Blackberry 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

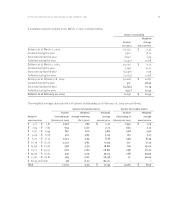

Share Capital

Common share

Common purchase

shares warrants Total

Balance as at March 2, 2002 $ 894,380 $ 370 $ 894,750

Exercise of options 1,155 – 1,155

Common shares repurchased pursuant to the Common

Share Purchase Program (21,528) – (21,528)

Balance as at March 1, 2003 874,007 370 874,377

Exercise of options 49,771 – 49,771

Exercise of warrants 370 (370) –

Common shares pursuant to public share offering,

net of related costs 905,240 – 905,240

Balance as at February 28, 2004 1,829,388 – 1,829,388

Exercise of options 54,151 – 54,151

Deferred income tax benefit attributable to fiscal 2004

financing costs 8,727 – 8,727

Balance as at February 26, 2005 $ 1,892,266 $ – $ 1,892,266

As a result of the NTP resolution during the fourth quarter of fiscal 2005, as described in notes 9 and 15,

the Company has recognized a deferred tax asset of $8,727 with respect to share issue financing costs.

On January 22, 2004, the Company completed a public share issue of 24.2 million common shares for

proceeds of $905,240, net of related issue costs of $39,629.

During fiscal 2004, the Company’s share purchase warrants were redeemed and converted into common shares.

On October 3, 2002, the Company’s Board of Directors approved the purchase during the subsequent 12

months of up to as many as 7.6 million common shares, which approximated 5% of the common shares

outstanding at that date. No shares were repurchased under this Common Share Purchase Program during

fiscal 2004 or fiscal 2005. During the year ended March 1, 2003 the Company repurchased 3.9 million common

shares pursuant to its Common Share Purchase Program at a cost of $24,502. The amount paid in excess of

the carrying value of the common shares of $2,974 was charged to retained earnings. All common shares

repurchased by the Company pursuant to the Common Share Purchase Program have been cancelled.

(b) Stock option plan

The Company has an incentive stock option plan for all of its directors, officers and employees. The option

exercise price is the fair market value of the Company’s common shares at the date of grant. These options

generally vest over a period of five years after which they are exercisable for a maximum of ten years after

the grant date. The Company’s shareholders approved a reconstitution of the stock option plan at the Annual

General Meeting on August 12, 2002. The reconstitution increased the number of common shares available

for the grant of options by 5,512. As at February 26, 2005, there were 11,151 options outstanding with exercise

prices ranging from $1.22 to $88.97. Options issued and outstanding for 4,505 common shares are vested as at

February 26, 2005 and there are 6,294 common shares available for future grants under the stock option plan.

Research In Motion Limited •Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)