CVS 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

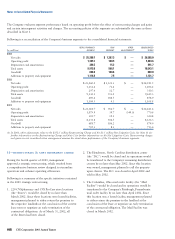

Stock-based compensation ~ The Company accounts for

its stock-based compensation plans under the recognition

and measurement principles of Accounting Principles Board

(“APB”) Opinion No. 25, “Accounting for Stock Issued

to Employees,” and related interpretations. As such, no

stock-based employee compensation cost is reflected in net

earnings for options granted under those plans since they

had an exercise price equal to the market value of the

underlying common stock on the date of grant. See Note 7

for further information on stock-based compensation. The

following table summarizes the effect on net earnings and

earnings per common share if the company had applied the

fair value recognition provisions of Statement of Financial

Accounting Standards (“SFAS”) No. 123, “Accounting for

Stock-Based Compensation,” to stock-based employee

compensation for the respective years:

Notes to Consolidated Financial Statements

(32) CVS Corporation 2003 Annual Report

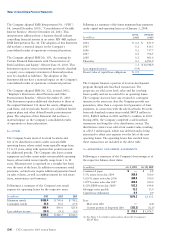

In millions, except per share amounts 2003 2002 2001

Net earnings, as reported $ 847.3 $ 716.6 $ 413.2

Add: Stock-based employee compensation expense

included in reported net earnings, net of

related tax effects(1) 2.2 2.7 3.3

Deduct: Total stock-based employee compensation

expense determined under fair value based method

for all awards, net of related tax effects 52.4 56.8 59.4

Pro forma net earnings $ 797.1 $ 662.5 $ 357.1

Basic EPS: As reported $ 2.11 $ 1.79 $ 1.02

Pro forma 1.98 1.65 0.87

Diluted EPS: As reported $ 2.06 $ 1.75 $ 1.00

Pro forma 1.95 1.62 0.86

(1) Amounts represent the after-tax compensation costs for restricted stock grants.

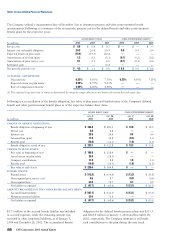

Advertising costs ~ Advertising costs are expensed when

the related advertising takes place. Advertising costs, net

of vendor funding, which is included in selling, general

and administrative expenses, were $178.2 million in 2003,

$152.2 million in 2002 and $126.9 million in 2001.

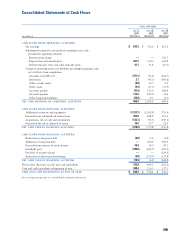

Interest expense, net ~ Interest expense was $53.9 million,

$54.5 million and $65.2 million and interest income was

$5.8 million, $4.1 million and $4.2 million in 2003, 2002

and 2001, respectively. Capitalized interest totaled $11.0

million in 2003, $6.1 million in 2002 and $10.1 million

in 2001. Interest paid totaled $64.9 million in 2003,

$60.7 million in 2002 and $75.2 million in 2001.

Nonrecurring items ~ During 2001, the Company received

$50.3 million of settlement proceeds from various lawsuits

against certain manufacturers of brand name prescription

drugs. The Company elected to contribute $46.8 million

of the settlement proceeds to the CVS Charitable Trust,

Inc. The net effect of the two nonrecurring items was a

$3.5 million pre-tax ($2.1 million after-tax) increase in

net earnings (the “Net Litigation Gain”). The Company

also recorded a $352.5 million pre-tax ($230.5 million

after-tax) restructuring and asset impairment charge in

connection with the 2001 strategic restructuring, which

resulted from a comprehensive business review designed

to streamline operations and enhance operating efficiencies.

See Note 11 for further information on the 2001 strategic

restructuring and resulting charge.

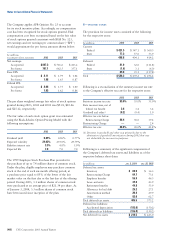

Income taxes ~ The Company provides for federal and

state income taxes currently payable, as well as for those

deferred because of timing differences between reporting

income and expenses for financial statement purposes

versus tax purposes. Federal and state incentive tax credits

are recorded as a reduction of income taxes. Deferred

tax assets and liabilities are recognized for the future

tax consequences attributable to differences between

the carrying amount of assets and liabilities for financial

reporting purposes and the amounts used for income tax

purposes. Deferred tax assets and liabilities are measured

using the enacted tax rates expected to apply to taxable

income in the years in which those temporary differences

are expected to be recoverable or settled. The effect of

a change in tax rates is recognized as income or expense

in the period of the change.

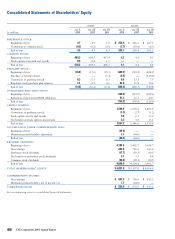

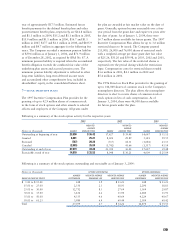

Accumulated other comprehensive loss ~ Accumulated

other comprehensive loss consists of a $36.9 million and

$44.6 million minimum pension liability, net of a $22.5

and $27.3 million income tax benefit, as of January 3,

2004 and December 28, 2002, respectively. There was

no accumulated other comprehensive income or loss as

of December 29, 2001.

Earnings per common share ~ Basic earnings per

common share is computed by dividing: (i) net earnings,

after deducting the after-tax ESOP preference dividends,

by (ii) the weighted average number of common shares