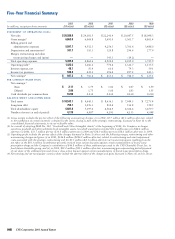

CVS 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

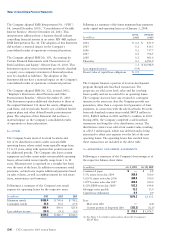

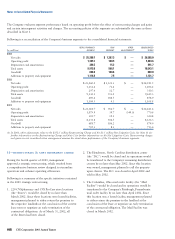

The Company applies APB Opinion No. 25 to account

for its stock incentive plans. Accordingly, no compensation

cost has been recognized for stock options granted. Had

compensation cost been recognized based on the fair value

of stock options granted consistent with SFAS No. 123,

net earnings and net earnings per common share (“EPS”)

would approximate the pro forma amounts shown below:

In millions,

except per share amounts 2003 2002 2001

Net earnings:

As reported $ 847.3 $ 716.6 $ 413.2

Pro forma 797.1 662.5 357.1

Basic EPS:

As reported $ 2.11 $ 1.79 $ 1.02

Pro forma 1.98 1.65 0.87

Diluted EPS:

As reported $ 2.06 $ 1.75 $ 1.00

Pro forma 1.95 1.62 0.86

The per share weighted average fair value of stock options

granted during 2003, 2002 and 2001 was $9.01, $10.46

and $25.12, respectively.

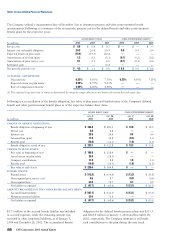

The fair value of each stock option grant was estimated

using the Black-Scholes Option Pricing Model with the

following assumptions:

2003 2002 2001

Dividend yield 0.85% 0.96% 0.77%

Expected volatility 29.63% 29.50% 29.79%

Risk-free interest rate 3.5% 4.0% 5.0%

Expected life 7.0 7.0 7.0

The 1999 Employee Stock Purchase Plan provides for

the purchase of up to 7.4 million shares of common stock.

Under the plan, eligible employees may purchase common

stock at the end of each six-month offering period, at

a purchase price equal to 85% of the lower of the fair

market value on the first day or the last day of the offering

period. During 2003, 1.1 million shares of common stock

were purchased at an average price of $21.34 per share. As

of January 3, 2004, 3.3 million shares of common stock

have been issued since inception of the plan.

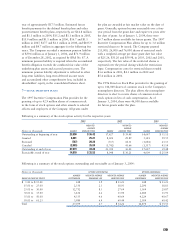

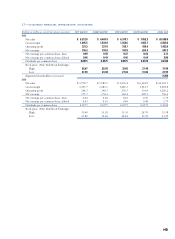

8—INCOME TAXES

The provision for income taxes consisted of the following

for the respective years:

In millions 2003 2002 2001

Current:

Federal $ 421.5 $ 347.1 $ 360.3

State 77.3 57.0 53.9

498.8 404.1 414.2

Deferred:

Federal 31.0 32.0 (111.8)

State (1.6) 3.1 (6.0)

29.4 35.1 (117.8)

To t a l $ 528.2 $ 439.2 $ 296.4

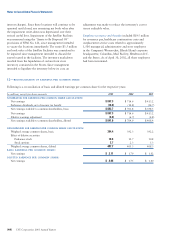

Following is a reconciliation of the statutory income tax rate

to the Company’s effective tax rate for the respective years:

2003 2002 2001

Statutory income tax rate 35.0% 35.0% 35.0%

State income taxes, net of

federal tax benefit 3.6 3.4 3.4

Goodwill and other(1) (0.2) (0.4) 1.0

Effective tax rate before

Restructuring Charge 38.4 38.0 39.4

Restructuring Charge ——2.4

Effective tax rate 38.4% 38.0% 41.8%

(1) Decrease in goodwill and other was primarily due to the

elimination of goodwill amortization during 2002 that was

not deductible for income tax purposes.

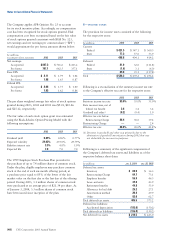

Following is a summary of the significant components of

the Company’s deferred tax assets and liabilities as of the

respective balance sheet dates:

In millions JAN. 3, 2004 DEC. 28, 2002

Deferred tax assets:

Inventory $ 65.5 $ 36.3

Restructuring Charge 64.7 73.1

Employee benefits 55.9 46.3

Lease and rents 47.0 43.9

Retirement benefits 44.8 53.9

Allowance for bad debt 25.2 27.1

Amortization method 20.4 29.9

Other 82.0 62.7

To t a l deferred tax assets 405.5 373.2

Deferred tax liabilities:

Accelerated depreciation (195.0) (150.2)

To t a l deferred tax liabilities (195.0) (150.2)

Net deferred tax assets $ 210.5 $ 223.0

Notes to Consolidated Financial Statements

(40) CVS Corporation 2003 Annual Report