CVS 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

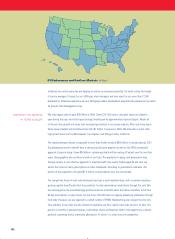

(4)

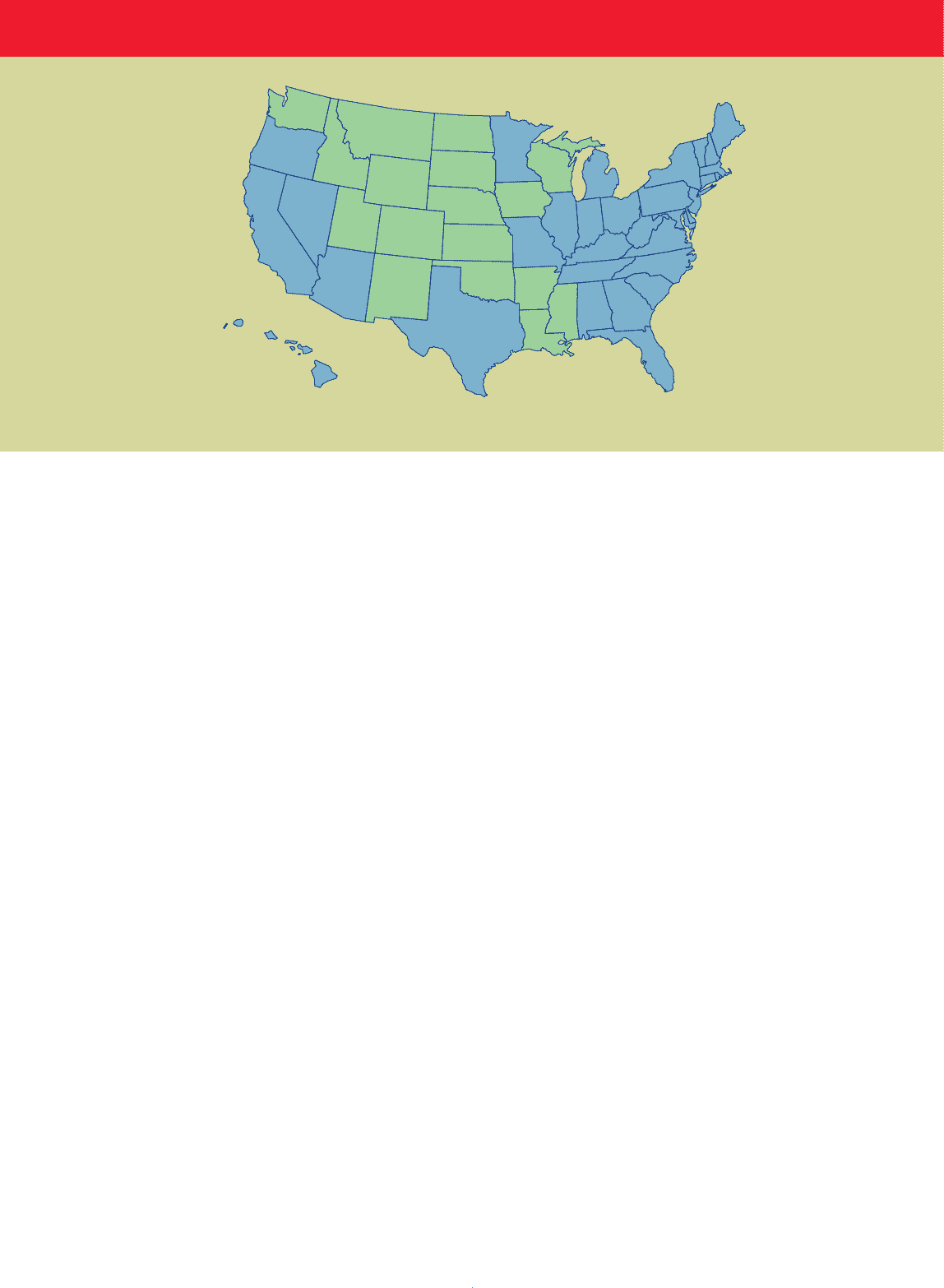

CVS/pharmacy and ProCare Markets (In blue)

initiatives into action every day and helping us unlock our enormous potential. It’s worth noting that length

of service averages 10 years for our 4,000-plus store managers and nine years for our more than 12,000

pharmacists. Extensive experience and our Emerging Leaders development program help prepare our top talent

for broader field management roles.

EXPANDING OUR PRESENCE We fully expect sales to pass $28 billion in 2004. Some 225–250 new or relocated stores are slated to

IN NEWER MARKETS open during the year, and total square footage should grow by approximately 4 percent again. Nearly all

of the net store growth will come from increased penetration in our newer markets. After only three years,

these newer markets will contribute more than $1 billion in revenue in 2004. We also plan to enter other

high-growth areas such as Minneapolis, Los Angeles, and Orange County, California.

The retail pharmacy industry is expected to more than double to about $450 billion in annual sales by 2012.

Our pharmacies stand to benefit from a strong drug discovery pipeline as well as the FDA’s accelerated

approval of generic drugs. Some $50 billion in pharmaceuticals will be coming off patent over the next four

years. Demographics also continue to work in our favor. The population is aging, and prescription drug

therapy remains a cost-effective approach to meeting health care needs. People aged 65 and over use

almost four times as many prescriptions as other individuals. According to government estimates, this

portion of the population will spend $1.8 trillion on prescriptions over the next decade.

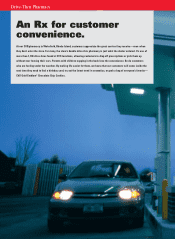

The competitive threat of mail order pharmacy has been a much debated issue, with consumer resistance

growing against benefit plans that force patients to order maintenance medications through the mail. We

are encouraged by the overwhelmingly positive response to benefit plans that allow customers to fill their

90-day prescriptions in retail stores. Let me stress that CVS does not oppose dispensing medication through

mail order. However, we are opposed to a small number of PBMs implementing plan designs that not only

force patients to use mail, but also dictate that patients use their captive mail order services. At best, this

practice is harmful to patients because it eliminates choice and deprives them of the opportunity to obtain

personal counseling from a community pharmacist. At worst, it is unfair and anti-competitive.