Cigna 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K 63

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

•a substantial increase in funding over current projections is required

for the Company’s pension plan; or

•a substantial increase in funding is required for the Company’s

GMDB and GMIB equity and interest rate hedge programs.

In those cases, the Company expects to have the fl exibility to satisfy

liquidity needs through a variety of measures, including intercompany

borrowings and sales of liquid investments. e parent company may

borrow up to $600 million from CGLIC without prior state approval.

In addition, the Company may use short-term borrowings, such as the

commercial paper program and the committed line of credit agreement

of up to $1.7 billion subject to the maximum debt leverage covenant in

its line of credit agreement. As of December 31, 2010, the Company

had $1.7 billion of borrowing capacity within the maximum debt

leverage covenant in the line of credit agreement in addition to the

$2.8 billion of debt outstanding.

ough the Company believes it has adequate sources of liquidity,

signifi cant disruption or volatility in the capital and credit markets

could aff ect the Company’s ability to access those markets for additional

borrowings or increase costs associated with borrowing funds.

Solvency regulation

Many states have adopted some form of the National Association of

Insurance Commissioners (“NAIC”) model solvency-related laws and

risk-based capital rules (“RBC rules”) for life and health insurance

companies. e RBC rules recommend a minimum level of capital

depending on the types and quality of investments held, the types of

business written and the types of liabilities incurred. If the ratio of the

insurer’s adjusted surplus to its risk-based capital falls below statutory

required minimums, the insurer could be subject to regulatory actions

ranging from increased scrutiny to conservatorship.

In addition, various non-U.S. jurisdictions prescribe minimum

surplus requirements that are based upon solvency, liquidity and

reserve coverage measures. During 2010, the Company’s HMOs and

life and health insurance subsidiaries, as well as non-U.S. insurance

subsidiaries, were compliant with applicable RBC and non-U.S.

surplus rules.

Eff ective December 31, 2009 the Company’s principal life insurance

subsidiary, CGLIC, implemented the NAIC’s Actuarial Guideline

XLIII (also known as AG 43 or VACARVM), which is applicable to

CGLIC’s statutory reserves for GMDB and GMIB contracts totaling

$1.5 billion as of December 31, 2010. As provided under this

guidance, CGLIC received approval from the State of Connecticut to

grade-in the full eff ect of the guideline over a 3-year period beginning

in 2009. At December 31, 2010, statutory reserves for CGLIC were

higher than the pre-AG 43 reserves by $123 million. If the guidance

had been fully implemented at December 31, 2010, statutory reserves

would have been higher by an additional $62 million. Management

does not anticipate that VACARVM will have a material impact

on the amount of dividends expected to be paid by CGLIC to the

parent company in 2011. In addition, VACARVM has no impact

on measurement of the Company’s results of operations or fi nancial

condition as determined under GAAP.

Unfunded Pension Plan Liability

As of December 31, 2010, the unfunded pension liability was

$1.5 billion, substantially unchanged from December 31, 2009,

refl ecting a decline in the discount rate of approximately 50 basis

points as well as an update to mortality assumptions during 2010

to better refl ect recent experience, entirely off set by contributions of

$212 million during 2010 and favorable investment asset performance

in 2010. Although the GAAP funded status did not decline as a result

of the contributions made in 2010, required pension contributions

in 2011 under the Pension Protection Act of 2006 are not expected

to signifi cantly change from previous estimates, since discount rates

used for funding purposes are based on a 24-month moving average

which is less susceptible to volatility than the rate required to be used

to compute the liability for the fi nancial statements.

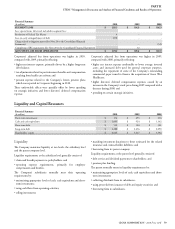

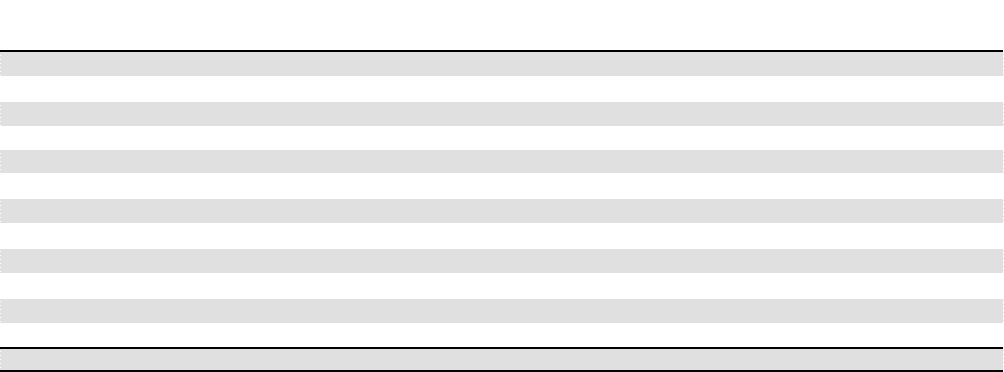

Guarantees and Contractual Obligations

e Company is contingently liable for various contractual

obligations entered into in the ordinary course of business. e

maturities of the Company’s primary contractual cash obligations, as

of December 31, 2010, are estimated to be as follows:

(In millions, on an undiscounted basis)

Total Less than 1year 1-3years 4-5years After 5years

On-Balance Sheet:

Insurance liabilities:

Contractholder deposit funds $ 7,293 $ 677 $ 875 $ 769 $ 4,972

Future policy benefi ts 11,182 459 846 891 8,986

Health Care medical claims payable 1,246 1,213 22 2 9

Unpaid claims and claims expenses 4,445 1,374 847 583 1,641

Short-term debt 574 574---

Long-term debt 4,390 146 299 313 3,632

Other long-term liabilities 1,274 556 220 132 366

O -Balance Sheet:

Purchase obligations 1,284 578 446 173 87

Operating leases 496 105 163 104 124

TOTAL $ 32,184 $ 5,682 $ 3,718 $ 2,967 $ 19,817