Blackberry 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

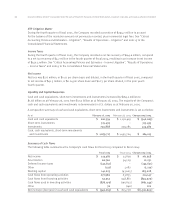

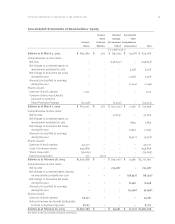

A summary of the differences to reported values contained in the Company’s consolidated statements of

operations under U.S. GAAP and Canadian GAAP is set out in the table below:

Fiscal year ended February 26, 2005 February 28, 2004

Net income under U.S. GAAP $213,387 $51,829

Adjustments – Canadian GAAP

Start-up costs (a) –(1,392)

Stock-based compensation costs (b) (6,255) (2,890)

Share issue costs (c) 8,727 –

Investment tax credits (d) (9,664) –

Net income under Canadian GAAP $ 206,195 $47,547

Notes:

a) U.S. GAAP, Statement of Position 98-5, Reporting on the Cost of Start-up Activities, prescribes that start-up costs should be

expensed as incurred. Canadian GAAP allows for the capitalization of start up costs, namely the costs incurred during the

start-up of the Company’s European operations. As of August 30, 2003, the Company had expensed all start-up costs

previously incurred, as the Company had determined that there was no remaining value to these costs as a result of changes

in the underlying operations.

b) Previously, under Canadian GAAP, for any stock option with an exercise price that was less than the market price on the date of

grant, the difference between the exercise price and the market price on the date of grant was required to be recorded as

compensation expense (the intrinsic value based method). As the Company grants stock options at the fair market value of the

shares on the day preceding the date of the grant of the options, no compensation expense was recognized. In November 2003,

Canadian Institute of Chartered Accountants (“CICA”) 3870 was amended to provide transitional provisions which allow for the

adoption of fair value based accounting recording of stock options. The Company had elected the prospective method of

adoption for Canadian GAAP purposes effective for the year ended February 28, 2004. In accordance with CICA 3870, the

Company has recorded stock-based compensation expense for all grants issued and subsequently cancelled during fiscal 2005

and 2004. In addition, proforma stock-based compensation expense was calculated on grants issued since March 2, 2003.

c) As described in “Critical Accounting Policies and Estimates – Income taxes” and in note 9 to the Consolidated Financial

Statements, the Company determined that it was more likely than not it would realize its deferred tax assets during the fourth

quarter of fiscal 2005. Accordingly, the Company has recognized a deferred tax asset of $8.7 million on account of the remaining

unamortized balance of the share issue costs arising from the Company’s January 2004 public share offering, and credited

$8.7 million to Capital stock on the consolidated balance sheet. Under Canadian GAAP, the credit of $8.7 million was to recovery

of future income taxes on the consolidated statement of operations.

d) As described in “Critical Accounting Policies and Estimates – Income taxes” and in note 15 to the Consolidated Financial

Statements, the Company determined that it was more likely than not it would realize its deferred tax assets during the fourth

quarter of fiscal 2005. Accordingly, the Company has recognized a deferred tax asset of $50.4 million with respect to investment

tax credits (“ITC’s”) not previously recorded. ITC’s are generated as a result of the Company incurring current and capital costs

on account of eligible scientific research and experimental development expenditures. For U.S. GAAP purposes, under the

“flow-through” method, the $50.4 million was credited as a recovery of deferred income taxes on the consolidated statement

of operations. For Canadian GAAP, under the “cost reduction” method, the cost of the related expenditures has been credited

as follows: i) $40.7 million as a reduction of research and development expense; and ii) $9.7 million as a reduction of the capital

cost of the assets acquired.

Differences to reported values contained in the Company’s consolidated statements of cash flows under U.S.

GAAP and Canadian GAAP result from the differences discussed above.

Research In Motion Limited •Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)