CVS 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

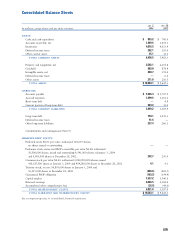

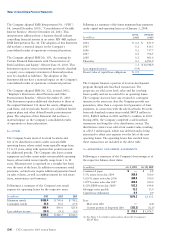

Following are the components of property and equipment

included in the consolidated balance sheets as of the

respective balance sheet dates:

In millions JAN. 3, 2004 DEC. 28, 2002

Land $ 180.7 $ 132.3

Building and improvements 492.8 479.2

Fixtures and equipment 2,123.3 1,769.3

Leasehold improvements 1,012.8 899.0

Capitalized software 149.5 124.5

Capital leases 1.3 1.3

3,960.4 3,405.6

Accumulated depreciation

and amortization (1,418.3) (1,189.8)

$ 2,542.1 $ 2,215.8

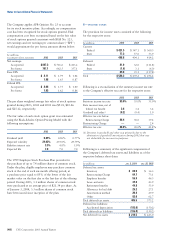

In accordance with Statement of Position No. 98-1,

“Accounting for the Costs of Computer Software Developed

or Obtained for Internal Use,” the Company capitalizes

application stage development costs for significant

internally developed software projects. These costs are

amortized over a 5-year period. Unamortized costs were

$90.6 million as of January 3, 2004 and $89.5 million

as of December 28, 2002.

Impairment of long-lived assets ~ The Company groups

and evaluates fixed and intangible assets excluding

goodwill, for impairment at the individual store level,

which is the lowest level at which individual cash flows

can be identified. When evaluating assets for potential

impairment, the Company first compares the carrying

amount of the asset to the asset’s estimated future cash

flows (undiscounted and without interest charges). If the

estimated future cash flows used in this analysis are less

than the carrying amount of the asset, an impairment loss

calculation is prepared. The impairment loss calculation

compares the carrying amount of the asset to the asset’s

estimated future cash flows (discounted and with interest

charges). If the carrying amount exceeds the asset’s

estimated future cash flows (discounted and with interest

charges), the loss is allocated to the long-lived assets of

the group on a pro rata basis using the relative carrying

amounts of those assets.

Intangible assets ~ Purchased customer lists are amortized

on a straight-line basis over their estimated useful lives

of up to 10 years. Purchased leases are amortized on

a straight-line basis over the remaining life of the lease.

See Note 4 for further information on intangible assets.

Revenue recognition ~ The Company recognizes revenue

from the sale of merchandise at the time the merchandise is

sold. Service revenue from the Company’s pharmacy benefit

management segment, which is recognized using the

net method under Emerging Issues Task Force (“EITF”)

No. 99-19, “Reporting Revenue Gross as a Principal Versus

Net as an Agent,” is recognized at the time the service is

provided. Service revenue totaled $96.0 million in 2003,

$84.9 million in 2002 and $82.1 million in 2001. The

Company offers sales incentives that entitle customers to

receive a reduction in the price of a product or service. For

sales incentives in which the Company is the obligor, the

reduction in revenue is recognized at the time the product

or service is sold. Customer returns are immaterial.

Vendor allowances ~ The Company accounts for vendor

allowances under the guidance provided by EITF No.

02-16, “Accounting by a Reseller for Cash Consideration

Received from a Vendor.” Vendor allowances reduce the

carrying cost of inventory unless they are specifically

identified as a reimbursement for promotional programs

and/or other services provided. Funds that are directly

linked to advertising commitments are recognized as a

reduction of advertising expense in the selling, general and

administrative expenses line when the related advertising

commitment is satisfied. Any such allowances received in

excess of the actual cost incurred also reduce the carrying

cost of inventory. The total value of any upfront payments

received from vendors that are linked to purchase

commitments is initially deferred. The deferred amounts

are then amortized to reduce cost of goods sold over the

life of the contract based upon purchase volume. The total

value of any upfront payments received from vendors that

are not linked to purchase commitments is also initially

deferred. The deferred amounts are then amortized to

reduce cost of goods sold on a straight-line basis over the

life of the related contract. The total amortization of these

upfront payments was not material to the accompanying

consolidated financial statements.

Store opening and closing costs ~ New store opening

costs, other than capital expenditures, are charged directly

to expense when incurred. When the Company closes a

store, the present value of estimated unrecoverable costs,

including the remaining lease obligation less estimated

sublease income and the book value of abandoned property

and equipment, are charged to expense.

Insurance ~ The Company is self-insured for certain losses

related to general liability, workers’ compensation and

automobile liability. The Company obtains third party

insurance coverage to limit exposure from these claims.

The Company’s self-insurance accruals, which include

reported claims and claims incurred but not reported,

are calculated using standard insurance industry

actuarial assumptions and the Company’s historical

claims experience.

(31)