CVS 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(38) CVS Corporation 2003 Annual Report

Notes to Consolidated Financial Statements

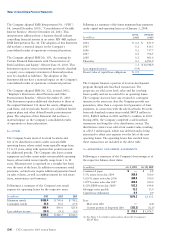

The Company utilized a measurement date of December 31st to determine pension and other postretirement benefit

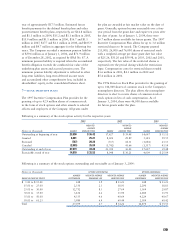

measurements. Following is a summary of the net periodic pension cost for the defined benefit and other postretirement

benefit plans for the respective years:

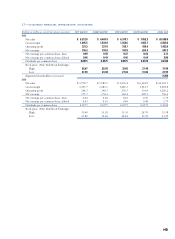

DEFINED BENEFIT PLANS OTHER POSTRETIREMENT BENEFITS

In millions 2003 2002 2001 2003 2002 2001

Service cost $ 0.8 $ 0.8 $ 0.5 $— $— $—

Interest cost on benefit obligation 20.5 20.4 20.9 0.8 0.9 0.9

Expected return on plan assets (18.4) (19.3) (20.2) ———

Amortization of net loss (gain) 1.5 0.1 (0.3) (0.1) (0.2) (0.2)

Amortization of prior service cost 0.1 0.1 0.1 (0.1) (0.1) (0.1)

Settlement gain ——(0.2) ———

Net periodic pension cost $ 4.5 $ 2.1 $ 0.8 $ 0.6 $ 0.6 $ 0.6

ACTUARIAL ASSUMPTIONS:

Discount rate 6.25% 6.50% 7.50% 6.25% 6.50% 7.25%

Expected return on plan assets(1) 8.50% 8.75% 9.25% ———

Rate of compensation increase 4.00% 4.00% 4.00% ———

(1) The expected long-term rate of return is determined by using the target allocation and historical returns for each asset class.

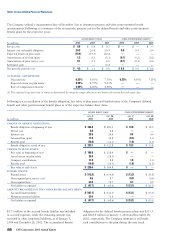

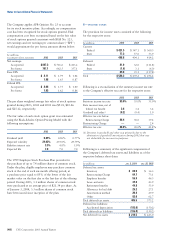

Following is a reconciliation of the benefit obligation, fair value of plan assets and funded status of the Company’s defined

benefit and other postretirement benefit plans as of the respective balance sheet dates:

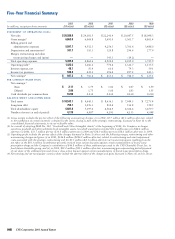

DEFINED BENEFIT PLANS OTHER POSTRETIREMENT BENEFITS

JAN. 3, DEC. 28, JAN. 3, DEC. 28,

In millions 2004 2002 2004 2002

CHANGE IN BENEFIT OBLIGATION:

Benefit obligation at beginning of year $ 322.8 $ 283.1 $ 13.8 $ 12.9

Service cost 0.8 0.8 ——

Interest cost 20.5 20.4 0.8 0.9

Actuarial loss (gain) 11.0 34.8 (0.3) 1.0

Benefits paid (16.0) (16.3) (1.0) (1.0)

Benefit obligation at end of year $ 339.1 $ 322.8 $ 13.3 $ 13.8

CHANGE IN PLAN ASSETS:

Fair value at beginning of year $ 186.8 $ 218.4 $— $—

Actual return on plan assets 38.4 (24.1) ——

Company contributions 17.4 8.8 1.0 1.0

Benefits paid (16.0) (16.3) (1.0) (1.0)

Fair value at end of year $ 226.6 $ 186.8 $— $—

FUNDED STATUS:

Funded status $ (112.5) $ (136.0) $ (13.3) $ (13.8)

Unrecognized prior service cost 0.6 0.7 (0.5) (0.6)

Unrecognized loss 64.2 74.7 0.7 0.9

Net liability recognized $ (47.7) $ (60.6) $ (13.1) $ (13.5)

AMOUNTS RECOGNIZED IN THE CONSOLIDATED BALANCE SHEET:

Accrued benefit liability $ (107.1) $ (132.5) $ (13.1) $ (13.5)

Minimum pension liability 59.4 71.9 ——

Net liability recognized $ (47.7) $ (60.6) $ (13.1) $ (13.5)

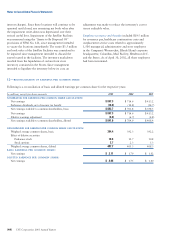

$17.1 million of the accrued benefit liability was included

in accrued expenses, while the remaining amount was

recorded in other long-term liabilities, as of January 3,

2004 and December 28, 2002. The accumulated benefit

obligation for the defined benefit pension plans was $333.5

and $318.0 million at January 3, 2004 and December 28,

2002, respectively. The Company estimates it will make

cash contributions to the plan during the next fiscal

(38) CVS Corporation 2003 Annual Report