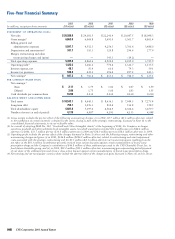

CVS 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

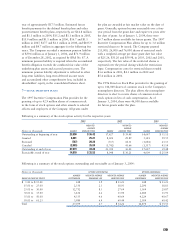

The amortization expense for these intangible assets totaled

$63.2 million in 2003, $53.3 million in 2002 and $52.7

million in 2001. The anticipated annual amortization

expense for these intangible assets is $66.7 million in

2004, $59.6 million in 2005, $54.5 million in 2006,

$49.0 million in 2007 and $45.0 million in 2008.

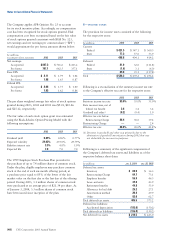

5—EMPLOYEE STOCK OWNERSHIP PLAN

The Company sponsors a defined contribution Employee

Stock Ownership Plan (the “ESOP”) that covers full-time

employees with at least one year of service.

In 1989, the ESOP Trust issued and sold $357.5 million of

20-year, 8.52% notes due December 31, 2008 (the “ESOP

Notes”). The proceeds from the ESOP Notes were used to

purchase 6.7 million shares of Series One ESOP Convertible

Preference Stock (the “ESOP Preference Stock”) from the

Company. Since the ESOP Notes are guaranteed by the

Company, the outstanding balance is reflected as long-term

debt and a corresponding guaranteed ESOP obligation is

reflected in shareholders’ equity in the accompanying

consolidated balance sheets.

Each share of ESOP Preference Stock has a guaranteed

minimum liquidation value of $53.45, is convertible into

2.314 shares of common stock and is entitled to receive

an annual dividend of $3.90 per share. The ESOP Trust

uses the dividends received and contributions from the

Company to repay the ESOP Notes. As the ESOP Notes are

repaid, ESOP Preference Stock is allocated to participants

based on (i) the ratio of each year’s debt service payment

to total current and future debt service payments multiplied

by (ii) the number of unallocated shares of ESOP Preference

Stock in the plan. As of January 3, 2004, 4.5 million shares

of ESOP Preference Stock were outstanding, of which

2.7 million shares were allocated to participants and

the remaining 1.8 million shares were held in the ESOP

Trust for future allocations.

Annual ESOP expense recognized is equal to (i) the interest

incurred on the ESOP Notes plus (ii) the higher of (a) the

principal repayments or (b) the cost of the shares allocated,

less (iii) the dividends paid. Similarly, the guaranteed ESOP

obligation is reduced by the higher of (i) the principal

payments or (ii) the cost of shares allocated.

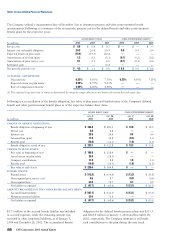

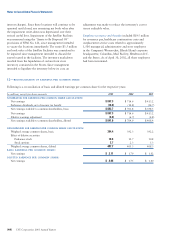

Following is a summary of the ESOP activity for the

respective years:

In millions 2003 2002 2001

ESOP expense recognized $ 30.1 $ 26.0 $ 22.1

Dividends paid 17.7 18.3 19.1

Cash contributions 30.1 26.0 22.1

Interest payments 16.6 18.7 20.5

ESOP shares allocated 0.4 0.4 0.4

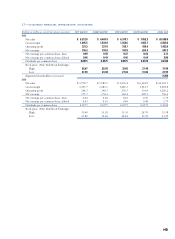

6—PENSION PLANS AND OTHER

POSTRETIREMENT BENEFITS

Defined Contribution Plans

The Company sponsors a voluntary 401(k) Savings Plan

that covers substantially all employees who meet plan

eligibility requirements. The Company makes matching

contributions consistent with the provisions of the plan.

At the participant’s option, account balances, including the

Company’s matching contribution, can be moved without

restriction among various investment options, including the

Company’s common stock. The Company also maintains

a nonqualified, unfunded Deferred Compensation Plan

for certain key employees. This plan provides participants

the opportunity to defer portions of their compensation

and receive matching contributions that they would have

otherwise received under the 401(k) Savings Plan if not

for certain restrictions and limitations under the Internal

Revenue Code. The Company’s contributions under the

above defined contribution plans totaled $46.9 million in

2003, $29.1 million in 2002 and $26.7 million in 2001.

The Company also sponsors an Employee Stock Ownership

Plan. See Note 5 for further information about this plan.

Notes to Consolidated Financial Statements

(36) CVS Corporation 2003 Annual Report

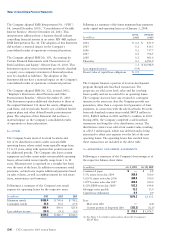

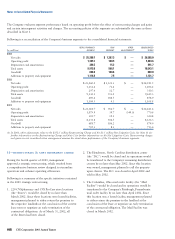

JAN. 3, 2004 DEC. 28, 2002

GROSS GROSS

CARRYING ACCUMULATED CARRYING ACCUMULATED

In millions AMOUNT AMORTIZATION AMOUNT AMORTIZATION

Customer lists and Covenants not to compete(1) $ 571.3 $ (241.4) $ 464.5 $ (194.1)

Favorable leases and Other(2) 152.3 (78.5) 153.1 (72.1)

$ 723.6 $ (319.9) $ 617.6 $ (266.2)

(1) The increase in the gross carrying amount during 2003 was primarily due to the acquisition of customer lists.

(2) The decrease in the gross carrying amount during 2003 resulted from the write-off of fully amortized favorable leases.

Following is a summary of the Company’s amortizable intangible assets as of the respective balance sheet dates: