CVS 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(42) CVS Corporation 2003 Annual Report

Notes to Consolidated Financial Statements

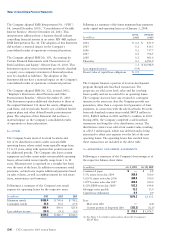

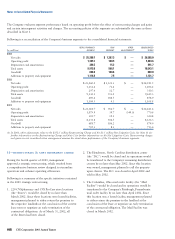

Following is a reconciliation of the Company’s business segments to the consolidated financial statements:

RETAIL PHARMACY PBM OTHER CONSOLIDATED

In millions SEGMENT SEGMENT ADJUSTMENTS(1) TOTALS

2003:

Net sales $25,280.7 $ 1,307.3 $ — $ 26,588.0

Operating profit 1,323.1 100.5 — 1,423.6

Depreciation and amortization 326.5 15.2 — 341.7

To t a l assets 9,975.0 568.1 — 10,543.1

Goodwill 690.4 198.6 — 889.0

Additions to property and equipment 1,114.2 7.5 — 1,121.7

2002:

Net sales $ 23,060.2 $ 1,121.3 $ — $ 24,181.5

Operating profit 1,134.6 71.6 — 1,206.2

Depreciation and amortization 297.6 12.7 — 310.3

To tal assets 9,132.1 513.2 — 9,645.3

Goodwill 690.4 188.5 — 878.9

Additions to property and equipment 1,104.5 4.3 — 1,108.8

2001:

Net sales $ 21,328.7 $ 912.7 $ — $ 22,241.4

Operating profit 1,079.9 39.7 (349.0) 770.6

Depreciation and amortization 301.7 19.1 — 320.8

To tal assets 8,131.8 504.5 — 8,636.3

Goodwill 688.7 186.2 — 874.9

Additions to property and equipment 705.3 8.3 — 713.6

(1) In 2001, other adjustments relate to the $352.5 million Restructuring Charge and the $3.5 million Net Litigation Gain. See Note 11 for

further information on the Restructuring Charge and Note 1 for further information on the Net Litigation Gain. Nonrecurring charges

and gains are not considered when management assesses the stand-alone performance of the Company’s business segments.

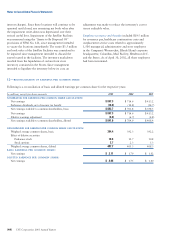

11—RESTRUCTURING & ASSET IMPAIRMENT CHARGE

During the fourth quarter of 2001, management

approved a strategic restructuring, which resulted from

a comprehensive business review designed to streamline

operations and enhance operating efficiencies.

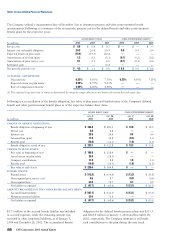

Following is a summary of the specific initiatives contained

in the 2001 strategic restructuring:

1. 229 CVS/pharmacy and CVS ProCare store locations

(the “Stores”) would be closed by no later than

March 2002. Since these locations were leased facilities,

management planned to either return the premises to

the respective landlords at the conclusion of the current

lease term or negotiate an early termination of the

contractual obligations. As of March 31, 2002, all

of the Stores had been closed.

2. The Henderson, North Carolina distribution center

(the “D.C.”) would be closed and its operations would

be transferred to the Company’s remaining distribution

centers by no later than May 2002. Since this location

was owned, management planned to sell the property

upon closure. The D.C. was closed in April 2002 and

sold in May 2002.

3. The Columbus, Ohio mail order facility (the “Mail

Facility”) would be closed and its operations would be

transferred to the Company’s Pittsburgh, Pennsylvania

mail order facility by no later than April 2002. Since

this location was a leased facility, management planned

to either return the premises to the landlord at the

conclusion of the lease or negotiate an early termination

of the contractual obligation. The Mail Facility was

closed in March 2002.

(42) CVS Corporation 2003 Annual Report

The Company evaluates segment performance based on operating profit before the effect of nonrecurring charges and gains

and certain intersegment activities and charges. The accounting policies of the segments are substantially the same as those

described in Note 1.