Blackberry 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

NTP Litigation Matter

During the fourth quarter of fiscal 2005, the Company recorded a provision of $294.2 million to account

for the balance of the resolution amount not previously recorded, plus incremental legal fees. See “Critical

Accounting Policies and Estimates – Litigation”, “Results of Operations – Litigation” and note 15 to the

Consolidated Financial Statements.

Income Taxes

During the fourth quarter of fiscal 2005, the Company recorded a net tax recovery of $144.6 million, compared

to a net tax recovery of $4.2 million in the fourth quarter of fiscal 2004, resulting in an increase in net income

of $140.4 million. See “Critical Accounting Policies and Estimates – Income Litigation”, “Results of Operations

– Income Taxes” and note 9 to the Consolidated Financial Statements.

Net Income

Net loss was $2.6 million, or $0.01 per share basic and diluted, in the fourth quarter of fiscal 2005, compared

to net income of $41.5 million, or $0.24 per share basic and $0.23 per share diluted, in the prior year’s

fourth quarter.

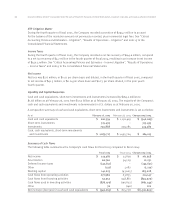

Liquidity and Capital Resources

Cash and cash equivalents, short-term investments and investments increased by $184.0 million to

$1.68 billion as at February 26, 2005 from $1.50 billion as at February 28, 2004. The majority of the Company’s

cash and cash equivalents and investments is denominated in U.S. dollars as at February 26, 2005.

A comparative summary of cash and cash equivalents, short-term investments and investments is set out below:

As at February 26, 2005 February 28, 2004 Change 2005/2004

Cash and cash equivalents $610,354 $1,156,419 $(546,065)

Short-term investments 315,495 –315,495

Investments 753,868 339,285 414,583

Cash, cash equivalents, short-term investments

and investments $1,679,717 $1,495,704 $184,013

Summary of Cash Flows

The following table summarizes the Company’s cash flows for fiscal 2005 compared to fiscal 2004:

Fiscal 2005 Fiscal 2004 Change 2005/2004

Net income $213,387 $51,829 $161,558

Amortization 66,760 54,529 12,231

Deferred income taxes (143,651) –(143,651)

Other (137) 1,082 (1,219)

Working capital 141,623 (43,605) 185,228

Cash flows from operating activities 277,982 63,835 214,147

Cash flows from financing activities 53,952 948,881 (894,929)

Cash flows used in investing activities (878,075) (196,832) (681,243)

Other 76 (146) 222

Net increase (decrease) in cash and cash equivalents $(546,065) $815,738 $(1,361,803)

Research In Motion Limited •Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)