growth.