Blackberry 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

Handheld revenue increased by $130.9 million or 94.5% to $269.5 million in the fourth quarter of fiscal 2005

compared to $138.6 million in the preceding year’s comparable period. The number of BlackBerry handhelds

sold increased by 333,000 or 87.9% to 712,000 in fiscal 2005 compared to 379,000 in the fourth quarter

of fiscal 2004. ASP increased by $14 or 3.8% to $379, primarily as a result of the higher percentage of

color handhelds in the overall handheld mix in the current year’s fourth quarter compared to the prior year’s

comparable quarter. Service revenue increased by $20.1 million to $67.6 million in the current quarter,

compared to $47.5 million in the fourth quarter of fiscal 2004, as a result of the increased number of BlackBerry

subscribers. Software revenue increased by $39.7 million to $55.9 million, compared to $16.2 million in the

fourth quarter of fiscal 2004, primarily as a result of the introduction of BES 4.0 during the fourth quarter

of fiscal 2005, as well as increased sales of CALs consistent with the growth in BlackBerry subscribers.

Gross Margin

Gross margin increased significantly to 56.8% of revenue in the fourth quarter of fiscal 2005, compared to

49.1% of revenue in the same period of the previous fiscal year. The net improvement of 7.7% in consolidated

gross margin percentage was primarily due to the following factors:

•Software revenues at $55.9 million comprised 13.8% of the total revenue mix, compared to $16.2 million

and 7.7% respectively, in the fourth quarter of fiscal 2004;

•An increase in NRE revenue in the current year’s fourth quarter;

•Improved service margins resulting from cost efficiencies in RIM’s network operations infrastructure

as a result of the increase in BlackBerry subscribers;

•A reduction in net warranty expense; and

•A decline in amortization expense as a percentage of consolidated revenue, as the Company continues

to realize economies of scale in its manufacturing operations.

Research and Development, Selling, Marketing and Administration, and Amortization Expense

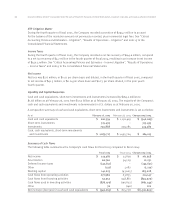

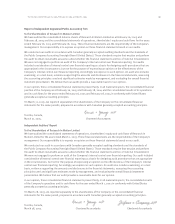

The table below presents a comparison of Research and development, Selling, marketing and administration,

and Amortization expenses for the fourth quarter ended February 26, 2005 compared to the quarter ended

November 27, 2004 and the fourth quarter ended February 28, 2004. The Company believes it is also

meaningful to provide a comparison between the fourth quarter and the third quarter of fiscal 2005, given the

quarterly increases in revenue realized by the Company during fiscal 2005.

Three month fiscal periods ended

February 26, 2005 November 27, 2004 February 28, 2004

$% of Revenue $% of Revenue $ % of Revenue

Revenue $404,802 $365,852 $ 210,585

Research and development $29,076 7.2% $27,137 7.4% $ 17,877 8.5%

Selling, marketing

and administration 56,595 14.0% 49,297 13.5% 32,310 15.3%

Amortization 9,114 2.2% 8,337 2.3% 6,702 3.2%

$94,785 23.4% $84,771 23.2% $ 56,889 27.0%

For the years ended February 26, 2005, February 28, 2004 and March 1, 2003