Blackberry 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

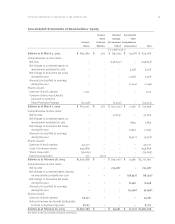

Investing Activities

During fiscal 2005, cash flow used for investing activities equalled $878.1 million, which included the

acquisition of investments, net of proceeds on disposition, of $596.7 million, the acquisition of short-term

investments, net of proceeds on disposition, of $151.1 million, the acquisitions of capital assets and intangible

assets of $109.4 million and $17.1 million, respectively, and the acquisition of subsidiaries of $3.9 million.

During fiscal 2004, cash flow used for investing activities equalled $196.8 million, which included the

acquisition of investments, net of proceeds on disposition, of $143.2 million, and the acquisitions of capital

assets and intangible assets of $21.8 million and $32.3 million, respectively.

NTP Litigation

As discussed in “Critical Accounting Policies and Estimates – Litigation”, “Results of Operations – Litigation”

and note 15 to the Consolidated Financial Statements, RIM will pay to NTP $450 million in final and full

resolution of all claims to date against RIM, as well as for the NTP license going forward.

Prior to this resolution with NTP and commencing in the first quarter of fiscal 2004 and on a quarterly basis

thereafter, the Company has been required to deposit the current fiscal period’s enhanced compensatory

damages amount plus postjudgment interest (the “quarterly deposit”) into a bank escrow account 30 days

subsequent to the end of the quarter. These quarterly deposits were to have been set aside in escrow until the

appeals process is complete. The quarterly deposit fundings for fiscal 2004 and fiscal 2005 total $112.0 million

and are classified as Restricted cash on the Company’s consolidated balance sheet as at February 26, 2005.

The Company intends to fund this $450 million resolution amount by: i) utilizing the $112.0 million set aside

in escrow, as described above; and ii) using $338.0 million of its portfolio of cash, cash equivalents and short-

term investments as at February 26, 2005. Funds totaling $338.0 million were generated from operations,

regular investment maturities and the sale of investments with a carrying value of $119 million, and have been

converted to a liquid available position subsequent to February 26, 2005. The proceeds on the sale of these

investments approximated their carrying value.

The Company has a $70 million Letter of Credit Facility (the “Facility”) for operating requirements.

Approximately $48 million of the Facility has been utilized in order to satisfy a portion the Company’s liability

and funding obligation with respect to the NTP matter, as described in note 15 to the Consolidated Financial

Statements. During the third quarter of fiscal 2004 and pending the completion of the appeals process, the

Company posted, with the approval of the Court, a $48 million Standby Letter of Credit (“LC”) to guarantee the

monetary damages of the Court’s final order. The LC amount of $48 million excludes the fiscal 2005 and 2004

quarterly deposit obligations into the escrow bank account. The Company has pledged specific investments as

security for the Facility. Upon payment of the resolution amount and receipt of Court approval, the Company

intends to cancel this LC.

Research In Motion Limited •Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)