CVS 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

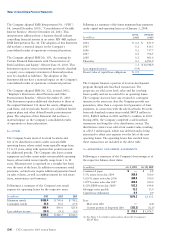

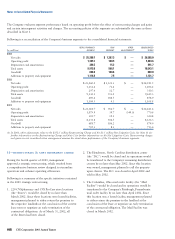

Income taxes paid were $510.4 million, $319.5 million

and $397.0 million for 2003, 2002 and 2001, respectively.

The Company believes it is more likely than not that the

deferred tax assets included in the above table will be

realized during future periods in which the Company

generates taxable earnings.

9—COMMITMENTS & CONTINGENCIES

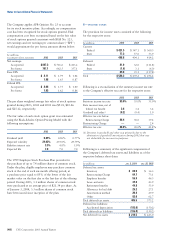

Between 1991 and 1997, the Company sold or spun

off a number of subsidiaries, including Bob’s Stores,

Linens ’n Things, Inc., Marshalls, Kay-Bee Toys, Wilsons,

This End Up and Footstar, Inc. In many cases, when a

former subsidiary leased a store, the Company provided

a corporate level guarantee of the store’s lease obligations.

When the subsidiaries were disposed of, the Company’s

guarantees remained in place, although each purchaser

indemnified the Company for any lease obligations the

Company was required to satisfy. If any of the purchasers

were to become insolvent and failed to make the required

payments under a store lease, the Company could be

required to satisfy these obligations. As of January 3, 2004,

the Company guaranteed approximately 706 stores with

leases extending through 2018. Assuming that each

respective purchaser became insolvent, and the Company

was required to assume all of these lease obligations,

management estimates that the Company could settle

the obligations for approximately $592 million as of

January 3, 2004.

Management believes the ultimate disposition of any of the

corporate level guarantees will not have a material adverse

effect on the Company’s consolidated financial condition,

results of operations or future cash flows.

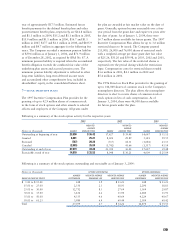

As of January 3, 2004, the Company had outstanding

commitments to purchase $163 million of merchandise

inventory for use in the normal course of business. The

Company currently expects to satisfy these purchase

commitments by 2008.

Beginning in August 2001, a total of nine actions were

filed against the Company in the United States District

Court for the District of Massachusetts asserting claims

under the federal securities laws. The actions were

subsequently consolidated under the caption In re

CVS Corporation Securities Litigation, No. 01-CV-11464

(D. Mass.) and a consolidated and amended complaint

was filed on April 8, 2002. The consolidated amended

complaint names as defendants the Company, its chief

executive officer and its chief financial officer and asserts

claims for alleged securities fraud under sections 10(b)

and 20(a) of the Securities Exchange Act of 1934 and

Rule 10b-5 thereunder on behalf of a purported class of

persons who purchased shares of the Company’s common

stock between February 6, 2001 and October 30, 2001.

On June 7, 2002, all defendants moved to dismiss the

consolidated amended complaint. This motion was denied

by the court on December 18, 2002. The parties are

currently engaged in discovery. The Company believes the

consolidated action is without merit and intends to defend

against it vigorously.

The Company is also a party to other litigation arising

in the normal course of its business, none of which is

expected to be material to the Company.

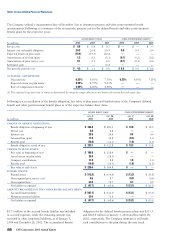

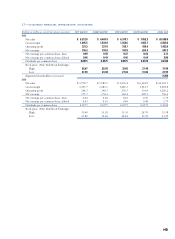

10—BUSINESS SEGMENTS

The Company currently operates two business segments,

Retail Pharmacy and Pharmacy Benefit Management (“PBM”).

The operating segments are segments of the Company for

which separate financial information is available and for

which operating results are evaluated regularly by executive

management in deciding how to allocate resources and in

assessing performance.

As of January 3, 2004, the Retail Pharmacy segment

included 4,132 retail drugstores and the Company’s online

retail website, CVS.com. The retail drugstores are located

in 27 states and the District of Columbia and operate under

the CVS/pharmacy name. The Retail Pharmacy segment is

the Company’s only reportable segment.

The PBM segment provides a full range of prescription

benefit management services to managed care providers and

other organizations. These services include plan design and

administration, formulary management, mail order pharmacy

services, claims processing and generic substitution. The PBM

segment also includes the Company’s specialty pharmacy

business, which focuses on supporting individuals that

require complex and expensive drug therapies. The PBM

segment operates under the PharmaCare Management

Services name, while the specialty pharmacy mail order

facilities and 47 retail pharmacies, located in 19 states and the

District of Columbia, operate under the CVS ProCare name.

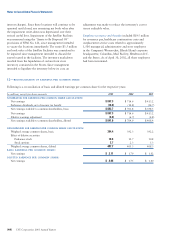

Following is a reconciliation of the significant components

of the Company’s net sales for the respective years:

2003 2002 2001

Pharmacy 68.8% 67.6% 66.1%

Front store 31.2 32.4 33.9

100.0% 100.0% 100.0%

(41)