CVS 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(19)

—In recent years, the growth in mail order pharmacy

has outpaced the growth in retail pharmacy. Recently, a

number of payors have changed their pharmacy benefit

plan designs to require maintenance medications to be

filled exclusively through mail order pharmacies. To

address this trend, we have dropped and/or renegotiated

a number of third party programs that have adopted

a plan of this kind. In the event this trend continues,

and we elect to withdraw from current pharmacy

benefit plans, and/or decide not to participate in future

programs, we may not be able to sustain our current

rate of sales growth.

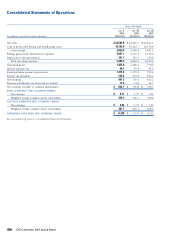

Gross margin, which includes net sales less the cost

of merchandise sold during the reporting period and the

related purchasing costs, warehousing costs, delivery costs

and actual and estimated inventory losses, as a percentage

of net sales was 25.8% in 2003. This compares to 25.1%

in 2002 and 25.6% in 2001. As you review our gross

margin performance, we believe you should consider

the following important information:

—Inventory losses were 0.92% of total net sales in

2003, compared to 1.19% in 2002 and 1.52% in

2001. During 2002, we initiated a number of programs

that reduced inventory losses during the second half of

2002 and we continued to see improvements in 2003.

While we believe our programs will continue to provide

future operational benefits, we expect the financial

improvement trend realized in 2003 will be less significant

in 2004. In addition, we cannot guarantee that our

programs will continue to reduce inventory losses.

—Our front store gross margin rate benefited from a more

profitable front store sales mix in 2003, which included

increased sales of higher gross margin categories such

as health and beauty.

—Our pharmacy gross margin rate benefited from

an increase in generic drug sales in 2003, which

normally yield a higher gross margin than brand name

drug sales.

—Our total gross margin rate benefited from an earlier

and more severe flu season in 2003, which increased

over-the-counter product sales such as cough and cold

and flu-related prescription sales, both of which

generally yield higher gross margins.

—Our gross margin rate continues to be adversely

affected by pharmacy sales growing at a faster pace

than front store sales. On average, our gross margin

on pharmacy sales is lower than our gross margin

on front store sales. Pharmacy sales were 68.8%

of total sales in 2003, compared to 67.6% in 2002 and

66.1% in 2001. In addition, sales to customers covered

by third party insurance programs have continued to

increase and, thus, have become a larger component

of our total pharmacy business. On average, our gross

margin on third party pharmacy sales is lower than our

gross margin on non-third party pharmacy sales. Third

party pharmacy sales were 93.2% of pharmacy sales in

2003, compared to 92.3% in 2002 and 90.9% in 2001.

We expect these negative trends to continue.

—Our gross margin rate in 2002, was negatively

impacted by higher markdowns associated with

increased promotional programs that were designed

to respond to competitive and economic conditions.

—Our third party gross margin rates have been adversely

affected by the efforts of managed care organizations,

pharmacy benefit managers, governmental and other

third party payors to reduce their prescription drug

costs. To address this trend, we have dropped and/or

renegotiated a number of third party programs that

fell below our minimum profitability standards.

To date, these efforts have helped stabilize our

third party reimbursement rates. However, numerous

state legislatures have proposed or, at least, appear

to be considering further reductions in pharmacy

reimbursement rates for Medicaid and other

governmental programs as well as other measures aimed

at reducing their prescription drug costs. In the event

this trend continues and we elect to, for any reason,

withdraw from current third party programs and/or

decide not to participate in future programs, we may

not be able to sustain our current rate of sales growth

and gross margin dollars could be adversely impacted.

Total operating expenses, which include store and

administrative payroll, employee benefits, store and

administrative occupancy costs, selling expenses,

advertising expenses, administrative expenses and

depreciation and amortization expense were 20.5%

of net sales in 2003. This compares to 20.1% of net

sales in 2002 and 22.1% in 2001. As you review our

performance in this area, we believe you should consider

the following items, which management removes in its

assessment of total operating expenses because their

impact affects year-to-year comparability:

—As a result of adopting Statement of Financial

Accounting Standards (“SFAS”) No. 142 at the

beginning of 2002, we no longer amortize goodwill.

Goodwill amortization totaled $31.4 million in

2001. Please see Note 4 to the consolidated financial

statements for further information on the impact

of adopting SFAS No. 142.