CVS 2003 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(1)

TO OUR CVS can look back over 2003 with a great sense of accomplishment. We turned in the best performance in

SHAREHOLDERS: our 40-year history, with sales hitting an all-time high of $26.6 billion. Our sales results improved steadily

throughout the year, finishing with a record-breaking holiday season. Same-store sales grew by 5.8 percent,

while diluted earnings per share rose a healthy 17.7 percent, to $2.06. Much of the credit for these results

can be attributed to the success of our associates’ efforts to make CVS the easiest pharmacy for customers

to use. Our research shows that customers are noticing the difference.

Our pharmacy business, which accounts for roughly 70 percent of overall sales, turned in a tremendous year.

Pharmacy same-store sales jumped 8.1 percent, with CVS filling more than one in every 10 U.S. retail drug

prescriptions. Front-end same-store sales increased 1.2 percent. We also saw improvements in gross

margins, due largely to increased generic drug sales, a significant reduction in inventory losses, and a more

profitable product mix in the front of the store. These are just some of the strong underlying fundamentals

that helped CVS’ share price increase 45 percent in 2003 versus a 23 percent increase for the S&P 500.

Our balance sheet remained among the best in our industry, with low leverage and excellent working capital

ratios. We generated a significant amount of cash and continued to put this money to use on a number of

fronts—opening stores, investing in technology, and increasing our dividend payout. In fact, the 15 percent

dividend hike we announced in October was the largest since we went public in 1996, reflecting our strong

results and confidence in our future. Our return on invested capital increased to 9.9 percent, with the spread

above our weighted average cost of capital once again demonstrating economic value creation.

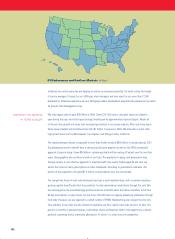

GROWING OUR STORE BASE We continued our successful expansion, opening 275 convenient new stores in 2003. After factoring in

relocations and closings, we achieved a 3.5 percent expansion in square footage and net unit growth of 92

stores. Of these, more than 80 are located in fast-growing new CVS markets such as Florida, Texas, Chicago,

Phoenix, and Las Vegas. We also broke ground for a distribution center in Ennis, Texas, scheduled to open

in late 2004. The first facility of its kind in North America, it will utilize state-of-the-art storage and retrieval

systems that are 30 percent more productive and require half the space of traditional distribution centers.

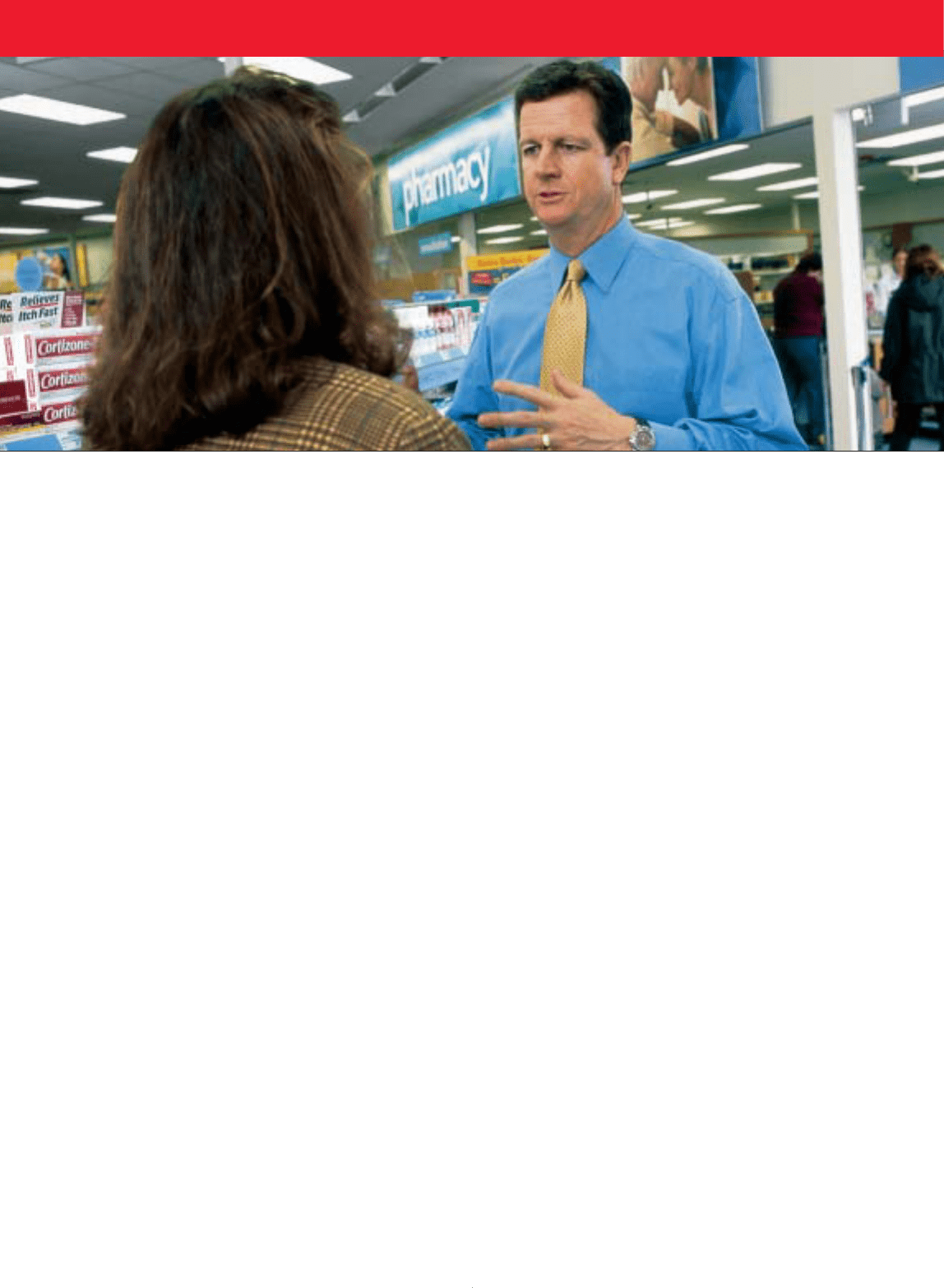

Chairman, President, and CEO Tom Ryan visits Store Manager Terri Chalifoux at the CVS/pharmacy in Wakefield, Rhode Island.

Message from our Chairman