CVS 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion & Analysis of Financial Condition and Results of Operation

(20) CVS Corporation 2003 Annual Report

—During 2001, we recorded a $346.8 million pre-tax

($226.9 million after-tax) restructuring and asset

impairment charge to total operating expenses in

connection with our 2001 strategic restructuring.

We also recorded a $5.7 million pre-tax ($3.6 million

after-tax) charge to cost of goods sold to reflect the

markdown of certain inventory contained in the

stores to be closed to its net realizable value. In total,

the restructuring and asset impairment charge was

$352.5 million pre-tax ($230.5 million after-tax),

the (“Restructuring Charge”). Please see Note 11

to the consolidated financial statements for further

information on the 2001 strategic restructuring.

—During 2001, we received $50.3 million of settlement

proceeds from various lawsuits against certain

manufacturers of brand name prescription drugs. We

elected to contribute $46.8 million of the settlement

proceeds to the CVS Charitable Trust, Inc. to fund

future charitable giving. The net effect of these

nonrecurring items was a $3.5 million pre-tax

($2.1 million after-tax) increase in net earnings.

If you exclude the impact of the items discussed above,

comparable total operating expenses as a percentage

of net sales were 20.5% in 2003, 20.1% in 2002 and

20.4% in 2001.

As you review our comparable total operating expenses,

we believe you should consider the following important

information:

—Total operating expenses as a percentage of net

sales increased during 2003 as a result of increased

advertising expense, higher payroll and benefit costs

and lower sales growth resulting, in part, from higher

generic drug sales. The increase in payroll and benefit

costs were driven by an increase in the number of

24-hour stores, new stores and the implementation

costs associated with strategic initiatives such as the

Pharmacy Service Initiative and Assisted Inventory

Management. Whereas we do not believe the increase

in total operating expenses as a percentage of net sales

that occurred in 2003 will continue in 2004, we cannot

guarantee that total operating expenses will decrease

as a percentage of net sales in 2004.

—Total operating expenses as a percentage of net sales

decreased during 2002 primarily due to completing

the 2001 strategic restructuring and implementing

technology initiatives such as the Excellence in

Pharmacy Innovation and Care initiative (“EPIC”)

that helped improve customer service while lowering

operating costs, particularly at the store level.

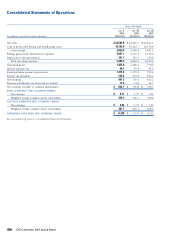

Interest expense, net consisted of the following:

In millions 2003 2002 2001

Interest expense $ 53.9 $ 54.5 $ 65.2

Interest income (5.8) (4.1) (4.2)

Interest expense, net $ 48.1 $ 50.4 $ 61.0

The decrease in interest expense, net during 2003 primarily

resulted from an increase in interest income resulting

from higher average cash balances. The decline in interest

expense, net in 2002 primarily resulted from lower average

interest rates on our outstanding borrowings and lower

average debt requirements due to improved working

capital management.

Income tax provision ~ Our effective income tax rate

was 38.4% in 2003, 38.0% in 2002 and 41.8% in 2001.

The increase in our effective income tax rate in 2003 was

primarily due to higher state income taxes. The decrease

in our effective income tax rate in 2002 was primarily due

to the elimination of goodwill amortization that was not

deductible for income tax purposes. Our effective income

tax rate was higher in 2001 because certain components of

the Restructuring Charge were not deductible for income

tax purposes. To better assess year-to-year performance,

management removes the impact of the Restructuring

Charge and uses 39.4% as a comparable 2001 effective

tax rate.

Net earnings increased $130.7 million or 18.2% to

$847.3 million (or $2.06 per diluted share) in 2003.

This compares to $716.6 million (or $1.75 per diluted

share) in 2002 and $413.2 million (or $1.00 per diluted

share) in 2001. To better assess year-to-year performance,

management removes the impact of the Restructuring

Charge and the $2.1 million net nonrecurring gain in

2001, and uses $641.6 million (or $1.56 per diluted share)

for comparable net earnings results in 2001.

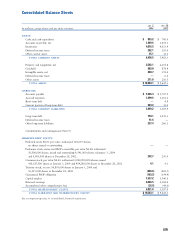

LIQUIDITY & CAPITAL RESOURCES

We anticipate that our cash flow from operations,

supplemented by debt borrowings and sale-leaseback

transactions, will continue to fund the growth of

our business.

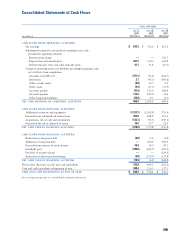

Net cash provided by operating activities decreased to

$968.9 million in 2003. This compares to $1,204.8 million

in 2002 and $680.6 million in 2001. The decrease in net

cash provided by operations during 2003 primarily resulted

from higher accounts receivable and lower accounts payable