CVS 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion & Analysis of Financial Condition and Results of Operation

(22) CVS Corporation 2003 Annual Report

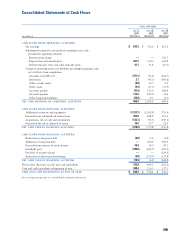

The following table summarizes our significant contractual obligations as of January 3, 2004:

PAYMENTS DUE BY PERIOD

WITHIN 1-3 3-5 AFTER

In millions TOTAL 1 YEAR YEARS YEARS 5 YEARS

Operating leases $ 10,788.9 $ 855.9 $ 1,574.0 $ 1,366.1 $ 6,992.9

Long-term debt 1,075.0 323.0 361.9 387.0 3.1

Purchase obligations 163.0 32.6 65.2 65.2 —

Other long-term liabilities reflected in

our consolidated balance sheet 173.0 36.6 87.7 18.6 30.1

Capital lease obligations 1.3 0.2 0.4 0.4 0.3

$ 12,201.2 $ 1,248.3 $ 2,089.2 $ 1,837.3 $ 7,026.4

OFF-BALANCE SHEET ARRANGEMENTS

Other than in connection with executing operating leases,

we do not participate in transactions that generate

relationships with unconsolidated entities or financial

partnerships, including variable interest entities, nor

do we have or guarantee any off-balance sheet debt.

We financ e a portion of our new store development

through sale-leaseback transactions, which involve selling

stores to unrelated parties at net book value and then

leasing the stores back under leases that qualify and are

accounted for as operating leases. We do not have any

retained or contingent interests in the stores nor do we

provide any guarantees, other than a corporate level

guarantee of the lease payments, in connection with the

sale-leasebacks. In accordance with generally accepted

accounting principles, our operating leases are not

reflected in our consolidated balance sheet.

Between 1991 and 1997, the Company sold or spun

off a number of subsidiaries, including Bob’s Stores,

Linens ’n Things, Inc., Marshalls, Kay-Bee Toys, Wilsons,

This End Up and Footstar, Inc. In many cases, when a

former subsidiary leased a store, the Company provided

a corporate level guarantee of the store’s lease obligations.

When the subsidiaries were disposed of, the Company’s

guarantees remained in place, although each purchaser

indemnified the Company for any lease obligations the

Company was required to satisfy. If any of the purchasers

were to become insolvent and failed to make the required

payments under a store lease, the Company could be

required to satisfy these obligations. As of January 3, 2004,

the Company guaranteed approximately 706 stores with

leases extending through 2018. Assuming that each

respective purchaser became insolvent, and the Company

was required to assume all of these lease obligations, we

estimate that the Company could settle the obligations

for approximately $592 million as of January 3, 2004.

During 2003, Bob’s Stores and affiliates filed a voluntary

petition for bankruptcy under Chapter 11 of the U.S.

Bankruptcy Code. Subsequent to the Bob’s Stores filing,

The TJX Companies, Inc. (“TJX”) purchased substantially

all of the assets of Bob’s Stores. Pursuant to the terms of

the purchase, a subsidiary of TJX has assumed each of

the Bob’s Stores leases that the Company has guaranteed.

Furthermore, TJX has agreed to indemnify the Company

for any liability the Company incurs or suffers in respect

of lease obligations during the time TJX or its affiliate

owns and operates these store locations.

In early 2004, KB Toys, Inc. and affiliates (“Kay-Bee

To ys”) and Footstar, Inc. and affiliates (“Footstar”) each

filed a voluntary petition for bankruptcy under Chapter 11

of the U.S. Bankruptcy Code. Due to the preliminary

nature of the Kay-Bee Toys and the Footstar proceedings,

the Company is unable to determine at this time the

potential liability the Company may have under the Kay-Bee

To y s a n d Fo o t s t a r leases it has guaranteed. However, the

Company believes that any potential liability with respect

to these lease guarantee obligations would be mitigated

by the indemnification the Company received from

Consolidated Stores Corporation (now known as Big Lots,

Inc.) as purchaser of Kay-Bee Toys from the Company, and

from Footstar in connection with the 1996 spin-off of

Footstar from the Company.

We believe the ultimate disposition of any of the corporate

level guarantees will not have a material adverse effect on

the Company’s consolidated financial condition, results

of operations or future cash flows.

The Company issues letters of credit for insurance

programs and import purchases. The fair value of the

outstanding letters of credit was $72.0 million as of

January 3, 2004.