CVS 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(39)

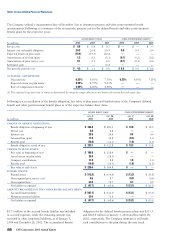

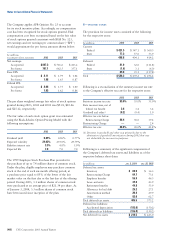

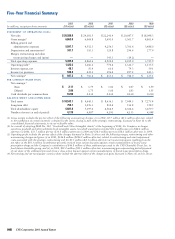

Following is a summary of the stock option activity for the respective years:

2003 2002 2001

WEIGHTED WEIGHTED WEIGHTED

AVERAGE AVERAGE AVERAGE

Shares in thousands SHARES EXERCISE PRICE SHARES EXERCISE PRICE SHARES EXERCISE PRICE

Outstanding at beginning of year 23,390 $ 36.42 17,627 $ 39.48 14,647 $ 31.11

Granted 6,401 25.21 8,022 29.89 5,381 59.55

Exercised (707) 20.26 (517) 18.31 (1,084) 23.13

Canceled (2,005) 35.84 (1,742) 41.66 (1,317) 43.14

Outstanding at end of year 27,079 34.22 23,390 36.42 17,627 39.48

Exercisable at end of year 14,870 $ 35.53 8,048 $ 30.21 4,609 $ 25.09

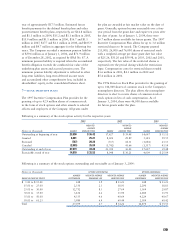

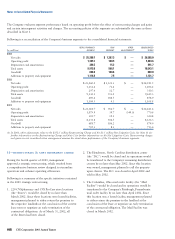

Following is a summary of the stock options outstanding and exercisable as of January 3, 2004:

Shares in thousands OPTIONS OUTSTANDING OPTIONS EXERCISABLE

NUMBER WEIGHTED AVERAGE WEIGHTED AVERAGE NUMBER WEIGHTED AVERAGE

RANGE OF EXERCISE PRICES OUTSTANDING REMAINING LIFE EXERCISE PRICE EXERCISABLE EXERCISE PRICE

$ 1.81 to $ 15.00 248 1.9 $ 13.23 248 $ 13.23

15.01 to 25.00 2,330 2.3 18.93 2,290 18.83

25.01 to 30.00 12,752 8.3 27.69 3,569 29.87

30.01 to 35.00 3,434 6.2 31.90 2,480 31.91

35.01 to 50.00 4,335 4.6 40.64 4,224 40.67

50.01 to 61.23 3,980 6.9 60.44 2,059 60.42

To tal 27,079 6.7 $ 34.22 14,870 $ 35.53

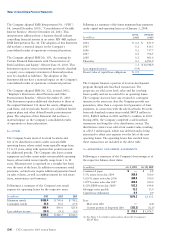

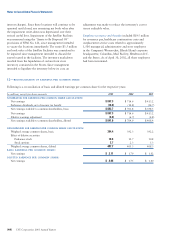

year of approximately $17.5 million. Estimated future

benefit payments for the defined benefit plans and other

postretirement benefit plans, respectively, are $14.8 million

and $1.1 million in 2004, $15.2 and $1.1 million in 2005,

$15.9 million and $1.1 million in 2006, $16.7 and $1.1

million in 2007, $17.7 and $1.1 million in 2008, and $105.9

million and $4.7 million in aggregate for the following five

years. The Company recorded a minimum pension liability

of $59.4 million as of January 3, 2004, and $71.9 million

as of December 28, 2002, as required by SFAS No. 87. A

minimum pension liability is required when the accumulated

benefit obligation exceeds the combined fair value of the

underlying plan assets and accrued pension costs. The

minimum pension liability adjustment is reflected in other

long-term liabilities, long-term deferred income taxes

and accumulated other comprehensive loss, included in

shareholders’ equity, in the consolidated balance sheet.

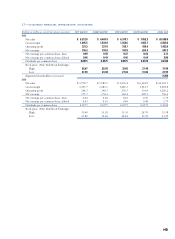

7—STOCK INCENTIVE PLANS

The 1997 Incentive Compensation Plan provides for the

granting of up to 42.9 million shares of common stock

in the form of stock options and other awards to selected

officers and employees of the Company. All grants under

the plan are awarded at fair market value on the date of

grant. Generally, options become exercisable over a four-

year period from the grant date and expire ten years after

the date of grant. As of January 3, 2004, there were

16.7 million shares available for future grants. The 1997

Incentive Compensation Plan allows for up to 3.6 million

restricted shares to be issued. The Company granted

213,000, 26,000 and 76,000 shares of restricted stock

with a weighted average per share grant date fair value

of $25.26, $31.20 and $59.98, in 2003, 2002 and 2001,

respectively. The fair value of the restricted shares is

expensed over the period during which the restrictions

lapse. Compensation costs for restricted shares totaled

$3.6 million in 2003, $4.3 million in 2002 and

$5.4 million in 2001.

The 1996 Directors Stock Plan provides for the granting of

up to 346,000 shares of common stock to the Company’s

nonemployee directors. The plan allows the nonemployee

directors to elect to receive shares of common stock or

stock options in lieu of cash compensation. As of

January 3, 2004, there were 46,000 shares available

for future grants under the plan.

(39)