CVS 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

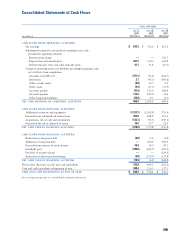

(21)

offset, in part, by higher net earnings. Accounts receivable

increased in 2003 primarily because our January 3, 2004

year-end ended in the middle of many of our third party

payors’ biweekly payment cycles. Accounts payable

decreased primarily due to the timing of vendor payments.

Net cash used in investing activities increased to $753.6

million in 2003. This compares to $735.8 million in 2002

and $536.8 million in 2001. The increase in net cash used

in investing activities during 2003 was primarily due to

acquisitions by our Pharmacy Benefit Management segment

and increased acquisitions of customer lists. Capital

expenditures totaled $1,121.7 million during 2003,

compared to $1,108.8 million in 2002 and $713.6 million

in 2001. During 2003, approximately 60% of our total

capital expenditures were for new store construction,

22% for store expansion and improvements, 14% for

technology and other corporate initiatives and 4% for

a new distribution center in Texas, which is expected

to be completed during the first quarter of 2004.

We financ e a portion of our new store development

program through sale-leaseback transactions. Proceeds

from sale-leaseback transactions totaled $487.8 million

in 2003. This compares to $448.8 million in 2002 and

$323.3 million in 2001. Under the transactions, the

properties are sold at net book value and the resulting

leases qualify and are accounted for as operating leases.

During 2001, we also completed a sale-leaseback

transaction on five of our distribution centers. The

distribution centers were sold at fair market value resulting

in a $35.5 million gain, which was deferred and is being

amortized to offset rent expense over the life of the new

operating leases.

During 2004, we currently plan to invest over $1.1 billion

in capital expenditures, which will include spending for

approximately 225-250 new or relocated stores, including

approximately 100 in new markets.

Following is a summary of our store development activity

for the respective years:

2003 2002 2001

To t a l stores

(beginning of year) 4,087 4,191 4,133

New stores 150 174 126

Closed stores (58) (278) (68)

To t a l stores (end of year) 4,179 4,087 4,191

Relocated stores(1) 125 92 122

(1) Relocated stores are not included in new or closed store totals.

Net cash used in financing activities increased to $72.5

million in 2003. This compares to $4.9 million in 2002

and $244.8 million in 2001. The increase in net cash used

in financing activities during 2003 was primarily because

we issued no new long-term debt in 2003. Our net debt

(i.e., our total debt less our cash and cash equivalents),

decreased to $233.1 million, compared to $412.7 million

in 2002 and $836.3 million in 2001. During 2003, we

paid common stock dividends totaling $90.6 million or

$0.23 per common share. In October 2003, our Board of

Directors authorized a 15% increase in our common stock

dividend to $0.265 per share for 2004.

We believe that our current cash on hand, cash provided

by operations and sale-leaseback transactions, together with

our ability to obtain additional short-term and long-term

financing, will be sufficient to cover our working capital

needs, capital expenditures, debt service and dividend

requirements for at least the next several years.

We had no commercial paper borrowings outstanding as of

January 3, 2004. In connection with our commercial paper

program, we maintain a $650 million, five-year unsecured

back-up credit facility, which expires on May 21, 2006 and

a $600 million, 364-day unsecured back-up credit facility,

which expires on May 17, 2004. We are currently evaluating

our long-term financing needs in connection with the

expiration of the 364-day facility. As of January 3, 2004,

we had not borrowed against the back-up credit facilities.

Our credit facilities and unsecured senior notes contain

customary restrictive financial and operating covenants.

These covenants do not include a requirement for the

acceleration of our debt maturities in the event of a

downgrade in our credit rating. We do not believe that

the restrictions contained in these covenants materially

affect our financial or operating flexibility.

Our liquidity is based, in part, on maintaining strong

investment-grade debt ratings. As of January 3, 2004,

our long-term debt was rated “A2” by Moody’s and “A”

by Standard & Poor’s, and our commercial paper program

was rated “P-1” by Moody’s and “A-1” by Standard and

Poor’s, each on a negative outlook. In assessing our credit

strength, both Moody’s and Standard & Poor’s consider

our capital structure and financial policies as well as our

consolidated balance sheet and other financial information.

We do not currently foresee any reasonable circumstances

under which we believe we would lose our investment-grade

debt ratings. However, if our debt ratings were downgraded

it could adversely impact, among other things, our future

borrowing costs, access to capital markets and new store

operating lease costs.

(21)