CVS 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In connection with our commercial paper program, the

Company maintains a $650 million, five-year unsecured

back-up credit facility, which expires on May 21, 2006 and

a $600 million, 364-day unsecured back-up credit facility,

which expires on May 17, 2004. The credit facilities allow

for borrowings at various rates depending on the Company’s

public debt ratings and require the Company to pay a

quarterly facility fee of 0.08%, regardless of usage. As of

January 3, 2004, the Company had not borrowed against the

credit facilities. There was no short-term debt outstanding

as of January 3, 2004. The weighted average interest rate

for short-term debt was 1.9% as of December 28, 2002.

In October 2002, the Company issued $300 million

of 3.875% unsecured senior notes. The notes are due

November 1, 2007, and pay interest semi-annually. The

Company may redeem these notes at any time, in whole or

in part, at a defined redemption price plus accrued interest.

Net proceeds from the notes were used to repay

outstanding commercial paper.

The Credit Facilities and unsecured senior notes contain

customary restrictive financial and operating covenants.

The covenants do not materially affect the Company’s

financial or operating flexibility.

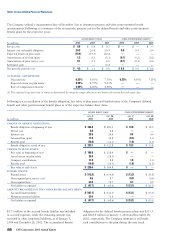

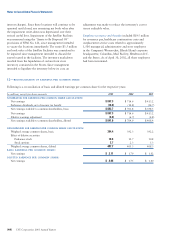

The aggregate maturities of long-term debt for each of

the five years subsequent to January 3, 2004 are $323.2

million in 2004, $27.9 million in 2005, $334.4 million in

2006, $341.7 million in 2007 and $45.8 million in 2008.

4—GOODWILL AND OTHER INTANGIBLES

Goodwill represents the excess of the purchase price over

the fair value of net assets acquired. Effective December 30,

2001, the Company adopted SFAS No. 142, “Goodwill

and Other Intangible Assets.” As a result of the adoption,

goodwill is no longer being amortized, but is subject to

annual impairment reviews, or more frequent reviews if

events or circumstances indicate there may be an impairment.

The Company groups and evaluates goodwill for impairment

at the reporting unit level annually, or whenever events or

circumstances indicate there may be an impairment. When

evaluating goodwill for potential impairment, the Company

first compares the fair value of the reporting unit, based on

estimated future discounted cash flows, with its carrying

amount. If the estimated fair value of the reporting unit is

less than its carrying amount, an impairment loss calculation

is prepared. The impairment loss calculation compares

the implied fair value of reporting unit goodwill with the

carrying amount of that goodwill. If the carrying amount

of reporting unit goodwill exceeds the implied fair value of

that goodwill, an impairment loss is recognized in an amount

equal to that excess. During the third quarter of 2003, the

Company performed its required annual goodwill impairment

test, which concluded there was no impairment of goodwill.

The following summary details the after-tax impact,

on a pro forma basis, of discontinuing the amortization

of goodwill on net earnings and earnings per common

share (“EPS”) for the respective years:

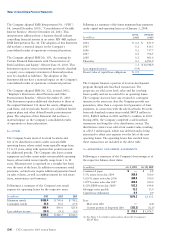

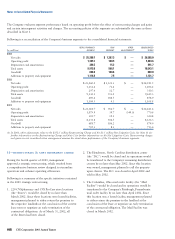

In millions,

except per share amounts 2003 2002 2001

Net Earnings:

As reported $ 847.3 $ 716.6 $ 413.2

Goodwill amortization ——28.2

As adjusted 847.3 716.6 441.4

Basic EPS:

As reported $ 2.11 $ 1.79 $ 1.02

Goodwill amortization ——0.07

As adjusted 2.11 1.79 1.09

Diluted EPS:

As reported $ 2.06 $ 1.75 $ 1.00

Goodwill amortization ——0.07

As adjusted 2.06 1.75 1.07

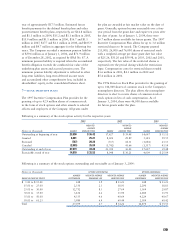

The carrying amount of goodwill was $889.0 million and

$878.9 million as of January 3, 2004 and December 28,

2002, respectively. During 2003, gross goodwill increased

$10.1 million, primarily due to acquisitions by the

Company’s PBM segment. There was no impairment

of goodwill during 2003.

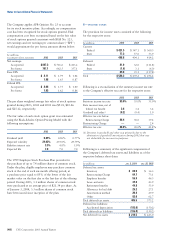

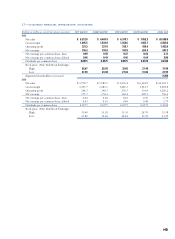

Intangible assets other than goodwill are required to be

separated into two categories: finite-lived and indefinite-

lived. Intangible assets with finite useful lives are amortized

over their estimated useful life, while intangible assets with

indefinite useful lives are not amortized. The Company

currently has no intangible assets with indefinite lives.

(35)