Blackberry 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

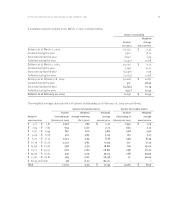

7. Intangible Assets

Intangible assets are comprised of the following:

February 26, 2005

Accumulated Net book

Cost amortization value

Acquired technology $12,151 $ 6,045 $ 6,106

Licenses 86,352 31,107 55,245

Patents 28,082 5,693 22,389

$126,585 $ 42,845 $ 83,740

February 28, 2004

Accumulated Net book

Cost amortization value

Acquired technology $ 10,012 $ 3,746 $ 6,266

Licenses 52,216 15,299 36,917

Patents 25,156 4,070 21,086

$87,384 $ 23,115 $ 64,269

The Company had been involved in patent litigation with Good Technology, Inc. (“GTI”). The Company and

GTI (the “parties”) entered into an agreement on March 26, 2004 whereby the parties signed a settlement

and license agreement and consequently dismissed a series of pending lawsuits between the two companies.

The parties entered into a settlement and royalty-bearing license agreement whereby RIM received a lump-sum

settlement during the first quarter of fiscal 2005 as well as the right to ongoing quarterly royalties. The lump-

sum settlement amount was credited to Patents in the first quarter of fiscal 2005, as a recovery of costs

previously incurred by the Company. The settlement of this dispute was not material to the Company’s

financial position.

During fiscal 2004, the Company recorded provisions amounting to $4,327 against the carrying values of

certain of its intangible assets as a result of changes in the Company’s current and intended product offerings.

Of this amount $2,750 was included in Cost of sales with the balance of $1,577 recorded as Amortization

expense. Such charges reflected management’s assessment of net realizable values.

For the year ended February 26, 2005, amortization expense related to intangible assets was $19,730

(February 28, 2004 – $19,462; March 1, 2003 – $2,848). Total additions to intangible assets in 2005 were

$37,061 (2004 – $32,252).

Based on the carrying value of the identified intangible assets as at February 26, 2005, and assuming no

subsequent impairment of the underlying assets, the annual amortization expense for the next five years is

expected to be as follows: 2006 – $25 million; 2007 – $16 million; 2008 – $7 million; 2009 – $6 million; and

2010 – $6 million. Licenses are amortized over the lesser of five years or on a per unit basis based upon the

anticipated number of units sold during the terms of the license agreements.

8. Acquisitions

During fiscal 2005, the Company completed two acquisitions. Effective March 2004, the Company purchased

the assets of a company whose proprietary software products enable wireless access to a corporate email

system using a handheld device. Effective February 2005, the Company acquired 100% of the common shares

of a company that offers technology that will be incorporated into the Company’s software.

For the years ended February 26, 2005, February 28, 2004 and March 1, 2003